Payments Industry News

-

Chargeback Management as a Merchant Retention Tool

Chargeback management helps MSPs reduce portfolio risk, retain merchants, and align with network compliance expectations. Discover how automation drives retention.

-

Automating Refunds With Visa RDR

Visa RDR helps automate refunds before disputes become chargebacks. Learn how to use Visa RDR to reduce fees and protect your merchant account.

-

VAMP for Acquirers: Portfolio Chargeback Compliance

Visa Acquirer Monitoring Program compliance now requires same-month resolution and portfolio automation. Learn how acquirers can reduce risk and avoid penalties.

-

How to Fight Chargebacks That Matter Most

Fight chargebacks that matter most. Learn how to prioritize disputes, recover revenue, and protect your merchant account with a smarter strategy.

-

Early Warning Signals for Chargeback Risk

Chargeback risk builds before ratios spike. Discover early warning signals and how to protect your merchant account from rising exposure.

-

How AI Is Reshaping Chargeback Management

AI commerce chargebacks are coming. Learn how agent-driven purchases will change disputes, evidence, and risk management for merchants preparing ahead.

-

Get to Know RECOVER: Fight Chargebacks

Fight chargebacks more effectively with automated representment. Learn how RECOVER helps merchants recover revenue and reduce chargeback losses.

-

Get to know RESOLVE: Get Chargeback Alerts

Chargeback alerts give merchants early visibility into disputes so they can act before fees and ratios are impacted. Learn how RESOLVE centralizes alerts.

-

Get to Know DEFLECT: Prevent Chargebacks

Prevent chargebacks by stopping disputes before they start. Learn how DEFLECT shares transaction data early to reduce risk and protect merchant accounts.

-

Chargeback Alerts as a Risk Management Signal

Chargeback alerts act as early risk signals for merchants, helping identify issues before disputes escalate into chargebacks and threaten account standing.

-

VAMP Ratio Management for High-Volume Merchants

VAMP ratio management for high-volume merchants. Learn how scale increases risk and how to control disputes, refunds, and chargebacks before thresholds are breached.

-

How Sportsbooks Win Disputes Behind Sports Betting Chargebacks

Sports betting chargebacks explained from inquiry to representment. Learn how sportsbooks reduce fraud, control volume, and win disputes.

-

Winning Online Gambling Chargebacks Tied to Wagers

Online gambling chargebacks often follow losing wagers. Learn how chargeback alerts reduce volume early and when representment is worth the effort.

-

How to Fight Chargebacks in 2026

How to fight chargebacks in 2026 by reducing risk early, resolving disputes fast, and protecting revenue under Visa’s new VAMP rules.

-

Common Chargeback Triggers on Online Casino Platforms

Online casino chargebacks often stem from buyer’s remorse, fraud, and payment confusion. Learn the most common triggers and how to reduce exposure early.

-

Chargeback Protection for High Risk Merchants

Chargeback protection helps high risk merchants reduce disputes, stay under network thresholds, and recover revenue before chargebacks escalate.

-

How To Reduce Chargebacks in Recurring SaaS Payments

SaaS chargebacks can quietly erode recurring revenue. Learn how to reduce billing confusion, prevent disputes, and protect your merchant account.

-

Rethinking eCommerce Chargebacks in a Global Market

Ecommerce chargebacks become more complex as merchants expand globally. Learn how international sales change risk, disputes, and chargeback strategy.

-

ChargebackHelp and DisputeHelp are Now Part of Global Payments Inc.

We are excited to announce that ChargebackHelp and DisputeHelp have joined the Global Payments Inc. – a leading worldwide provider of payment technology and software solutions.

-

Chargeback Management for Professional Services

Chargeback management for professional services requires clear documentation, proactive prevention, and recovery strategies that protect revenue and reduce account risk.

-

Simplifying Marketplace Chargebacks with ChargebackHelp

Online marketplace chargebacks are hard to manage at scale. Learn how ChargebackHelp helps marketplaces simplify workflows, automate chargeback management, and reduce risk.

-

How to Prepare For Q1 Chargeback Ratio Monitoring

Holiday chargebacks often appear in Q1 when transaction volume drops. Learn how to clean up post holiday data, reconcile refunds, and prepare for chargeback ratio monitoring.

-

Managing Delivery Delays Without Increasing Chargebacks

Delivery delays spike during late December and often lead to chargebacks. Learn how proactive communication, tracking visibility, and automated refunds help prevent disputes.

-

Preventing Chargebacks From Holiday Gifts and Returns

Holiday gift purchases often lead to unrecognized transactions and strained return workflows. Learn how merchants can prevent gift related chargebacks with clarity, documentation, and automated resolution tools.

