Preventing Chargebacks in Social Commerce

The Growth of Social Commerce and Its Risk Profile

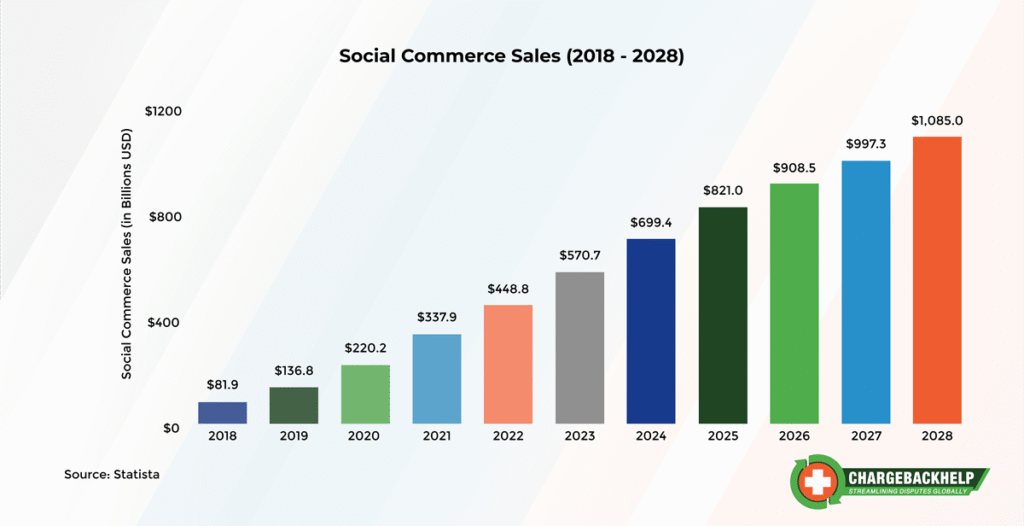

Social commerce sales have surged in recent years, with merchants riding influencer promotions and integrated shopping features to reach new audiences. While this growth expands revenue opportunities, it also introduces unique fraud and fulfillment risks. Many chargebacks originate from unrecognized transactions where customers forget about purchases made in-app. Others stem from delayed shipping confirmations or unclear product descriptions that spark confusion.

Unlike traditional e-commerce sites, social platforms limit direct communication with buyers. Merchants often lack access to the granular customer data needed for quick resolution, making proactive prevention even more critical. These conditions are especially challenging for small businesses that rely on a single merchant account to manage multiple social storefronts.

Common Chargeback Triggers on Social Platforms

Chargebacks in social commerce often follow different patterns than those in traditional e-commerce. A few common triggers stand out:

- Impulse purchases: Influencer-driven campaigns encourage rapid buying decisions. Later, customers may regret or forget the purchase and dispute the charge.

- Unclear billing descriptors: Many platforms process payments under their own name rather than the merchant’s brand, increasing confusion.

- High mobile fraud risk: Mobile-first checkouts can be more vulnerable to account takeovers and unauthorized use.

- Limited fraud screening: Social platforms may not offer the same customizable fraud tools available on dedicated e-commerce platforms.

These challenges highlight why merchants need specialized strategies to reduce disputes rather than relying solely on standard fraud filters or post-transaction support.

Prevention Tactics That Work Across Social Platforms

A strong prevention program addresses both customer confusion and outright fraud. Strategies should start with transparency: make product descriptions clear, send real-time fulfillment updates, and ensure contact details are visible in receipts or follow-up messages. These steps help customers recognize legitimate charges.

Merchants can also benefit from network-integrated solutions. Using Verifi Order Insight and Ethoca Consumer Clarity ensures cardholders and issuers see detailed purchase data, reducing unrecognized transactions. Real-time chargeback alerts provide early warnings so merchants can refund questionable orders before they escalate. Together, these solutions bridge the data gap between various social platforms and acquiring banks.

Operationally, consolidating transaction data from multiple platforms into a single dashboard simplifies review and response times. Merchants who automate this step often see measurable reductions in both dispute volume and resolution time.

Building Internal Workflows for Fast Response

Social commerce merchants must respond quickly when disputes arise. One way to accomplish this is to create tiered response playbooks. Assign clear steps for reviewing an alert, contacting the customer, and deciding whether to refund or contest the chargeback. Documenting these procedures ensures consistent handling even as sales volume fluctuates.

Investing in automation can also help. For example, integrating alerts with order management tools can allow automatic refunds on low-value transactions while flagging high-value ones for manual review. Pairing this with chargeback representment services helps recover revenue on disputes that merit a challenge.

