Spotting Risky Orders Before They Ship

Why Order Review Is Worth the Time

Every order looks like progress, until it comes back to bite. Chargebacks from fraud or buyer’s remorse don’t just take money out of your pocket. They can lock up funds, strain your fulfillment process, and even damage your standing with payment processors. Most of this trouble starts with a preventable decision: shipping an order that never should’ve left the warehouse.

You don’t need expensive fraud software to start catching the most common warning signs.

Just pause, check, and ask: Does this order make sense?

Common Red Flags to Look Out For

While no single factor proves intent to defraud, some patterns show up in risky orders more often than not. Here are some of the most common red flags:

Mismatched Shipping and Billing Details

If the shipping address is in a different state or country from the billing address, it doesn’t always mean fraud. But it should trigger a closer look, especially if the buyer’s name doesn’t match either address.

Generic or Suspicious Email Domains

Legitimate customers usually use Gmail, Outlook, or their own business email. Orders tied to domains like “disposablemail.com” or unusual strings of letters are worth flagging. More on this later.

Unusually Large Orders

A customer who normally buys one or two items suddenly ordering twenty is rare, and sometimes a sign someone else is using their card. Even if it’s not fraud, large orders often lead to higher buyer expectations and more disputes.

Repeat Failed Attempts

Multiple failed transactions followed by one that goes through might signal a brute-force attempt to find a working card. Even if the payment cleared, there’s a risk the real cardholder might soon notice and dispute the charge.

Overnight Shipping to a Different Address

Fraudsters tend to prefer fast shipping so they can receive goods before the chargeback is filed. If the address is different and the shipping is urgent, that combo should raise questions.

Bulk Orders of High-Resale Items

If you sell electronics, cosmetics, collectibles, or designer goods, and suddenly get a bulk order for just one product type, take a closer look. These are often targets for resale fraud.

When to Question the Legitimacy of Email Addresses

Email domains can tell you a lot about the legitimacy of an order. While not foolproof, they’re one of the easiest signals to check quickly.

Legitimate customers typically use one of the following:

- Free, trusted services like gmail.com, outlook.com, aol.com, or yahoo.com

- Region-specific versions like googlemail.co.uk or live.ca

- ISP-provided emails, including comcast.net, verizon.net, att.net, bellsouth.net, or cox.net

- Business domains that point to working websites

Seeing one of these doesn’t guarantee the buyer is trustworthy, but it’s a normal pattern. Suspicious orders often stand out because they break this pattern.

Red flag domains might include:

- Disposable or temporary email services like mailinator.com, 10minutemail.com, guerrillamail.com, or tempmail.net

- Random or nonsense strings such as js98234kjq@gmail.com, which may indicate bots or bulk fake accounts

- Domain extensions (TLDs) that are cheap to register and commonly used for fraud, including:

- .xyz

- .info

- .top

- .cc

- .tk

- .click

- .buzz

- .live (use caution, can be legit but often abused)

Also be cautious with newly registered domains and those with multiple hyphens. A custom domain like @secure-order-help.com might look official but could be brand new and used to impersonate your company or another legitimate business.

When in doubt, do a quick domain lookup (WHOIS or online tools) to check if the domain was registered very recently or has limited public ownership information. Scammers often create these “professional-looking” domains for a few days of use and then discard them.

While email domain checks aren’t a guarantee of fraud or safety, they’re a valuable tool in building your risk picture. Combining this with other red flags like mismatched addresses or unusually large orders can help you make smarter, safer decisions before shipping anything out.

Why It’s Okay to Slow Down

When you’re new to Shopify, every sale feels precious. That’s understandable. But if fulfilling 10 extra orders leads to 2 chargebacks, your net profit might vanish entirely. In high-risk moments, like after a big promo or during a holiday rush, it can actually pay to slow down your order volume.

Fewer shipped orders with zero refunds or chargebacks often outperform a higher volume full of problems. Profit isn’t just about growth. It’s also about what you don’t lose.

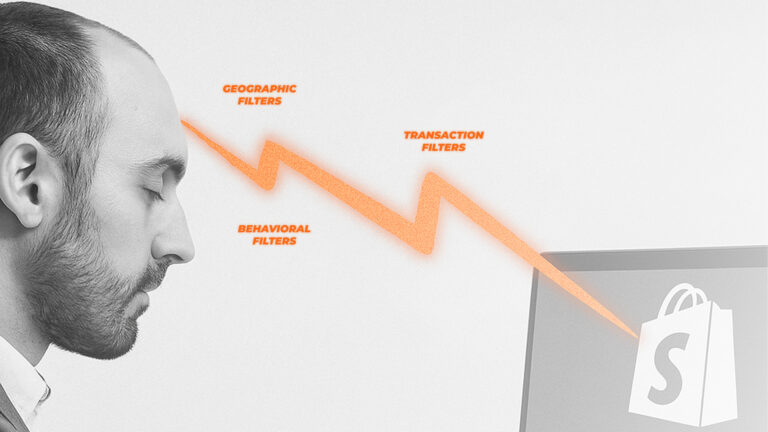

Building Your Review Process

You don’t need to inspect every order. But you should build a repeatable process to review the ones that show signs of risk. Even just 5 to 10 minutes per flagged order can prevent hours of wasted effort later.

Start small:

- Use Shopify’s fraud analysis tool as a first layer

- Set aside time once per day to manually review orders flagged by risk level or value

- Create a checklist of your top 3 to 5 red flags so your review process becomes second nature

And don’t be afraid to cancel an order if it doesn’t feel right. Refunds hurt less when the product hasn’t shipped.

What to Do When You’re Unsure

If you suspect an order might be risky but aren’t confident enough to cancel it, try reaching out to the customer. A quick email or call asking them to confirm the order details is sometimes enough to scare off fraud or reassure you it’s legit.

It also shows real customers that you’re careful, which can build trust. Just keep it friendly and professional.

Why This Matters for Long-Term Success

Getting proactive about order risk isn’t about being paranoid. It’s about building a business that can scale safely. Chargebacks don’t just affect your bottom line. Too many can damage your payment processing history and trigger costly holds or even account terminations.

Starting now, while your volume is still manageable, helps you build the instincts and systems to protect your business as it grows.