-

Navigating the Holiday Chargeback Surge

Holiday chargebacks spike after December spending. Learn why disputes rise and how to use automation, tracking visibility, and clear policies to keep ratios under control.

-

Cyber Monday Chargebacks: Why Post-Purchase Clarity Is Your Best Defense

Cyber Monday chargebacks often stem from delivery delays and unclear promotions. Learn how to improve clarity, automate refunds, and prevent disputes during the ecommerce surge.

-

Black Friday Chargebacks: How to Stay Ahead of the Chaos

Black Friday chargebacks can linger for months. Learn how to prepare with team training, clean records, alerts, and Visa RDR to prevent errors and protect ratios.

-

BFCM Chargebacks: How to Survive Black Friday and Cyber Monday

BFCM chargebacks rise fast during holiday sales. Learn how to prepare with audits, alerts, and Visa RDR, plus when to automate refunds to protect ratios.

-

Automate Refunds and Stay VAMP-Compliant With Visa RDR

Learn how Visa RDR automation helps merchants stay compliant with Visa’s new VAMP standards, prevent chargebacks, and reduce refund workloads through automation.

-

Automating Chargeback Responses in Shopify

Learn how Shopify merchants can automate chargeback responses to save time, reduce manual work, and improve win rates using connected dispute management tools.

-

The Future of Chargeback Regulation

Learn how Visa’s new VAMP rules and changing network oversight are shaping the future of chargeback regulation and what merchants can do to stay compliant.

-

Chargeback Prevention in Travel and Hospitality

Learn why chargeback prevention is critical in travel and hospitality, and how ChargebackHelp’s solutions safeguard bookings, revenue, and compliance.

-

Staying Under VAMP Thresholds with ChargebackHelp

Learn how merchants can stay under Visa’s VAMP thresholds, avoid penalties, and protect revenue with ChargebackHelp’s prevention and recovery solutions.

-

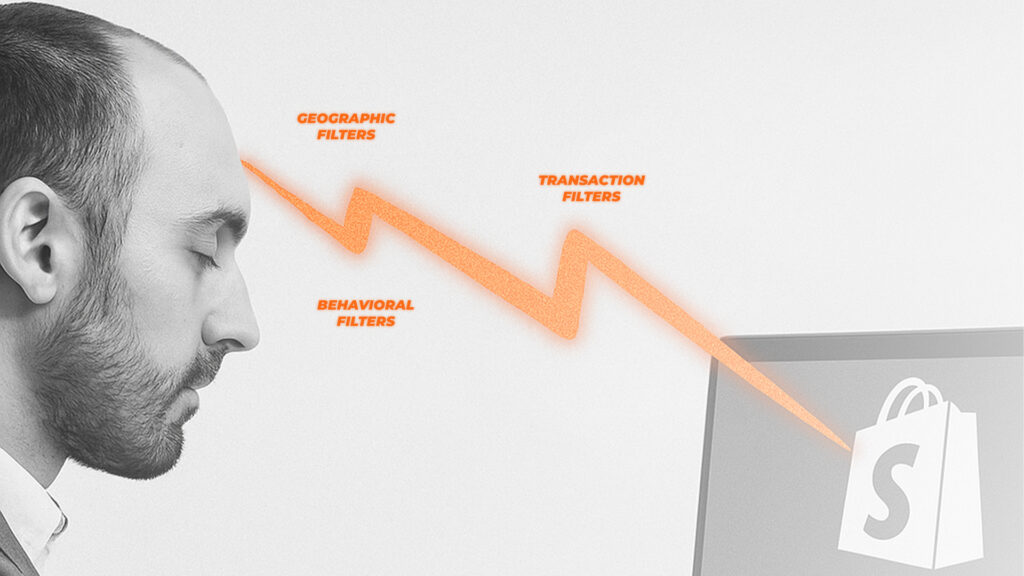

Creating Smart Rules to Flag Risky Shopify Orders

Learn how to create smart rules in Shopify to flag risky orders, reduce chargebacks, and protect your store from fraud while keeping customers satisfied.

-

Predictive Analytics for Chargeback Prevention

Understand how predictive analytics helps merchants prevent chargebacks before they happen. Learn how ChargebackHelp integrates predictive tools with alerts.

-

Protect Your VAMP Ratio by Deflecting Disputes

Protect your VAMP ratio by preventing disputes from becoming chargebacks. Learn how DEFLECT with Order Insight and Consumer Clarity keeps ratios in check.