Preparing for Emerging Trends in Social Commerce Fraud

Fraud tactics evolve alongside platform features. New risks include fake influencer promotions, synthetic identities, and cross-border payment disputes as platforms expand globally. Merchants that treat chargeback prevention as an ongoing process, not a one-time setup, are better positioned to adapt.

Regularly reviewing fraud data, updating refund policies, and staying aware of changes in card network programs can keep prevention measures aligned with the latest threats. Over time, this approach reduces exposure and preserves the trust merchants work hard to build with new audiences.

Where Do You Go from Here?

Social commerce isn’t slowing down, and neither are the disputes tied to it. If you’re struggling to unify data across multiple platforms or respond to chargebacks quickly, our team can help. ChargebackHelp connects social commerce merchants with real-time alerts, data-sharing solutions, and representment strategies designed to reduce losses and keep accounts in good standing. Reach out to our chargeback experts to explore a prevention plan tailored to your business.

Why ChargebackHelp?

From Verifi Order Insight and Ethoca Consumer Clarity to Visa RDR and Mastercom Collaboration, we integrate the tools merchants need to reduce risk and recover revenue. With expert guidance and automated workflows, our solutions help merchants safeguard their growth on social platforms and beyond.

Contact our team here to discuss a custom chargeback prevention strategy for your business.

FAQs: Preventing Chargebacks in Social Commerce

What is social commerce?

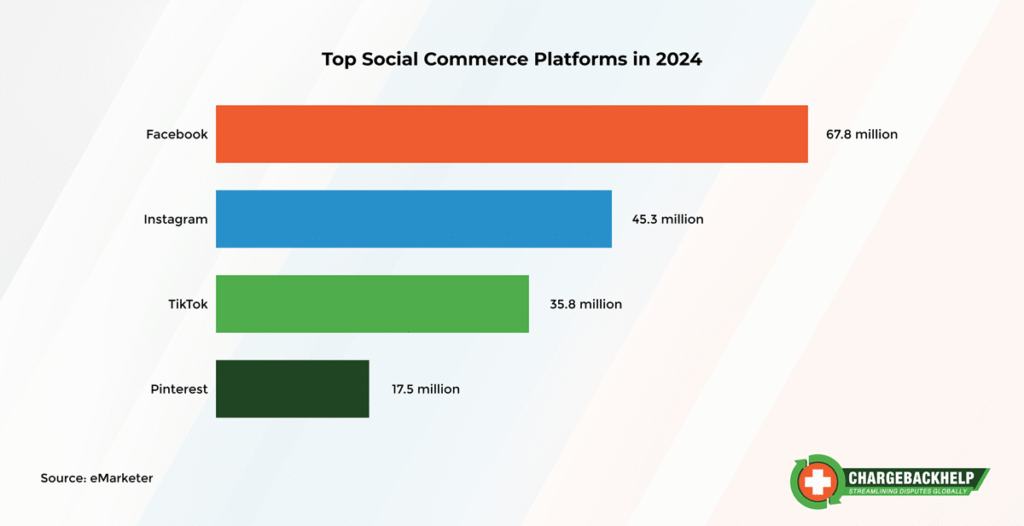

Social commerce refers to selling products directly through social media platforms like Instagram, TikTok, and Facebook. It integrates shopping into social apps, allowing customers to discover, browse, and purchase without leaving the platform.

Why do social commerce merchants face higher chargeback risks?

Transactions on social platforms often involve quick purchasing decisions, limited transaction details, and unclear billing descriptors. These factors can lead to customer confusion, friendly fraud, or disputes over fulfillment speed.

How can social commerce merchants reduce chargebacks?

Prevention starts with transparency: clear product descriptions, visible contact information, and real-time shipping updates. Merchants can also implement solutions like Verifi Order Insight and Ethoca Consumer Clarity to provide purchase details to cardholders and issuers, which reduces unrecognized charges.

Are chargeback alerts useful for social commerce?

Yes. Chargeback alerts give merchants a critical window to resolve issues before they become formal chargebacks. For social commerce, this early intervention is particularly valuable because merchants often lack direct access to customer service tools on the platform itself.

Can merchants recover funds lost to social commerce chargebacks?

Recovery is possible through chargeback representment. By submitting compelling evidence that links the customer to the purchase, merchants can overturn invalid disputes and reclaim lost revenue. ChargebackHelp offers representment support to help optimize win rates.

Does ChargebackHelp integrate with social commerce platforms?

ChargebackHelp connects to payment data rather than the social platform itself, allowing merchants to unify transactions from multiple sources. This enables early alerts, automated responses, and recovery strategies without requiring deep platform-specific integrations.