Understanding Visa’s VAMP

We keep this page updated as Visa makes changes to its VAMP guidelines, but it’s always a good idea to confirm current details with your merchant service provider.

Mark April 1st, 2025 on your calendar. The roll-out date for the new Visa Acquirer’s Monitoring Program (VAMP) is fast approaching. Both merchants and acquirers need to make sure they’re prepared. Not familiar with the new VAMP? Heard of it but not sure what it means for your company? We’ll touch on the key points below, but feel free to reach out to the ChargebackHelp team if you need more assistance. We stay up to date on the latest developments that could impact our clients.

Out With the Old VDMP/VFMP and in With the New VAMP

Up until March 31st, 2025, Visa used two separate programs to monitor separately for disputes and fraud: the Visa Dispute Monitoring Program (VDMP) and the Visa Fraud Monitoring Program (VFMP). These programs were designed to reduce both disputes and fraud and were effective in achieving their goals. However, the two separate programs proved difficult for merchants and acquirers to monitor and manage.

To streamline things, Visa has combined various aspects of the two programs under the Visa Acquirer’s Monitoring Program. While the name focuses on acquirers, merchants need to pay close attention to developments as well because the new program will directly and indirectly impact them.

Ultimately, the VAMP should prove easier for stakeholders to monitor and manage. However, the program will also feature thresholds that will likely prove less generous and forgiving in the long run, especially for acquirers.

How the Changes Will Impact Merchants and Other Stakeholders

Previously, merchants had to monitor a dispute ratio under VDMP and a separate fraud ratio under VFMP. Going forward, a new VAMP ratio will be used to monitor both fraud and non-fraud disputes, including processing errors and authorization issues. More specifically, chargebacks come with reason codes and the new VAMP ratio will monitor both TC40 and TC15 notices per the formula below:

( Total TC40 Notices + Total TC15 Notices ) – ( Designated Visa Exemptions )

Total Settled Transactions

- TC40 Notices: Reports of fraudulent transactions.

- TC15 Notices: Non-fraud dispute reports.

RATIO EXEMPTIONS

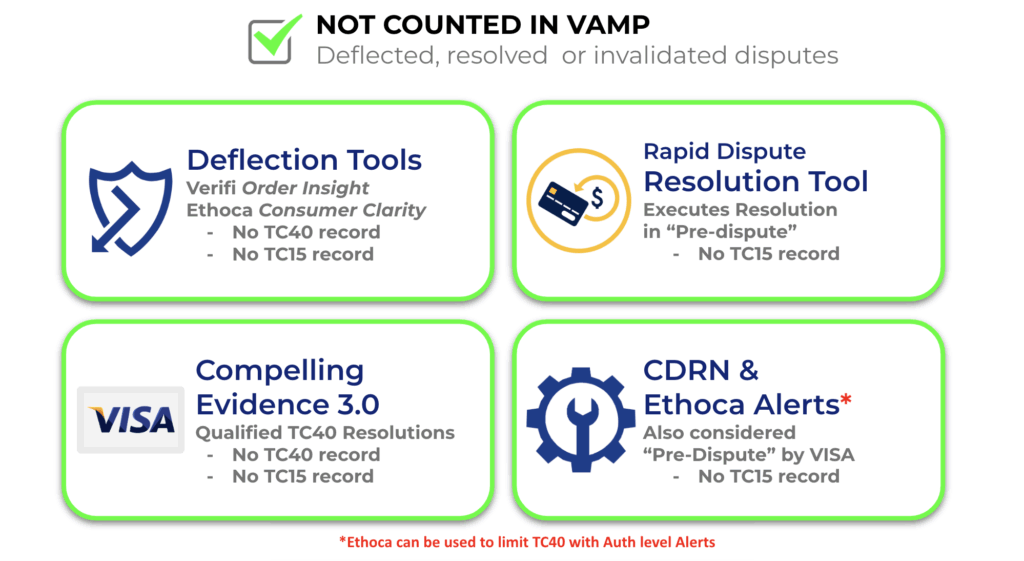

There has been a lot of back and forth on this from Visa, but certain fraud and dispute resolutions will not count against the VAMP ratio. However, as things have changed, a good rule of thumb is that any TC record will count once it is generated; as of June 2025, any resolutions that block or cancel TC records are subtracted from the total.

