Game Over for Fraud in the Video Game Industry

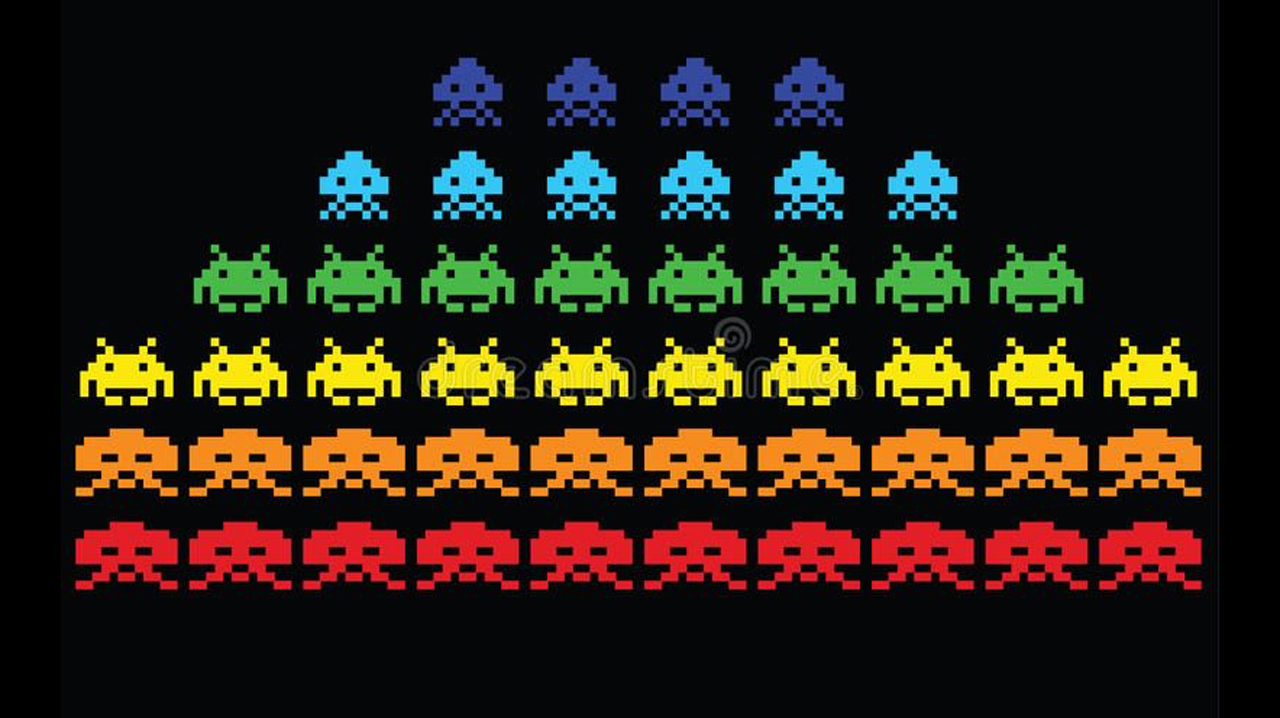

The global video game industry is absolutely massive, with gross revenues projected at $385 billion for 2023 alone. To put that into perspective, the ever-glamorous movie industry pulled in a global box office worth only about $26 billion in 2022 — chump change in comparison. Yet while the gaming industry supports hundreds of thousands of jobs and provides many millions of hours of entertainment, it’s also plagued by chargebacks.

The video game industry is invariably designated as “high risk” by payment processors and card networks. Merchants operating in “high-risk” industries may face higher processing fees even if they themselves haven’t been hit with an abnormal number of chargebacks. This means that right out of the gate, video game companies and online gaming platforms face higher OpEx in processing payments. Further, if video game companies suffer abnormally high chargeback ratios, payment processors may increase fees even more or may flat-out refuse to work with them.

Let’s dig into why the video game industry is often considered high-risk.

How the Video Game Industry Leveled-up into High-Risk

Video games started to appear in American households back in the 1970s. Initially, video games were rather expensive and sold through brick-and-mortar stores. If customers had problems, they’d turn to the store they bought the game from for assistance or a refund. As such, video games initially operated like many other traditional retail sectors.

Now, more games are being sold, updated, and expanded digitally. In general, e-commerce sees higher rates of chargebacks than brick-and-mortar retail. This is partly because fraud attacks in general have moved online. Further, criminals would typically rather not risk getting caught on camera or in a confrontation with security at a physical store.

Beyond that, digital releases have led to more developers launching incomplete games. If a promised release date is approaching but a game isn’t quite finished, the developer may release it anyway and then later release updates to the game to fix bugs and enhance UX. Unfortunately, this could lead to more chargebacks from dissatisfied customers who had been expecting a complete and polished game.

On top of all the above, many digital gaming platforms try to make it as easy as possible for customers to make purchases. Unfortunately, less friction often allows more fraud. Reducing friction at the point of sale can boost revenues, but it also increases chargebacks.

In-Game Transactions May Fuel Chargebacks

Within most games these days, players are given the option to buy more stuff (e.g. weapons or special character models called “skins”). In fact, many games are so good at monetizing in-game transactions that the base game is completely free, such as Fortnite or Roblox. Many developers also launch expansion packs, new map sets, and more. As a result, it’s now common for players to make multiple microtransactions, or even recurring subscriptions, within a single game.

