The Dispute Landscape Part II: Solutions galore

In business, problems are inversely proportionate to the profitability of their solutions. The more money you can save or make dealing with a problem, the less of a problem it becomes for you. The most successful businesses gather employees and partners that thrive on making their problems go away. This is the business model for dispute management, in a nutshell. We’ve examined the problems with disputes in a previous piece, now we will look at all the solutions available for merchants to save money and protect revenue.

As mentioned in the previous article, we are focusing on fraud-driven disputes in card-not-present transactions (CNP). There are two main choke points at which to deal with CNP fraud: before authorization (pre-auth) and after (post-auth). Most of your anti-fraud solutions are divided into these two categories.

PRE-AUTHORIZATION

Pre-auth fraud management has three main components: Verification, Scoring, and Manual Review. Technically, pre-auth countermeasures are not considered “dispute management” because if a transaction is declined in pre-auth, there’s nothing to dispute from the merchants’ perspective.

Verification

Verification is elemental to the authorization process, and is considered the most basic countermeasure against CNP fraud. Cardholder gateway inputs are all checked by Address Verification (AVS) and Card Verification Values (CVV). The merchant and/or processor can set varying degrees of rigor that may decline a transaction — eg. if user IP does not match the AVS. Or, they can outsource verification entirely to the card issuer by using 3DS Authentication.

Fraud Scoring

Fraud Scoring is the next step up in diligence and complexity. While the user may have entered the correct inputs to authenticate a transaction, artificial intelligence evaluates the submission for certain patterns that may indicate fraud. Does delivery and billing address match, and if not how far apart are they? Is user behavior consistent with known legitimate behaviors? Does user device ID match with previous purchases… These evaluations score each transaction on its likelihood to be fraud; past a certain threshold, the transaction is declined.

Manual Review

Manual Review is the OG fraud scoring, and is still deployed for transactions that score close to the fraud/not-fraud threshold. Here, an expert human reviews a questionable transaction and decides if it should proceed. They may call the cardholder or their issuer for further confirmation, or just flip a coin. Manual review is a high-trust, high-value job that most companies are trying to deprecate. To learn more about Manual Review, read this.

The Pros & Cons of Pre-auth

Obviously if you can stop a fraudulent transaction before it happens, that is the best outcome of all. The pre-auth fraud-prevention industry has exploded in pursuit of that holy grail. Leaps in AI are also improving fraud scoring and reducing the need for manual review.

Even so, fraud is keeping pace, always one step ahead of the best ideas to stop it. Pre-auth filtering is mostly geared to catching third-party fraud. Meanwhile, first-party fraud is virtually undetectable to pre-auth filters, as these transactions are made by the actual cardholder and they don’t become a problem until post-authorization.

POST-AUTHORIZATION

Post-auth dispute countermeasures are not alternatives to pre-auth, per se; savvy merchants use both. That said, a robust post-auth regime of solutions will allow you to process more aggressively and avoid more false positives in pre-auth. Think of these solutions as fail safes that can catch fraud throughout the post-auth dispute lifecycle.

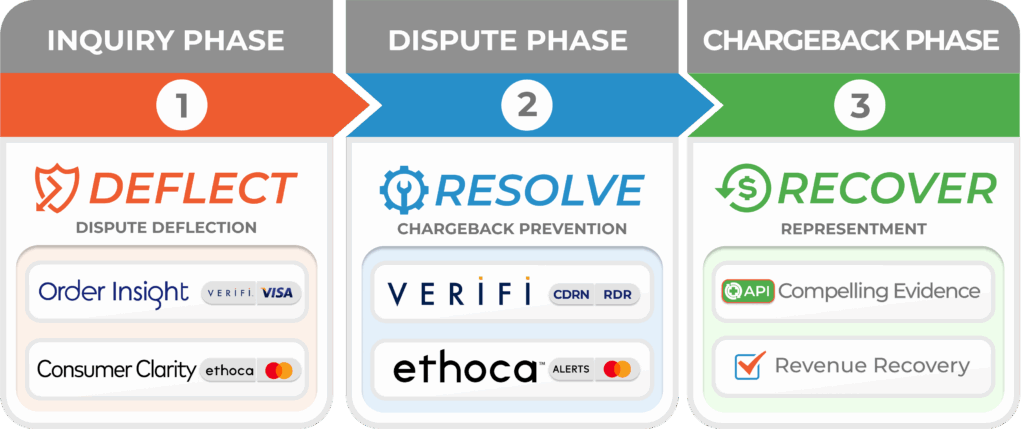

The dispute lifecycle has three phases: the Inquiry, Dispute and Chargeback phases. Each phase has a handful of solutions, that have been divided between the card schemes. The schemes issue mandates and rule changes to allow for their members to market their solutions to disputes. There is Ethoca, owned by Mastercard, and Verifi, a Visa solution. Both Verifi and Ethoca products are integrated within ChargebackHelp, which complies with all scheme mandates. Let’s look at each phase and their corresponding management tools.

