Big Changes Coming: VAMP Enforcement Begins October 1st

We keep this page updated as Visa makes changes to its VAMP guidelines, but it’s always a good idea to confirm current details with your merchant service provider.

Why VAMP Matters Right Now

The end of September closes the advisory phase of VAMP. From October 1 onward, merchants breaching Visa’s thresholds will face fees, penalties, and increased scrutiny.

This is not just another program update. It signals a tougher era of compliance where both disputes and fraud alerts carry weight in a single ratio.

Visa’s goal is simple: align acquirers and merchants under one unified monitoring process. For merchants, though, the reality is more complex. Even if a dispute is resolved later, if it was not settled in the same month it was filed, it still counts against the VAMP ratio. That makes speed and efficiency the defining factors of compliance going forward.

With just one month left before enforcement begins, merchants cannot afford to rely on outdated or semi-manual processes. VAMP compliance requires a system that can track disputes in real time, integrate fraud alerts seamlessly, and resolve cases within the same month they occur. Anything less exposes a business to fines, penalties, and strained acquirer relationships. The urgency is clear: merchants need to put vastly improved chargeback management practices in place now, or risk being caught unprepared when October arrives.

A Refresher on VAMP

Visa’s Acquirer Monitoring Program (VAMP) was introduced in April 2025 to replace two long-standing monitoring systems: the Visa Dispute Monitoring Program (VDMP) and the Visa Fraud Monitoring Program (VFMP). Both of those older programs tracked different types of merchant activity, but they often created confusion by operating in parallel and measuring performance separately. VAMP simplifies the process by consolidating everything into one framework and one metric.

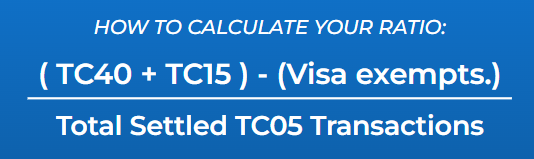

At the core of VAMP is the VAMP Ratio, which is calculated by dividing the total number of TC40 fraud alerts and TC15 disputes by the total number of settled transactions in a given month. This formula provides Visa with a single measure of both fraud and dispute activity across a merchant’s portfolio.

The program is designed with escalating enforcement in mind. Merchants are only evaluated against the “Excessive” threshold if they exceed it after October 1, 2025, they will face immediate financial penalties. The “Above Standard” designation applies only to acquirers, who, starting in January 2026, will be held accountable when their merchant portfolios cross that level. In April 2026, the Excessive thresholds for merchants will tighten further, raising the bar for compliance even higher.

The New Compliance Pressure Point

Once enforcement begins on October 1, 2025, merchants in violation can expect fines, increased monitoring, and intervention from acquirers.

This shift makes manual processes risky. Merchants who still rely on spreadsheets, staff reminders, or partial integrations are essentially gambling each month that they will not see a cluster of disputes come in at the tail end of the cycle. If they do, the odds of responding in time without automation are slim. By contrast, automated dispute management systems can capture alerts instantly, trigger same-day responses, and close cases quickly enough to keep the ratio under control.

In the VAMP era, automation is no longer a nice-to-have. It is the only reliable safeguard against sudden compliance failures.

The Role of Resolution Tools in VAMP Compliance

Visa’s own solutions, including Rapid Dispute Resolution (RDR), Verifi CDRN, and Ethoca Alerts, play an essential role. Each gives merchants a chance to resolve disputes before they escalate into chargebacks.

The key is speed.

- Rapid Dispute Resolution: Automated refunds triggered by preset merchant rules.

- Verifi CDRN: A direct alert system that allows merchants to resolve disputes before they hit the chargeback stage.

- Ethoca Alerts: Real-time notifications from participating banks that let merchants stop fulfillment or issue refunds immediately.

Together, these solutions offer a safety net, but only if they are fully integrated and monitored continuously. Missing even a few alerts can be enough to breach Visa’s thresholds.

Preparing Your Business for Enforcement

The move from advisory to enforcement means merchants cannot afford to delay. Every business should be reviewing:

- Current ratios: You can use our VAMP calculator to easily monitor your compliance.

- Resolution processes: Are you already resolving alerts within the same month they are filed, or is this something you need to implement now?

- Integration coverage: Are Rapid Dispute Resolution, Verifi CDRN, and Ethoca Alerts all connected and monitored effectively, and within the same platform for simplicity so that nothing falls through the cracks?

Answering these questions honestly helps merchants understand whether they are ready for October or at risk of costly violations.

The Road Forward Under VAMP

Visa’s VAMP program signals a permanent shift in how the network expects merchants to manage risk. With the advisory window closing, it is no longer about preparing, it is about performing. If your dispute and fraud ratios are not under control, October 1 will bring a new wave of penalties that can impact both revenue and merchant account standing. ChargebackHelp’s dispute management expertise and portfolio-level visibility can help businesses adjust before enforcement takes effect. Reach out to our VAMP specialists today to ensure you are ready.

Become a VAMP Champ!

Visa’s new global monitoring program is changing the rules for chargeback compliance, and merchants who aren’t prepared risk heavy fines and increased scrutiny. Our free resource, The VAMP Survival Guide for Merchants, breaks down thresholds, timelines, and strategies you can put into action today. Download your copy here to stay compliant and keep your revenue protected.

Why ChargebackHelp?

ChargebackHelp gives merchants the full spectrum of solutions to prepare for VAMP enforcement and beyond. With DEFLECT, businesses can prevent many disputes before they are ever filed. RESOLVE consolidates Verifi CDRN, Ethoca Alerts, and Visa RDR into one streamlined platform, ensuring merchants can act quickly on alerts. And when chargebacks cannot be avoided, RECOVER provides automated, data-driven representments to protect revenue. Combined with real-time reporting and expert support, ChargebackHelp helps merchants reduce risk, avoid penalties, and safeguard their business against the tightening requirements of card networks.

FAQs: Visa’s VAMP Enforcement

What is Visa’s VAMP program?

Visa’s Acquirer Monitoring Program (VAMP) is the card network’s unified framework for monitoring merchant disputes and fraud. It replaces older programs like VDMP and VFMP. ChargebackHelp helps merchants adapt to these changes with integrated compliance solutions.

When does VAMP enforcement begin?

Visa begins enforcing VAMP on October 1, 2025. From that date forward, merchants who exceed thresholds will face penalties. ChargebackHelp can help assess your ratios and create a strategy for compliance.

How is the VAMP ratio calculated?

The ratio is calculated by dividing the total number of TC40 fraud alerts and TC15 disputes by the total number of settled transactions. ChargebackHelp provides reporting and monitoring to keep merchants aligned with these requirements.

What happens if a merchant breaches Visa’s thresholds?

Merchants may face fines, higher processing costs, and stricter oversight from acquirers. Ongoing non-compliance could even risk account standing. ChargebackHelp’s solutions help mitigate these risks before they escalate.

Can dispute alerts prevent a VAMP violation?

Yes, if disputes are resolved in the same month they are opened, they may not count against the VAMP ratio. Tools like Verifi CDRN, Ethoca Alerts, and Visa RDR are vital. ChargebackHelp integrates all three for maximum coverage.

Are VAMP rules different for high-risk industries?

High-risk sectors such as subscription boxes, CBD, or online gaming may see higher alert and dispute volumes, making compliance more challenging. ChargebackHelp specializes in supporting merchants across these verticals.

What should merchants do right now?

Merchants should review ratios, integrate resolution tools, and confirm that disputes are being resolved within the same month they occur.