Separately, but still under VAMP, enumeration attacks will be monitored with the so-called VAMP Enumeration Ratio. The enumeration attacks monitored include brute force card testing attacks and if a merchant is hit with 300,000 or more enumeration attacks and their enumeration transaction ratio hits 20%, they could be penalized.

Our VAMP Calculator makes it easy to monitor compliance.

Visa Will Roll Out VAMP and the New Thresholds in Stages

Visa understands that the VAMP presents major changes for merchants and acquirers. From April 1st, 2025 to September 30, 2025, Visa will institute an “advisory” period. Merchants and acquirers typically won’t be penalized for exceeding thresholds but they will need to get on the right side of the thresholds quickly.

In 2025, acquirers will want to keep their VAMP ratio below .5% or they could be deemed as “Excessive.” Starting on January 1st, 2026, merchants also need to stay below just .3% or they’ll be deemed as “Above Standard.”

In 2025, merchants should aim to keep their VAMP ratio below 1.5% or they will be designated as “Excessive.” This threshold drops to just .9% for merchants in 2026. Merchants and acquirers who exceed these thresholds can be penalized. Moreover, Visa states that merchants that keep a ratio below .3% won’t be categorized as “Above Standard” or “Excessive” and therefore won’t be subject to enforcement.

Visa Acquirer’s Monitoring Program (VAMP) – Timeline and Thresholds

Important Dates

| Date | Event |

|---|---|

| March 31, 2025 | Last day of old Visa Dispute Monitoring Program (VDMP) and Visa Fraud Monitoring Program (VFMP) |

| April 1, 2025 | VAMP official roll-out date |

| April 1, 2025 – September 30, 2025 | VAMP “advisory period” (typically no penalties for exceeding thresholds) |

| January 1, 2026 | New stricter thresholds take effect |

Update:The advisory period has been extended to September 30, 2025, and enforcement begins October 1, 2025. The stricter thresholds originally scheduled for January 1, 2026, are now set to take effect April 1, 2026

VAMP Thresholds – 2025

| Stakeholder | Threshold | Designation if Exceeded |

|---|---|---|

| Acquirers | 0.5% | “Excessive” |

| Merchants | 1.5% | “Excessive” |

VAMP Thresholds – 2026

| Stakeholder | Threshold | Designation if Exceeded |

|---|---|---|

| Acquirers | 0.3% | “Above Standard” |

| Merchants | 0.9% | “Excessive” |

Enumeration Attack Monitoring

| Metric | Threshold |

|---|---|

| Enumeration attacks | 300,000+ |

| Enumeration transaction ratio | 20%+ |

Program Comparison

| Feature | Old Programs | New VAMP |

|---|---|---|

| Structure | Two separate programs (VDMP and VFMP) | Single combined program |

| Monitoring | Separate dispute ratio and fraud ratio | Single VAMP ratio for both fraud and non-fraud disputes |

| Scope | Limited to specific dispute types | Includes processing errors and authorization issues |

| Exemptions | N/A | Disputes resolved with Visa Verifi’s RDR or CDRN won’t count toward VAMP ratio |

Revamping Your Approach to Chargebacks as VAMP Rolls Out

It’s vital for merchants and acquirers to closely consider how the new VAMP program could impact their financials and business operations. Some merchants may enjoy the streamlined approach, but keep in mind that thresholds for acquirers and merchants will be lower under the new program.

It’s wise to build a diverse toolkit for dealing with chargebacks and disputes. Preventing disputes, chargebacks, and fraud will help merchants and acquirers stay on the right side of thresholds. Of course, fighting fraud and chargebacks can benefit a merchant’s bottom line in other ways as well.

It’s smart to use Visa’s own fraud tools. Some disputes deflected by Visa Verifi’s Rapid Dispute Resolution (RDR) and Cardholder Dispute Resolution Network (CDRN) won’t count toward the VAMP ratio, for example. ChargebackHelp also offers a variety of tools you can use to prevent disputes, and we make it easy to integrate Verifi’s tools as well.