Visa’s Acquirer Monitoring Program: How it affects merchants (updated)

Visa has now consolidated all of its fraud & dispute monitoring programs under VAMP, the Visa Acquirer Monitoring Program. VAMP consolidates existing fraud and dispute programs into a single framework intended to simplify compliance efforts for stakeholders. This new framework applies not only to merchants, as the previous programs had, but also brings your acquiring banks into the fold of accountability for processing excessive fraudulent and disputed transactions.

VAMP came into effect April 1, 2025; prior to that, there existed a mosaic of different regulatory structures specializing in specific processing outcomes: one program for disputes, one for fraud, another for chargebacks etc. High-risk merchants tend to be more familiar with these previous monitoring programs than most merchants because these older programs targeted merchants with specific business cases almost exclusively affecting high-risk MCCs. Now, the new VAMP framework applies to all merchants, in all geos, and their processing partners. There are three key changes wrought by VAMP:

- Calculation of the Fraud/Dispute Ratio Thresholds

- Accountability for Compliance

- Criteria Included in the Ratios

1. Calculating VAMP Ratios

VAMP introduces a unified ratio to determine standard versus excessive thresholds for fraud and disputes:

( Total TC40 Notices + Total TC15 Notices ) – ( Designated Visa Exemptions )

Total Settled Transactions

- TC40 Notices: Reports of fraudulent transactions.

- TC15 Notices: Non-fraud dispute reports.

The VAMP ratio combines the total monthly TC40 fraud and TC15 non-fraud dispute notices generated by an acquirer’s merchant portfolio, minus any resolutions exempted by Visa (more below on this), all divided by total monthly transaction volume. While merchants must be vigilant for the fraud & dispute levels on their MIDs, the acquiring banks are also now keeping an eye on the ratio of their overall merchant portfolio.

2. VAMP Ratio Thresholds

This new risk-based enforcement strategy has two ratio thresholds: one for merchants and one for acquirers, using basis points (100bps = 1%).

For Merchants

Merchant ratios are as follows. NOTE: the merchant is charged a flat $8 USD for each dispute once they exceed the thresholds listed:

For Acquirers

Acquirer ratios are calculated from the sum total of all their Visa processing merchants. The chart below includes penalties in red for each disputed transaction once the ratios are exceeded for that level:

Acquirers exceeding these thresholds will be notified through Visa’s OneERS platform, who must then notify the merchant with the following details:

- Reason for identification

- Expected response timeline

- Consequences for noncompliance

- Best practices (when applicable)

KEEP IN MIND!

While VAMP charges acquirers with overseeing their merchants, Visa will continue to monitor certain merchants directly. If an acquirer enters the “Above Standard” level (above 0.3%), Visa will also monitor the acquirer’s merchants directly.

Starting April 1, 2025, Visa will reset the ratios for all participants, meaning acquirers and merchants alike start with a ratio of zero. A grace period is in effect until September 30, 2025, after which enforcement commences in earnest. Subsequently, acquirers are granted a grace period before enforcements are applied for a single threshold violation within a rolling 12-month period.

3. Exclusions to the VAMP Ratio

There has been a lot of back and forth on this from Visa, but certain fraud and dispute resolutions will not count against the VAMP ratio. However, as things have changed, a good rule of thumb is that any TC record will count once it is generated; as of June 2025, any resolutions that block or cancel TC records are subtracted from the total.

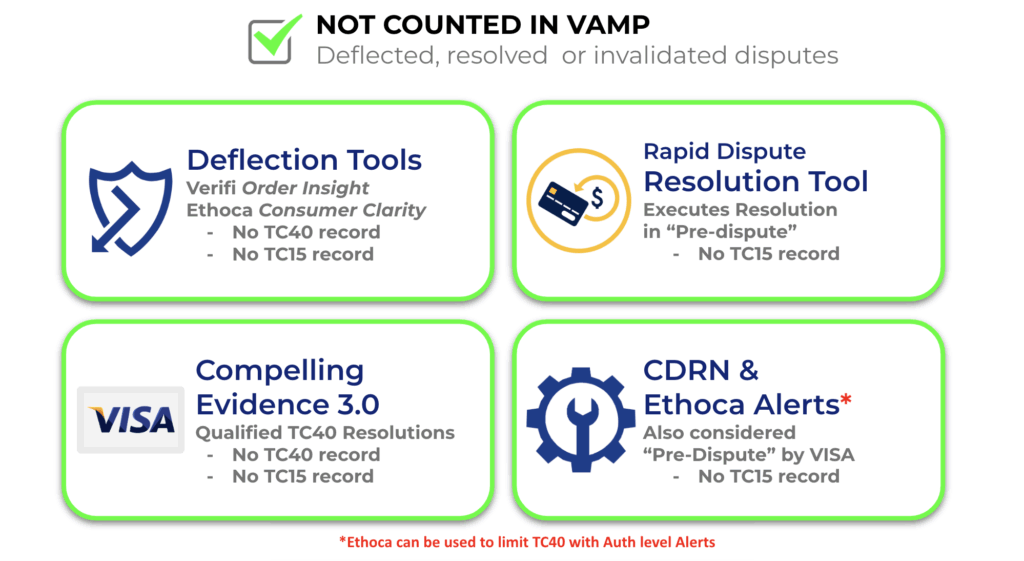

- Deflection tools: Verifi Order Insight, Ethoca Consumer Clarity, and Visa’s Compelling Evidence 3.0 framework all prevent disputes so that no TC record is generated.

- Visa’s Rapid Dispute Resolution automation resolves disputes in a designated “pre-dispute” phase just before a TC record is created, so again, these resolutions are exempt.

- CDRN & Ethoca Alerts are the newest exemptions added by Visa, as these resolution tools now cancel a dispute’s TC15 record when it is refunded using alerts.

ChargebackHelp is Here to Help!

ChargebackHelp is closely monitoring VAMP and its impact on the dispute management ecosystem. The bottom line is that our clients will continue to benefit from the protections our solutions provide, regardless of any changes by Visa to the VAMP framework. In addition, there are some high-level measures merchants should be taking to be VAMP-compliant:

- Monitor your VAMP ratio monthly.

- Identify synergies in fraud/disputes where VAMP-exempt resolutions can be leveraged.

- Develop a compliance plan in the event of exceeding thresholds

- Avoid surprises by keeping an open dialog with your acquirer or payment service provider.

- Consult with ChargebackHelp on fraud and dispute management strategies specific to your business.

As always, clients can reach out to their ChargebackHelp relationship managers with any VAMP-related questions they might have.

If you are considering a partnership with ChargebackHelp, this is all the more reason to build a dispute management strategy with us. Start the conversation today! Send us an email, call us at 1.800.975.9905 or contact us here.