INQUIRY PHASE: Merchant goal => Deflection

When the cardholder has a problem with a transaction, they usually call their bank — not the merchant — to find out what’s going on. The problem is that the issuing bank often has little more information than the cardholder. The inquiry phase can be resolved, and a potential dispute can be prevented with additional information that ties to the cardholder to the transaction in question.

Dispute Prevention, aka “Deflection” at the inquiry phase is the best of all possible post-auth dispute outcomes for merchants. They can achieve dispute deflection at the inquiry phase with two main tools, all integrated within ChargebackHelp’s DEFLECT Module:

- Verifi Order Insight® for Visa and non-Visa transactions

- Ethoca Consumer Clarity for Mastercard

DEFLECT captures deeper transaction and fulfillment data from merchant sales streams, and feeds that data to Order Insight/Consumer Clarity. OI/CC then distributes them to cardholder digital statements and issuer call centers.

The DEFLECT Integration

The DEFLECT Workflow

Transaction data includes anything that is captured during the purchase process:

- Authentication data – card information, billing, identity, etc.

- Product amount, SKU, descriptions

- Purchase IP address

- Purchase Device ID or Device Fingerprint

Fulfillment data can be anything captured in delivery of that purchase, including:

- Shipping address

- Delivery confirmations

- User engagement and logins

Compelling Evidence 3.0

However, authentications and proofs of delivery do not necessarily merit a deflection. Visa has worked to create more predictable, merchant-friendly outcomes where first-party misuse is suspected, with a rule change called Compelling Evidence 3.0 (CE3.0).

CE3.0 blocks any Visa dispute with reason-code “10.4 CNP Other Fraud.” where it is proven the cardholder made at least two qualified historical transactions on the same Personal Account Number that a) can no longer be disputed and b) must not have had a fraud report associated. That is quite the word salad, no? Let’s break it down to bullets:

- “That can no longer be disputed”; means any transaction where the dispute window has closed: older than 120 days, but less than or equal to 365 days.

- “Must not have had a fraud report associated” means the previous transactions did not have any reported 10.4 fraud.

- “Qualified Historical Transaction” means any two of the following criteria match, at least one of which should be from the items in bold:

- IP Address

- Device ID or Device Fingerprint

- Account ID

- Delivery Address

As long as you have that qualified transaction history that does not have any associated Fraud disputes, you are not liable for the dispute.

CE3.0 is most likely the first of many qualifying rule changes from the schemes which will better guarantee deflection outcomes for merchants in cases of confirmed first-party misuse. Deservedly so, because again, deflections are the best outcome for post-authorization disputes. Learn more here…

DISPUTE PHASE: Merchant goal => Resolution

When a dispute is not deflected at the inquiry stage, it enters the dispute phase. Here, the issuing bank begins to take action to recover the transaction amount for its cardholder. The merchant’s dispute-phase goal is resolution, where you refund a transaction directly to prevent a chargeback from doing the same thing, plus fees and penalties. You’ll want to refund any true fraud dispute, as the liability for processing fraud falls squarely on the merchant.

RESOLVE integrates the following tools for pre-chargeback resolution:

- Ethoca alerts

- Mastercom

- Verifi Cardholder Dispute Resolution Network™ (CDRN®)

- Verifi Rapid Dispute Resolution (RDR)

The first three tools are considered managed resolution tools, in that they are resolved manually by a person. RDR is the first of the automated alerts, that are resolved automatically with machine decisioning.

The RESOLVE Integration

The RESOLVE Workflow

Manual Alerts

Ethoca and Verifi CDRN operate on the same principle. Register your descriptors with either of these services, and they will alert you of a pending chargeback when transactions on those descriptors are disputed. Even though Ethoca is Mastercard and Verifi is Visa, both alert services are card-agnostic. It’s all about who you register your descriptors with, not which card was used for those descriptors.

Manual alerts are also known as “managed” resolution tools. This means the merchant or their intermediary (aka managed alerts) must take action to resolve them. This is done in the merchant gateway by refunding the transaction that matches the dispute ARN#. Most gateways allow for batch resolutions where a spreadsheet created in RESOLVE is uploaded to the gateway.

