DEFLECT

The Best Defense Against First-Party Fraud

Stop chargebacks before they start by sending real-time transaction data to card networks. DEFLECT helps prevent disputes from ever being filed by giving cardholders and issuers the details they need to recognize legitimate purchases. The result is fewer chargebacks, fewer fees, and a stronger merchant profile.

Avoid confusion with deeper data.

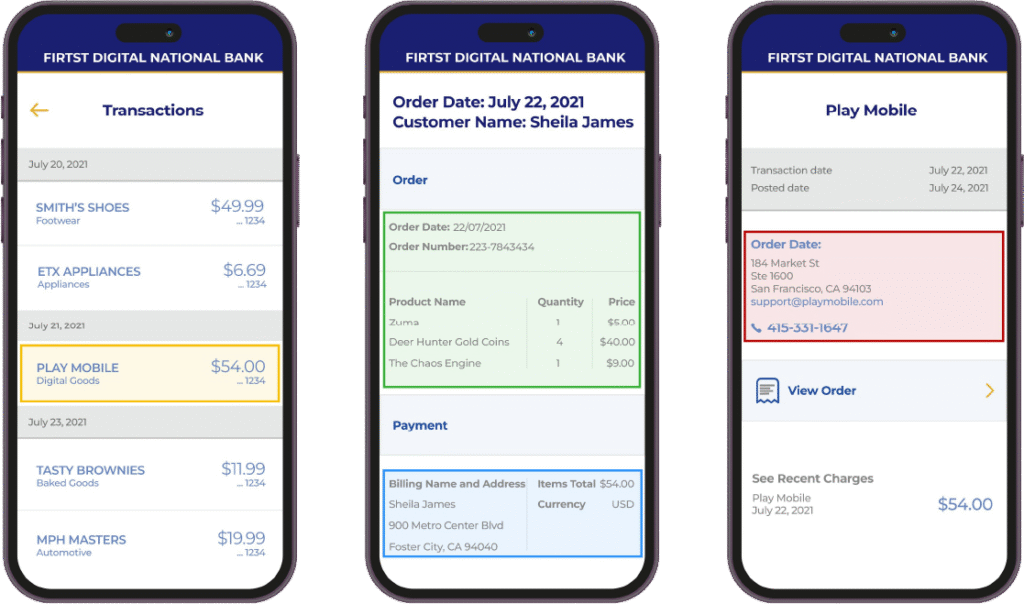

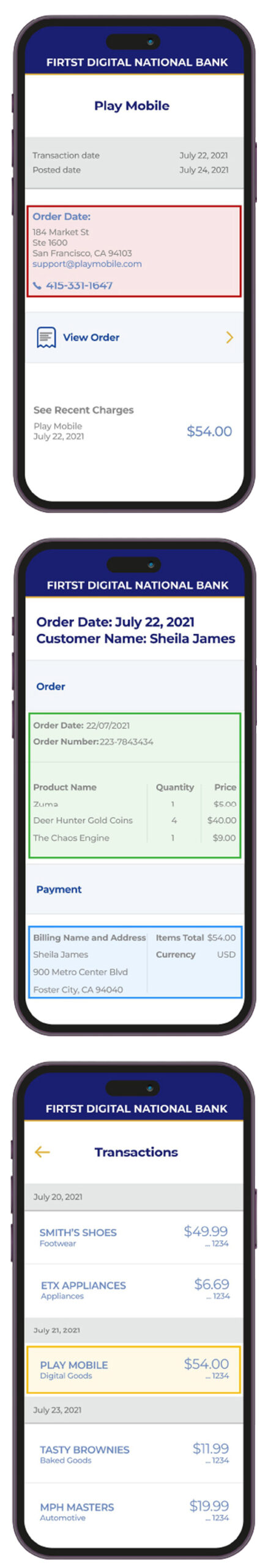

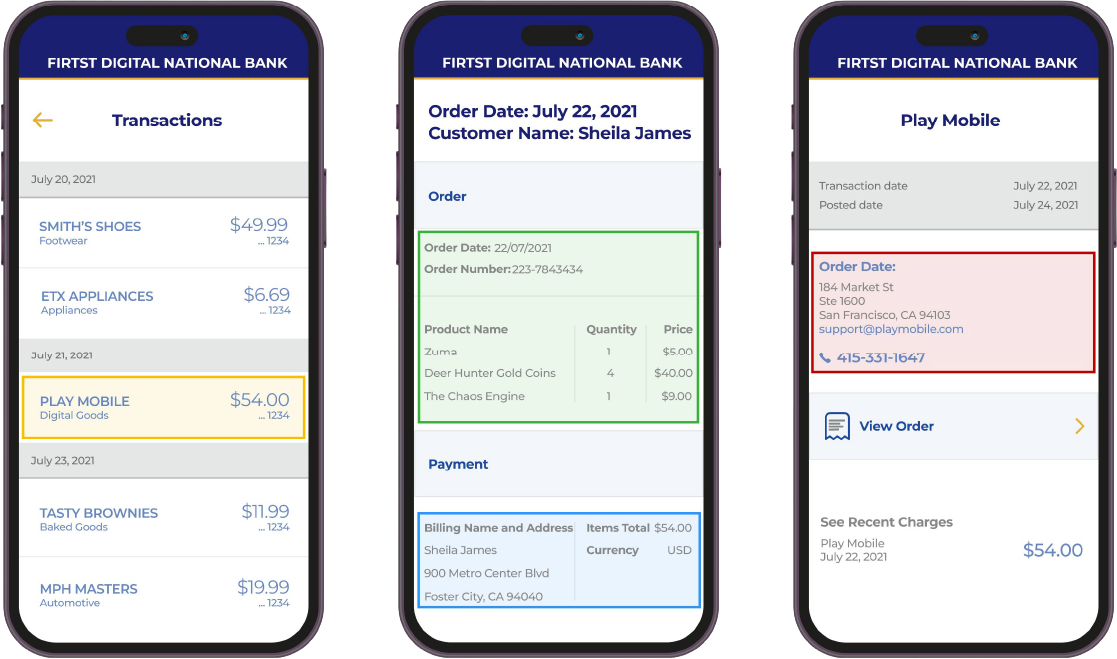

DEFLECT connects your transaction and fulfillment data to Verifi Order Insight and Ethoca Consumer Clarity. Cardholders see what they bought, when it shipped, and who they bought it from, right when they’re deciding whether to file a dispute.

Stop chargebacks at the point of inquiry.

DEFLECT integrates directly with issuer apps and call centers, displaying key order details when a cardholder asks their bank about a charge. That visibility protects your revenue and reputation.

Dispute prevention that works in real time.

DEFLECT delivers the right data to the right place at the right moment, so you stay out of the dispute process entirely.

Protect your brand & bottom line.

Chargebacks often start with misunderstanding. DEFLECT solves that by making sure your customer and their bank can verify the transaction without escalating the dispute.

Overview

How DEFLECT Works?

You can be on the hook for over three times the transaction amount of each chargeback. Our RESOLVE module empowers your business to eliminate these chargebacks and avoid fees & penalties.

Features

Powerful Tools,

Real Results.

Instead of going straight to a chargeback, banks see product, fulfillment, and branding data. That’s often enough to confirm the transaction and stop the dispute from escalating.

Cardholders see your product name, logo, and delivery status directly in their bank’s app before they decide to dispute.

Cardholders get real answers quickly, reducing frustration and unnecessary refund requests.

DEFLECT pushes key transaction and fulfillment data to Visa and Mastercard networks through Verifi Order Insight and Ethoca Consumer Clarity.

Supports Visa Compelling Evidence 3.0 and Mastercard First-Party Trust frameworks out of the box.

