A Brief History of Credit Cards

It’s easy to mistake the concept of credit cards as relatively new; they seem so dependent on the hyper-connectivity of the Internet Age. But credit cards are old technology — old as money, maybe just as old as writing. So let’s kill some time with a short trip into the long history of credit cards.

Charge Coins:

Early Diners Club Card

Early Visa & AMEX

TABLET-PRESENT TRANSACTIONS

Some of the oldest known forms of writing were clay tablets that tallied a person’s livestock, their transactions, or even their bar tab. These were basically credit cards — a medium with which to exchange goods and services without using actual money. Behold! Over six thousand years ago, the fist card/tablet-present transactions ascribed purchases to a particular person.

These credit tablets were closed-network, meaning both merchant and consumer had to be in on this system and recognize each other for it to work. You couldn’t go on an international shopping spree yet. Though money had a far wider currency, the tablet system was superior for larger transactions. While cash has anonymous value which then can be stolen on the road to Jericho, credit is only as valuable as the name or face behind it, and debits could be charged to a specific identity to be paid later.

INNOVATIONS ON AN OLD IDEA

Credit networks like these remained as closed loops for a long time, until the late 19th century. Merchants began issuing top clients “charge coins”, with information like the customer’s name and address on it. This moved the concept to these small portable tokens you could fit in your pocket. They would be stamped into the customer’s receipt, intended to reduce mistakes caused from bad handwriting or human error.

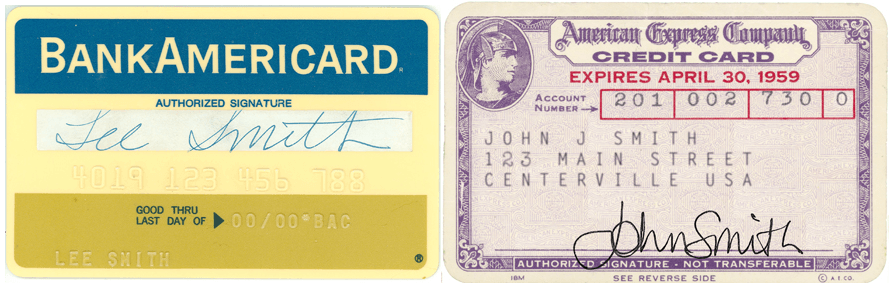

Around the middle of the 20th Century, the modern concept of the credit card began to take shape. Diner’s Club debuted in 1950, after its founder forgot his wallet to a dinner (and probably failed to convince his fellow diners to pick up the tab). The cardboard Diners Club Card became the first credit card in widespread use, where you could make purchases with multiple merchants. Wells Fargo offshoot American Express came out with the first plastic card, similar to the Diner’s Club. American Airlines issued the first ever bin-numbered card scheme instead of just the cardholder’s name and address. Their current manifestation, the UATA card, still issues the only cards that begin with a bin number 1.

THE CARDS WE KNOW

Bank of America came up with the first truly modern credit card. It was a plastic, bin-numbered card, where users no longer had to be a member of the issuing bank. Nor did they have to pay the balance in full every month, but could carry it forward for a fee. It was the first ever open network scheme, and it was also the first to use revolving credit.

Once BofA took their card international, they named it VISA. Soon after, a network of banks came out with the MasterCard to directly compete with VISA. In their battle for market share, VISA and MasterCard created global open-network credit cards offering revolving credit and enabling the commercial landscape we live in today. Stay tuned for our sequel, the history of Card-Not-Present transactions, coming soon!