-

Fraud Prevention Tools for Growing Shopify Stores

Learn the essential fraud prevention tools Shopify merchants need to protect growing stores, reduce chargebacks, and maintain customer trust.

-

Lower Your VAMP Ratio with Ethoca Alerts

Lower your vamp ratio with Ethoca Alerts. Discover how ChargebackHelp’s solutions prevent chargebacks, reduce costs, and safeguard your merchant account.

-

Decoding VAMP: From Confusion to Clarity

Discover what Visa’s VAMP program means for merchants. Learn when fines begin, how thresholds work, and how ChargebackHelp can support compliance.

-

GDPR and Chargebacks: What Merchants Need to Know

GDPR chargeback management requires secure handling of personal data. Learn how merchants can align workflows to reduce risks, avoid fines, and build trust.

-

The True Cost of Chargebacks for Shopify Stores

Understand the true cost of chargebacks for Shopify stores, from lost inventory and shipping fees to tighter VAMP scrutiny. Learn practical steps to reduce disputes and protect growth.

-

Managing Chargebacks in the Voice Payments Era

Voice payments are rising fast. Discover how merchants can manage chargebacks in this new channel and protect revenue with ChargebackHelp solutions.

-

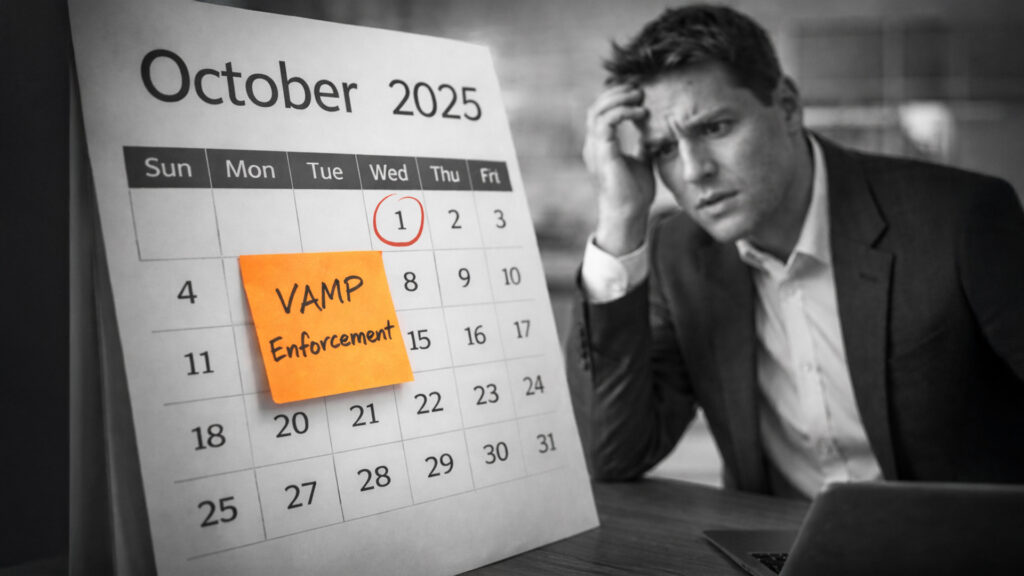

Big Changes Coming: VAMP Enforcement Begins October 1st

Visa’s VAMP enforcement begins October 1. Discover how merchants can avoid penalties by improving chargeback management and same-month dispute resolution.

-

How to Improve Your Chargeback Win Rate

Chargeback win rate optimization for merchants. Learn how evidence, speed, and automation improve representment outcomes with ChargebackHelp’s RECOVER solution.

-

Crypto Exchange Chargeback Management Strategies

Crypto Exchange Chargebacks need proactive prevention and fast resolution. Learn how alerts, automation, and clear evidence reduce risk and protect revenue.

-

Why Chargebacks Rise as Your Shopify Store Grows

Uncover why Shopify chargebacks tend to rise as your store grows, the hidden risks behind scaling, and practical steps to keep dispute volumes in check.

-

How to Reduce Chargeback Reserve Funds

Chargeback reserve funds tie up working capital. Learn what they are, why acquirers use them, and practical ways merchants can reduce reserve requirements.

-

Using Dispute Notifications to Reduce Chargebacks

Dispute notifications give merchants a chance to resolve issues early and avoid chargebacks. Learn how ChargebackHelp streamlines dispute notification workflows.

-

BNPL Chargebacks Explained: What Merchants Need to Know

BNPL chargebacks are rising fast as Buy Now Pay Later adoption grows. Learn what makes these disputes unique and how merchants can manage them effectively.