Choose seamless API integration or let ChargebackHelp deploy DEFLECT with minimal lift from your team.

DEFLECT runs in the background with no manual work required. Once integrated, your order data flows automatically to the card networks.

Whether you process 100 or 100,000 transactions per day, DEFLECT keeps your dispute prevention consistent and automated.

DEFLECT’s automation keeps support queues clean and chargebacks low without slowing down your operations.

By tying cardholders to their purchases, DEFLECT helps prevent “I didn’t buy that” claims before they’re filed.

When issuers and cardholders have clarity, they file fewer disputes. DEFLECT reduces unnecessary chargebacks across the board.

They damage your reputation and threaten your ability to process payments. DEFLECT prevents those downstream effects by intercepting disputes at the point of inquiry.

See DEFLECT in action

Want to know how it works? Schedule a quick walkthrough and see how DEFLECT fits into your existing stack.

Outstanding Service

Don’t just fight chargebacks. Avoid them entirely.

DEFLECT’s integrations with Verifi and Ethoca give merchants a proactive edge by defusing disputes before they escalate.

Features

The ChargebackHelp Advantage

Chargebacks are complex. We make them manageable. ChargebackHelp equips merchants with the right mix of tools, automation, and expertise to reduce chargebacks and recover revenue without added overhead.

Everything in one place

Combine alerts, prevention, and recovery with a unified partner. Our all-in-one platform is built to support your business at every stage of the dispute lifecycle.

Built on Expertise

We work with thousands of merchants across a wide variety of industries to reduce chargebacks and mitigate fraud while navigating evolving card network rules.

Partners in your success

What sets us apart is more than technology, it’s partnership. ChargebackHelp brings together network integrations, automation, and expert support to help merchants reduce chargebacks at scale.

Solutions

Key Integrated Solutions

Meet the Smarter Way to Prevent, Respond to, and Recover Chargebacks

FAQ

DEFLECT FAQ

Not sure if DEFLECT is a fit?

We’ll walk you through how it works, how it’s deployed, and what kind of impact to expect. Just reach out to start the conversation.