Mastercom Acquirer Collaboration

Mastercard recently issued a mandate that there will be alerts for all disputes on its network, whether a merchant is registered to get them or not. This is called Acquirer Collaboration. Dispute alerts on unregistered descriptors will be sent via Mastercom to the merchant’s acquiring bank, and the bank will be charged per alert. Guess what your acquirer is going to do… Let’s just say it is cheaper for the merchant to register its MC descriptors with Ethoca and receive alerts that way, and avoid getting them through the acquirer via Mastercom. This is Mastercard’s subtle hint that you need to register your descriptors through Ethoca.

Ethoca, CDRN and Mastercom alerts are manually resolved, either by the merchant or by a service like ChargebackHelp. We manage alerts, and this is preferable for many merchants because manual resolutions are a headache and a time-sink. Though our module RESOLVE puts all your alerts in one place, you will have to find each alert’s transaction in your gateway to refund the dispute before it becomes a chargeback.

Automation: Rapid Dispute Resolution

Automation is the next logical step in resolution innovation. If you’ve ever manually resolved alerts, you know why. Verifi’s RDR is the first product of its kind to provide this.

The RDR Workflow

RDR operates on a set of rules defined by the merchant, where if a transaction matches a set of criteria, an automatic refund is executed. No gateways and no manual interactions are required beyond an initial configuration; it’s “set and forget.” RDR is integrated into RESOLVE, and ChargebackHelp configures and maintains the rulesets.

Here’s what that looks like. Merchants can set up to ten rules per BIN, and seven attributes for each rule. The ruleset attributes are:

- Issuer BIN

- Transaction Date

- Transaction Amount

- Transaction Currency Code

- Purchase Identifier

- Dispute Category

- Dispute Condition Code

What’s in an RDR ruleset?

A simple example is for Transaction Amount. A rule can be set that if a disputed transaction is under a specified amount, a refund is automatically issued to the cardholder. You can also qualify that refund further if the dispute has a specific reason code in Dispute Category.

Visa mandated a pre-dispute phase for its transactions, where RDR works its magic, after the Inquiry phase. If the dispute is not resolved by RDR, it will become a chargeback. However, if RDR resolves the pre-dispute, it does not count against the merchant’s dispute-to-sales ratios. Even better, the cardholder receives their refund immediately for an added wow-factor chalked-up on to your customer service. Learn more about RDR here.

CHARGEBACK PHASE: Merchant goal => Recovery

If a dispute survives deflection and does not meet your requirements for resolution, a chargeback must go through. BUT, you’ll still have one more wack to recover your revenue: representment. For representment, the merchant re-presents said transaction to the issuer with complete fulfillment data.

The RECOVER Integration

The RECOVER Workflow

Unlike the third-party tools utilized for deflections and resolutions, representment is powered entirely by ChargebackHelp. The only integrations needed here are with the merchant’s transaction and fulfillment assets: gateways, shopping carts, CRMs, and user logs to name a few. Transaction and fulfillment data capture is only limited by the API docs on each asset, though the API is highly customizable and effective at integrating any merchant platform.

RECOVER AI matches all captured data to the chargeback. Like alerts, this is a passive tool, where the merchant or their intermediary reviews and submits chargeback rebuttals through the acquirer to the issuing bank. However, each representment case is compiled by automation; the user only need hit “send.” A successful rebuttal ties the transaction to the cardholder and compels the issuer to reverse the chargeback.

While the merchant recovers their revenue in successful cases, chargeback fees and penalties are irreversible. Again, RECOVER is the last resort after deflection and resolution have failed. Successful merchants never leave revenue on the table.

CONCLUSION

Well folks, we covered a whole lot here. Dispute phases, the corresponding management tools, their providers, and where they fall in the solution spectrum. Deflect would-be disputes at the inquiry phase with DEFLECT, integrating Verifi Order Insight, Ethoca Consumer Clarity and Visa CE3.0. Resolve disputes in the dispute phase with RESOLVE, integrating Verifi RDR and CDRN, Ethoca Alerts, and as a last resort, Mastercom. And never leave revenue on the table from the chargeback phase with RECOVER, our best-in-class representment module.

Thank you so much for taking the time to read this tome about the dispute solutions landscape. However, we could have saved you that time, HAD YOU ONLY CALLED US! It’s not too late. Let’s talk about how these tools will work for your specific business, and you can impress our specialists with how much you now know. Send us an email, call us at 1.800.975.9905 or contact us here.