-

A Look Into Gen Z Chargeback Behavior

Explore chargeback behavior among Gen Z shoppers and learn how merchants can prevent disputes through alerts, transparency, and proactive communication.

-

Using Shopify’s Tools to Fight Chargebacks

Learn how to use Shopify’s dispute dashboard to fight chargebacks, automate parts of your response process, and avoid common mistakes when submitting evidence.

-

Preventing Chargebacks in Social Commerce

Chargeback prevention is vital for merchants selling on social platforms like TikTok and Instagram. Learn proven strategies to reduce disputes and protect revenue.

-

How to Respond to a Chargeback on Shopify

Learn how to respond to a chargeback on Shopify, navigate Shopify’s dispute resolution system, and explore support options from chargeback management experts.

-

Managing Chargebacks in the Travel Industry

Managing chargebacks in the travel industry requires clear policies, proactive alerts, and strong evidence to reduce disputes and protect revenue.

-

Chargeback Management Do’s and Don’ts

Chargeback management is filled with avoidable mistakes. Learn what merchants should do, and stop doing, to reduce chargebacks and protect revenue.

-

Spotting Risky Orders Before They Ship

Prevent chargebacks on Shopify by spotting risky orders before they ship by identifying common red flags like mismatched addresses, suspicious email domains, and bulk orders of high-resale items.

-

Preventing Chargebacks with Rapid Dispute Resolution

Rapid dispute resolution helps merchants prevent chargebacks automatically, protect revenue, and lower fees. Learn how ChargebackHelp makes setup simple.

-

Chargeback Prevention in High-Risk Industries

Chargeback prevention is critical for high-risk merchants. Learn how to stay below chargeback thresholds, avoid penalties, and protect payment processing access.

-

Simple Steps to Reduce Chargebacks on Shopify

Learn how to reduce chargebacks on your Shopify store by understanding common causes and applying clear, proactive solutions.

-

How to Set Up Chargeback Management for Your Business

Learn how to set up chargeback management for your business with tools like alerts, representment, and transaction data. Discover solutions to stay compliant and protected.

-

Mastercard Report on the True Cost of Chargebacks in 2025

Protect your business by understanding the true cost of chargebacks in 2025 and how to prevent unnecessary losses with modern solutions.

-

Shopify Chargebacks 101

Crash course on how Shopify chargebacks work, why customers file chargebacks, and how merchants can prevent chargebacks and manage disputes to protect their profits.

-

Understanding Chargebacks on Shopify: 2025 Merchant Guide

This first part of our running series helps Shopify merchants manage chargebacks with confidence, offering clear guidance for stores at every stage of growth.

-

How Chargeback Alerts Power Automated Protection

Learn how chargeback alerts and automation combine to help merchants reduce risk, protect revenue, and simplify chargeback management.

-

How to Build Strong Chargeback Protection for Ecommerce

Learn how ecommerce merchants can reduce chargebacks, protect revenue, and automate dispute handling with a multi-layered chargeback protection strategy.

-

How ChargebackHelp Uses Order Insight to Deflect Disputes

Order Insight helps prevent chargebacks by resolving confusion early. Learn how ChargebackHelp delivers it seamlessly through DEFLECT.

-

Reducing First-Party Fraud with Mastercard’s First-Party Trust

First-party fraud is rising. Learn how Mastercard’s First-Party Trust helps merchants reduce friendly fraud, avoid chargebacks, and stay aligned with network standards.

-

How Ethoca Consumer Clarity Prevents Confusion and Chargebacks

Ethoca Consumer Clarity helps merchants prevent confusion-based chargebacks by giving customers the transaction details they need to recognize legitimate purchases.

-

Mastercom Collaboration as a Competitive Advantage

Mastercom Collaboration helps merchants resolve Mastercard disputes before they escalate. Learn how ChargebackHelp integrates it for early resolution and revenue protection.

-

How Automated Chargeback Protection Works

Discover how automated chargeback protection helps merchants reduce manual work, improve dispute outcomes, and scale faster with ChargebackHelp’s integrated platform.

-

Important VAMP Update Every Merchant Should Review

Visa’s VAMP changes take effect June 1, redefining how merchant risk is calculated. Learn what’s changing and how to protect your business from penalties.

-

Why ChargebackHelp Uses Visa RDR for Auto Representment

Visa RDR lets merchants resolve disputes instantly. Learn how ChargebackHelp integrates RDR for faster revenue recovery, lower chargebacks, and less manual work.

