Ethoca Alerts: The Smart Way to Prevent Chargebacks

Quick Take

Chargebacks have a way of sneaking up on merchants, quietly eroding profits before anyone notices. Once you’re notified, the damage is usually done. Revenue is lost, fees are assessed, and your account status suffers. Ethoca Alerts flip the script by providing real-time notifications when a cardholder initiates a dispute. This gives you a window to resolve the issue before it escalates into a costly chargeback. In this article, you’ll learn how Ethoca Alerts work, why they’re a game-changer for proactive chargeback prevention, and the practical steps you can take to protect your chargeback ratio.

The Chargeback Problem for Merchants

Most merchants assume that if customers aren’t complaining, everything is running smoothly. But that’s rarely the case. Many disputes start with a cardholder contacting their bank, not the merchant. By the time you’re notified through the traditional chargeback process, it’s too late. The funds are gone, you’ve been hit with fees, and your chargeback ratio has crept higher. High chargeback ratios can trigger penalties, higher processing costs, or even account termination. It’s a headache that can sneak up on even the most diligent operators.

What Are Ethoca Alerts?

Ethoca Alerts are real-time notifications that let you know the instant a cardholder’s bank identifies a dispute or potential fraud on a transaction. Instead of waiting weeks for a chargeback notification, Ethoca’s network connects issuers and merchants in minutes. This early warning system gives you up to 24 hours to take action. That’s plenty of time to issue a refund, stop an order, or investigate the situation. Ethoca alerts work across all major card networks, making them a versatile and powerful tool for any merchant account.

How Ethoca Alerts Prevent Chargebacks

Here’s the heart of the solution. Ethoca alerts empower merchants to prevent chargebacks before they happen.

- Immediate Notification. You’re notified as soon as a dispute is initiated, not weeks later.

- Actionable Window. Merchants typically have up to 24 hours to resolve the dispute before it becomes a formal chargeback.

- Refund Instead of Chargeback. Issuing a prompt refund during this window avoids the chargeback process, saving you from fees and keeping your chargeback ratio low.

- Inventory and Fulfillment Control. If the order hasn’t shipped, you can halt fulfillment, protecting your inventory and reducing losses.

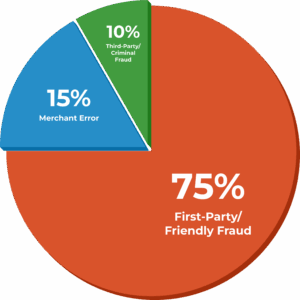

- Fraud and Friendly Fraud Detection. Early alerts help you spot patterns of first-party fraud and take steps to prevent repeat offenders.

Ethoca Alerts are especially effective at stopping “friendly fraud,” when a legitimate customer disputes a transaction out of confusion or forgetfulness. By reaching the merchant before the dispute escalates, Ethoca Alerts give you a chance to clarify, refund, or resolve the issue directly.

Benefits of Using Ethoca Alerts

Merchants using Ethoca Alerts consistently see:

- Fewer chargebacks and lower dispute ratios

- Reduced fees and penalties

- Improved merchant account health and processing rates

- Faster dispute resolution, often within hours, not weeks

- Better fraud detection and prevention

- Higher customer satisfaction due to quick resolutions

And here’s the kicker. Refunds issued in response to Ethoca Alerts do not count against your chargeback ratio. That’s a major win for any merchant trying to stay below network thresholds and avoid monitoring programs.

TIP: For a deeper dive into how these tools work together, see RESOLVE by ChargebackHelp.

Implementing Ethoca Alerts with ChargebackHelp

Managing multiple alert systems can get complicated, especially as your business grows. ChargebackHelp’s RESOLVE platform consolidates Ethoca Alerts, Verifi CDRN, Visa Rapid Dispute Resolution, and more into a single, easy-to-use dashboard. You can automate responses, issue refunds quickly, and track every alert in one place. That means less manual work, fewer errors, and more time to focus on what you do best, running your business.

ChargebackHelp also offers managed alert services, so you can let our team of experts handle the heavy lifting. Whether you want to self-manage or outsource, we’ve got you covered.

Ready to Stop Chargebacks Before They Happen?

If you’re tired of losing revenue to chargebacks, Ethoca Alerts are your first line of defense. ChargebackHelp’s RESOLVE solution brings all your alert systems together, making it easy to prevent disputes and protect your bottom line. Want to see Ethoca alerts in action? Contact us today to get started or schedule a demo.

Why ChargebackHelp?

ChargebackHelp delivers a fully-managed chargeback management platform that integrates Ethoca Alerts, Verifi CDRN, and other industry-leading tools into one seamless solution. Our platform automates dispute management, reduces costs, and improves your performance so you can focus on growth, not fighting chargebacks. With direct access to card networks, expert support, and powerful automation

ChargebackHelp is the partner you need for proactive chargeback prevention and revenue recovery.

FAQs: Ethoca Alerts and Chargeback Prevention

What are Ethoca alerts and how do they work?

Ethoca Alerts are real-time notifications that inform merchants when a cardholder’s bank identifies a dispute. Merchants can take immediate action, such as issuing a refund or stopping an order, to prevent the dispute from becoming a formal chargeback. The alerts provide a valuable window of up to 24 hours for resolution.

How do Ethoca alerts help reduce chargebacks?

By alerting merchants before a chargeback is filed, Ethoca Alerts enable proactive dispute resolution. Merchants can issue refunds or address customer concerns directly, which prevents the chargeback from being processed and helps keep chargeback ratios low.

Are Ethoca alerts compatible with all card networks?

Yes, Ethoca Alerts support all major card networks, including Visa, Mastercard, American Express, and Discover. This broad coverage ensures merchants can prevent chargebacks across their entire transaction base.

What is the difference between a refund and a chargeback?

A refund is initiated by the merchant and does not impact the chargeback ratio. A chargeback is initiated by the cardholder’s bank, incurs fees, and counts against the merchant’s chargeback ratio. Issuing a refund in response to an Ethoca alert is always preferable.

How does ChargebackHelp streamline Ethoca alert management?

ChargebackHelp’s RESOLVE platform consolidates Ethoca Alerts and other prevention tools into a single dashboard. This allows merchants to automate responses, track alerts, and resolve disputes efficiently, reducing manual work and operational costs.

Can Ethoca alerts help with friendly fraud?

Yes, Ethoca Alerts are especially effective at preventing friendly fraud by giving merchants the opportunity to clarify transactions or issue refunds before disputes escalate. This reduces unnecessary chargebacks and improves customer satisfaction.

What steps should merchants take to get started with Ethoca alerts?

Merchants can work with ChargebackHelp to integrate Ethoca Alerts into their chargeback prevention strategy. The process is straightforward, and ChargebackHelp provides both self-managed and fully managed solutions for maximum flexibility and impact.

Reach out to our team to learn how we can help.