Protect Your VAMP Ratio by Deflecting Disputes

Visa’s VAMP Ratio: A Defining Metric

Visa’s VAMP ratio is a defining metric for merchant health. When it rises, acquirers tighten oversight and penalties can follow, which puts revenue growth and processing access at risk. The most efficient way to protect the VAMP ratio is to reduce the number of disputes that ever reach the chargeback stage. DEFLECT delivers that protection by equipping issuers and cardholders with instant clarity at the point of doubt.

Why Deflection is Critical for Merchants

Every dispute that is deflected before it becomes a chargeback reduces the numerator of your VAMP ratio. That single change compounds across billing cycles, which lowers penalty exposure, preserves acquirer confidence, and stabilizes authorization performance. The operational downstream benefits are just as meaningful, since fewer chargebacks means fewer investigations, less manual work, and a faster path to refunds when appropriate.

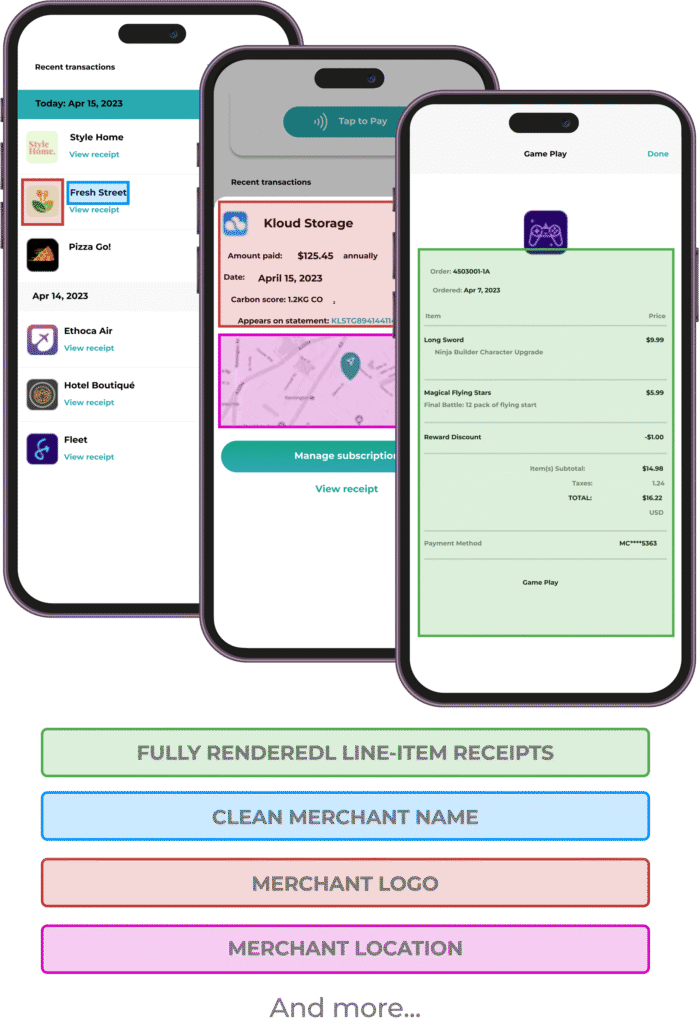

Consumer Clarity: Reduce Disputes at the Source

Consumer Clarity presents clear order details to cardholders inside participating issuer experiences. When a buyer sees the merchant name they recognize, item descriptions, delivery confirmations, or support links, the question often resolves in seconds. Confusion driven by unclear descriptors, family purchases, or subscription renewals becomes a quick recognition event rather than a chargeback that harms your VAMP performance. Consumer Clarity is a Mastercard owned capability that complements your Visa facing tools to protect the VAMP ratio across your entire card mix, supported by related alerting through Ethoca Alerts on the Mastercard network.

Order Insight: Real Time Transparency for Issuers

Order Insight gives issuers immediate access to the data they need to answer a cardholder’s question. Real time detail such as product names, dates, receipts, delivery status, and cancellation terms eliminates uncertainty and dramatically reduces the likelihood of a dispute progressing to a chargeback. The result is fewer chargebacks counted against your Visa metrics and stronger control of your VAMP ratio. Order Insight pairs naturally with rule based early resolution through Visa RDR when a dispute does proceed, which further limits downstream impact.

DEFLECT: Combined Coverage Across Networks

Consumer Clarity and Order Insight are both available through our DEFLECT platform. This combined approach creates consistent deflection across Visa and Mastercard, which prevents needless chargebacks, supports healthier ratios, and improves acquirer relationships. DEFLECT is designed to work alongside Verifi CDRN for near real time alerts on the Visa side and Mastercom collaboration flows on the Mastercard side, so you control risk proactively and resolve necessary cases quickly.

Become a VAMP Champ!

Visa’s new global monitoring program is changing the rules for chargeback compliance, and merchants who aren’t prepared risk heavy fines and increased scrutiny. Our free resource, The VAMP Survival Guide for Merchants, breaks down thresholds, timelines, and strategies you can put into action today. Download your copy here to stay compliant and keep your revenue protected.

Why ChargebackHelp

ChargebackHelp aligns prevention, alerts, and collaboration into a unified operating model, so each tool supports the next. Our DEFLECT deployment playbooks target descriptor clarity, data mapping, and issuer response success, which accelerates time to value. We pair implementation with merchant training and performance reviews that focus on one outcome, protect the VAMP ratio while improving customer experience.

Our team manages the day to day tuning of Consumer Clarity and Order Insight data fields, monitors issuer outcomes, and recommends specific changes that increase deflection. You get a proactive partner that reduces manual workload, documents measurable savings, and helps you stay ahead of tightening thresholds.

Contact our team today to discuss how to integrate DEFLECT into your chargeback deflection process.

FAQs: Protect VAMP Ratio and Dispute Deflection

How does DEFLECT help me protect the VAMP ratio?

DEFLECT reduces the number of disputes that turn into chargebacks by resolving cardholder confusion at the point of doubt. Fewer chargebacks means a lower VAMP numerator, which stabilizes the ratio and reduces penalty risk.

What is the difference between Consumer Clarity and Ethoca Alerts?

Consumer Clarity displays rich transaction details inside issuer experiences to prevent disputes from being filed. Ethoca Alerts notify you when a dispute is initiated so you can resolve it quickly, often by refund, before it becomes a chargeback that would hurt your ratio.

How does Order Insight differ from Visa RDR?

Order Insight focuses on real time data sharing to stop a potential dispute. Visa RDR is an automated rule based resolution path when a dispute is filed. Used together, they minimize chargebacks counted against your VAMP ratio.

Will DEFLECT work for subscription and digital goods merchants?

Yes. Transparent descriptors, receipt level detail, renewal dates, and access logs are especially effective for subscription and digital businesses, since most disputes arise from recognition or renewal questions.

How quickly can I see impact on my ratio?

Many merchants see immediate reductions in chargeback counts as recognition improves. Ratio movement follows your billing cycles, so the strongest impact appears as deflection gains accumulate across weeks and months.

What else should I do alongside DEFLECT?

Pair DEFLECT with clear descriptors, responsive support links in issuer views, and early resolution programs. ChargebackHelp can deploy related tools such as Visa RDR, Verifi CDRN, Ethoca Alerts, and Mastercom collaboration to create full coverage.