Common Chargeback Triggers on Online Casino Platforms

Why Online Casino Chargebacks Behave Differently

Online casinos sit at the intersection of entertainment, financial risk, and emotional volatility. Unlike traditional ecommerce, the product is intangible, outcomes are uncertain, and losses feel personal. That combination produces a very different chargeback profile.

Most online casino chargebacks are not tied to access issues or service outages. Instead, they originate after gameplay has concluded and outcomes are known. Players may initially authorize transactions willingly, then later challenge them once losses register emotionally. From the card network’s perspective, these disputes often appear as fraud-related claims. From the merchant’s perspective, they are frequently cases of first-party fraud.

This distinction matters. Prevention strategies that work for stolen card fraud do little to stop post-loss disputes. Operators need earlier visibility and faster response windows to control exposure.

Buyer’s Remorse After Losses

Buyer’s remorse is the most common trigger behind online casino chargebacks.

A player deposits funds, participates in gameplay, and loses. Hours or days later, the transaction no longer feels justified. The loss may be reframed as unfair, confusing, or unauthorized. At that point, the chargeback process becomes an emotional release valve.

These disputes often arrive quickly, sometimes within the same billing cycle. Without early notice, operators are forced into reactive workflows that increase fees, operational cost, and long-term risk. This is where chargeback alerts provide immediate value by creating a short window to resolve disputes before they escalate.

Our RESOLVE solution centralizes chargeback alerts from multiple networks into a single workflow, making it easier to act quickly, reduce unnecessary chargebacks, and keep operational risk under control.

Billing Descriptor Confusion

Unclear billing descriptors continue to drive unnecessary online casino chargebacks.

Many platforms operate under parent companies or payment entities that do not match the brand players recognize. When players review statements days later, unfamiliar descriptors raise suspicion. Combined with the frustration of losses, confusion can quickly become a dispute.

Descriptor-related chargebacks are especially damaging because they are preventable. Improving billing descriptors reduces confusion at the exact moment cardholders decide whether to contact their bank.

Withdrawal Delays and Payout Expectations

Delays in withdrawals are another frequent trigger.

Players tend to accept losses when expectations are clear. They are far less patient when funds they believe they have won are delayed. Even standard review periods can feel excessive without proactive communication.

These disputes often surface as service-related chargebacks, but the impact is the same. Once filed, they add to volume and attract scrutiny. Early dispute visibility through alerts allows operators to resolve these issues before formal chargebacks are recorded.

Bonus and Promotion Misunderstandings

Bonuses drive engagement, but they also drive disputes.

Wagering requirements, rollover conditions, and withdrawal restrictions are often clearly documented. Still, when expectations differ from outcomes, players may feel misled. These disputes are difficult to overturn through representment because card networks tend to side with cardholders when terms appear complex.

Preventing these disputes depends on identifying them early and resolving them before they escalate into formal chargebacks.

Shared Devices and Family Fraud

Shared devices create additional exposure for online casino chargebacks.

Family members or roommates may place wagers without clear authorization. When the primary cardholder notices the transaction, the dispute is often filed as fraud. These cases are rarely true third-party fraud and are extremely difficult to reverse.

Containing volume in these scenarios depends on speed. Alerts allow operators to respond before disputes mature into chargebacks that permanently affect account standing.

High-Velocity Play Sessions

Rapid deposits during intense play sessions can also trigger disputes after the fact.

Players may not fully process cumulative spend in the moment. When reviewing statements later, totals can feel excessive or shocking. The chargeback becomes an attempt to undo the session.

Velocity controls help, but they do not stop disputes once initiated. Alerts remain the final line of defense.

Why Alerts Matter More Than Ratios

Online casino operators cannot focus solely on staying below formal thresholds. Volume itself creates risk. Sustained chargeback volume attracts monitoring, restrictions, and potential account action.

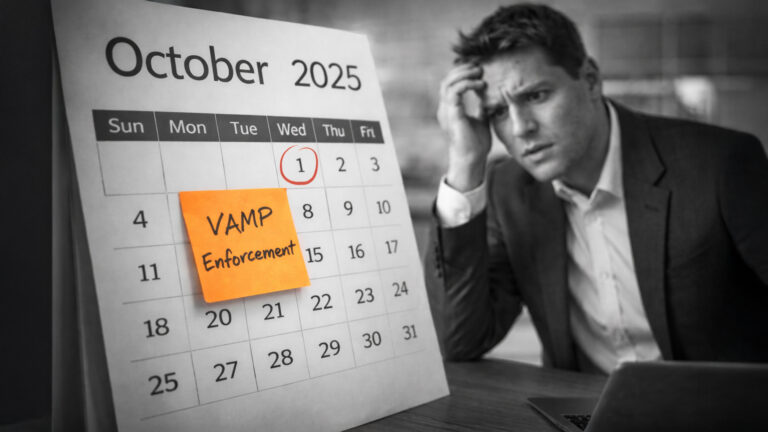

Chargeback alerts operate upstream in the chargeback process. They allow disputes to be resolved before fees, penalties, and reporting consequences apply. For casinos, this proactive control is more valuable than winning disputes weeks later.

From Chargeback Triggers to Control

If online casino chargebacks are repeatedly tied to losses, confusion, or payout delays, the issue is rarely policy alone. It is timing and visibility. Addressing these triggers requires earlier intervention, not stronger reactions. Chargeback alerts provide that intervention window and allow operators to control outcomes before disputes escalate.

Online casinos dealing with recurring chargebacks tied to player behavior, payout friction, or fraud exposure should contact our team to put proactive alert-driven controls in place before disputes escalate into costly chargebacks.

Why ChargebackHelp?

ChargebackHelp brings together Ethoca Alerts, Verifi CDRN, and automated workflows into a single solution designed for high-risk environments like online casinos. Our platform helps merchants resolve disputes earlier, control chargeback volume, and recover revenue when representment makes sense. By centralizing alerts, evidence, and resolution strategies, ChargebackHelp helps operators manage chargebacks as an operational risk rather than a reactive metric.

FAQs: Online Casino Chargebacks

Why are online casino chargebacks so common after losses?

Losses trigger emotional responses that cause players to reinterpret authorized transactions as unfair or unauthorized. ChargebackHelp helps operators resolve these disputes early through consolidated alert coverage.

Are most online casino chargebacks fraud-related?

Many are cases of first-party fraud rather than stolen card fraud. ChargebackHelp helps identify patterns and respond appropriately using alerts and automation.

Do chargeback alerts work for online casinos?

Yes. Alerts provide early notice that allows disputes to be resolved before becoming chargebacks. ChargebackHelp aggregates alert coverage into a single workflow.

Can billing descriptors reduce chargebacks?

Clear billing descriptors reduce confusion-driven disputes. ChargebackHelp supports transaction visibility that improves recognition and resolution.

Is it worth fighting online casino chargebacks?

Some are worth contesting, many are not. ChargebackHelp helps determine when to recover revenue and when early resolution better protects volume.