Microtransactions are fertile grounds for first-party fraud. Kids are constantly making unauthorized purchases with their parents’ credit cards, buying virtual currencies and upgrades. Purchases made by children are a bit of a gray area in regard to card payments and whether they should count as “unauthorized” (from the point of view of chargebacks). In 2014, the FTC sued Apple, Google, and other companies for charges made by children and ultimately forced them to pay millions in damages. Still, these unauthorized in-game purchases remain contentious. Sometimes parents are held responsible, other times video game companies must issue refunds or risk losing chargeback disputes.

Fraudsters Love Video Games Too

Videogames offer some unique opportunities for fraudsters. First, video games can provide a relatively quick and easy way for a criminal to test stolen credit or debit card data. When a criminal gets their hands on a card, they don’t actually know if it’ll work. The customer may have already disabled it, it might be maxed out, or the bank may have effective fraud filtering, among other things.

So, fraudsters often test their stolen credentials with a small transaction to see if they work. If so, they can move on to making larger transactions. Microtransactions are perfect for card testing, and pave the way for bigger unauthorized transactions — all of which generate chargebacks.

Account Takeover Fraud and the Gaming Industry

Account takeovers (ATOs) are another primary driver of chargebacks, and gaming accounts are a favorite target for these attacks. What makes video games so susceptible to ATOs? Among other things, many gamers simply reuse the same passwords for their gaming accounts. A password that works for a Steam account may also work for the user’s Xbox Live or GOG account, for example. So if a hacker gets their hands on a password, it may work for several accounts.

A hacker might break into an account, buy some gift cards, and then sell the gift card codes, for example. Once the account holder sees the illegitimate charge, they will file a chargeback. Some scammers also use phishing attacks to get gamers to hand over login credentials. Then, they can log in and make unauthorized purchases. Sometimes, login credentials for online gaming platforms are sold directly to other parties, which could also result in disputes.

First-Party Fraud is a Constant Threat

For a long time, first-party fraud was often a type of fraud referred to as “friendly” fraud. Of course, fraud is anything but friendly, and first-party fraud is a more apt term. Essentially, a cardholder reports a transaction they made as fraud, abusing the chargeback process to rip a merchant off.

A customer might buy a video game from a developer, for example. In this case, we’ll assume they’re buying a physical video game. A few days later, the game gets delivered, the customer installs it, plays, and has a good time. Only, they go to their bank and claim that the video game didn’t arrive. Then they file a chargeback. Why? They simply want a free product.

Buyer’s remorse can also be a major problem with video games. Someone might get caught up in the heat of the moment, in a pay-to-win scenario. Many video games are designed to be addictive and highly engaging, especially to drive microtransactions. After a player cools off, however, they may regret the purchases, and if they can’t get a refund, they might try going for a chargeback.

In either case, the game developer did nothing wrong, but they could get hit with a chargeback. If the bank approves it, the developer will lose the revenue from the sale and will incur fees. Fortunately, there are steps merchants can take to prevent and fight chargebacks.

Preventing Chargebacks in the Videogame Industry

Chargeback prevention can be broken into two broad categories: Pre-Authorization and Post-Authorization. Ultimately, both types are crucial for video game developers. Let’s look at both types.

Pre-Authorization Strategies for Preventing Chargebacks

A variety of pre-auth strategies can be deployed to disrupt fraud:

Pre-authorization prevention offers many benefits but there are some downsides. For example, you may suffer increased false declines, meaning you stopped and could potentially lose a legitimate sale.

Post-Authorization Chargeback Prevention

Ideally, you’ll prevent chargebacks before you authorize the purchase. However, in some cases, a fraudulent purchase may be authorized. In fact, first-party fraud is virtually impossible to prevent in pre-auth because the cardholder is making the purchase. Even so, there are strategies that you can use to prevent a chargeback.

Both deflections and alerts can effectively reduce chargebacks, saving video game developers from chargeback fees and a rising chargeback ratio.

How Video Game Companies Can Fight Chargebacks With Representment

If and when a merchant or video game developer gets hit with an unwarranted chargeback, they can use the chargeback dispute process, AKA representment, to challenge it. During this process, the merchant will draft a rebuttal letter, arguing that the charge in dispute was, in fact, legitimate. For example, if a customer is claiming that they never received a physical video game, but the merchant can supply a signed delivery receipt, it may prove that the goods were actually delivered.

When a merchant successfully refutes a chargeback through the dispute process, they can claw back the revenues from the sale. Unfortunately, the merchant will still be on the hook for chargeback fees and their chargeback ratio will rise. As already mentioned, if this ratio gets too high, they may be forced to pay higher processing and chargeback fees.

Managing disputes can be time-consuming for video game companies. Dispute management platforms make it easier to manage the whole process. There are many deadlines you need to track and managing disputes probably isn’t your core business.

Video Game Developers Need a Proactive Approach to Chargebacks

Ultimately, fighting and preventing chargebacks is especially difficult for video game developers and merchants. Markets are intensely competitive, and many developers will want to minimize friction when gamers make purchases. Otherwise, legitimate gamers may ditch games for competitors that make payments easier. At the same time, fraud and chargebacks are a major threat, and reduced friction can grease fraudulent activities. By taking steps to prevent chargebacks, video game developers and merchants can protect their businesses. If chargebacks are inevitable, there are steps you can take to fight them.