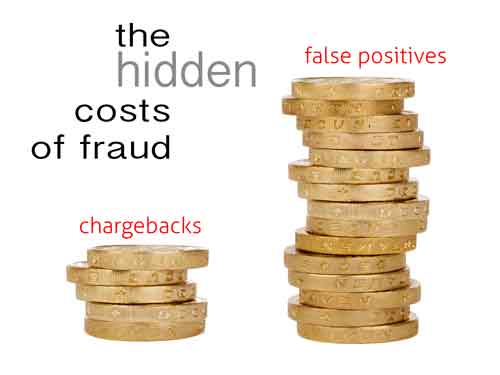

You think chargebacks are bad? Try false positives…

While screening out fraud is a top priority, it is five times more important to avoid false positives — mistakenly declining legitimate purchases as fraud. “Five times more” because merchants lose five times more to false positives than to chargebacks in time, resources, and revenue.

“Long-tail damage”

Javelin Strategy & Research did an interesting study into the costs of fraud. They found that 25-34% of all declined transactions actually turned out to be legit. They also emphasized that merchants in digital goods typically fell on the higher side of that spectrum. These merchants are more at-risk for fraud, but they’re also dealing with “sub-second fulfillment” where a customer’s information must be authenticated instantly to complete the sale. Those merchants more often over-compensate against fraud, and it ends up costing them.

False positives are more costly than chargebacks because of the “long-tail damage” they cause. When a legitimate customer is declined, they’ll simply take their money somewhere else, often never to return. In fact, two-thirds of all consumers who get false-positive declines will not return.

Your most-valuable are your most-vulnerable

Yet the devil is in the details. A closer look at who typically gets flagged with false positives reveals two groups you can’t afford to lose to carelessness: wealthy consumers and millennials. False positives turn away your best customers today and undermine future business.

Big spenders

High-dollar purchases are a common indicator of possible fraud, so consumers who typically make legitimate purchases in this price range inevitably get caught in the dragnet. Roughly 40% of declined transactions are for $250 or more, and high-income consumers initiate most of those, so it stands to reason that they show up as false positives more often.

Poor millennials

False positives are just one more thing troubling millennials these days. They have limited income and rarely make big purchases, so when they do, they can trigger a decline. They also make up an out-sized segment of card-not-present purchases, where merchants are more sensitive to fraud. Javelin estimates that 24% of young consumers have received at least one false positive decline.

Know your demo of declines

When false declines affect these two key consumer segments, it underscores one key fundamental: know your customers. As a merchant you should have the means to analyze your sales to determine how much of your business comes from either group. Furthermore, you should be able to look at the demographics of your declined sales. This will help you adjust any fraud safeguards you may have to better accommodate these decline-prone populations. Because otherwise, what you’re saving from in preventing chargebacks might be slipping away in lost sales.

Regardless of what type of customer is declined in a false positive, they all have one thing in common: they transform into found money if you can adjust your fraud prevention strategy to distinguish them from the real fraudsters. That requires capturing informative data on your customers and taking a diligent look at it. In our next post, we will explore how to better capture and parse your transactional data to prevent these costly errors and minimize their footprint on your bottom line.