-

How Verifi CDRN Helps Merchants Stay Ahead of Chargebacks

Verifi CDRN gives merchants an early edge by resolving disputes before they escalate. Learn how ChargebackHelp makes CDRN easy to implement and scale.

-

How ChargebackHelp Simplifies Chargeback Management

Discover how ChargebackHelp streamlines chargeback management by combining alerts, automation, and expert support into one solution merchants can trust.

-

Comparing Order Insight and Consumer Clarity for Chargeback Reduction

Compare Order Insight and Consumer Clarity to understand how each tool reduces chargebacks. Learn how ChargebackHelp’s DEFLECT solution supports both services.

-

New VAMP Rules Are Raising the Stakes for Merchants

Visa Acquirer Monitoring Program (VAMP) is raising the stakes for merchants and acquirers. Learn how to stay compliant, avoid penalties, and leverage ChargebackHelp’s solutions for chargeback and fraud management.

-

Ethoca Alerts: The Smart Way to Prevent Chargebacks

Discover how Ethoca alerts help merchants prevent chargebacks. Learn how real-time notifications empower you to take action, reduce risk, and protect your revenue with ChargebackHelp’s solutions.

-

How Chargeback Alerts Are Transforming Merchant Risk Management

Discover how chargeback alerts are reshaping merchant risk management, helping businesses prevent disputes, reduce chargebacks, and improve customer satisfaction.

-

What Every Merchant Should Know About Visa RDR

Visa RDR lets merchants resolve disputes automatically before they become chargebacks. Learn how Rapid Dispute Resolution works and how to activate it.

-

How Important Are Billing Descriptors?

Confused customers file chargebacks. Vague billing descriptors are often to blame. Discover how descriptive, brand-consistent billing details can lower your dispute ratio.

-

The Growing Trend of Family Fraud

Explore the complex issue of Family Fraud and how to protect your business from unauthorized purchases and costly chargebacks.

-

Preventing First-Party Fraud: Best Practices for Chargeback Defense

Discover key insights on preventing first-party fraud and safeguarding your business from chargeback risks.

-

Is a 30% Chargeback Win Rate Enough? What Merchants Need to Know

Uncover tips to elevate your chargeback win rate and minimize the impact of fraudulent transactions on your business.

-

The ISO Advantage: Efficient Merchant Services and Chargeback Management

Learn how ISOs, Independent Sales Organizations, operate and their impact on chargeback management for companies of all sizes.

-

What Gen Z Consumer Trends Mean for Your Chargeback Risk

Mitigate chargeback risk by understanding Gen Z shopping habits. Learn how to meet their high expectations and adapt to new consumer trends.

-

A Quick Look at the Legal History of Chargebacks

Learn about the key developments in the legal history of chargebacks that shaped today’s payment systems and the laws that govern them.

-

Six Tips For Reducing Chargebacks Due To Customer Confusion

Learn how to effectively reduce chargebacks with actionable tips to prevent customer confusion, a preventable cause of many chargebacks.

-

Understanding Transaction Data Analysis and Chargebacks

Discover the importance of transaction data analysis to help forecast and prevent chargebacks using a data-driven approach.

-

Chargebacks | Fraud | Industry

Understanding Visa’s VAMP

The VAMP is launching on April 1st, 2025. Discover what this means for merchants and acquirers and how to keep your business in compliance.

-

Considering Chargebacks from a Bank’s Perspective

Explore chargebacks from the perspective of the banks to understand the challenges faced by financial institutions and merchants.

-

2025 Chargeback Time Limits Explored and Explained

Understand Chargeback Time Limits to protect your business and manage disputes effectively. Learn all the necessary details.

-

Understanding the Chargeback Process in 2025

Understand the chargeback process and how it affects your transactions. Learn the steps to manage disputes effectively.

-

How FaaS (Fraud as a Service) Contributes to Chargebacks

Understand FaaS (Fraud as a Service): a troubling service that provides tools for fraudsters, impacting merchants small and large.

-

Could High Inflation Spur Chargebacks?

Learn effective strategies for managing chargebacks during inflation to protect your business and maintain profitability.

-

Chargebacks are Big Business: The Unique Challenge Large Merchants Face

Understand the chargeback challenges faced by large businesses. Discover how size impacts dispute management and fraud.

-

Chargebacks | Fraud | Industry

pAIscreen and ChargebackHelp Team Up to Bring Enhanced Screening and Fraud Prevention To Issuers and Merchants

pAIscreen is pleased to announce it is collaborating with ChargebackHelp, a leader in dispute management, to augment it’s AI-powered, real-time transaction screening solution.

-

What Defines Fraudulent Chargebacks?

Understand the difference between legitimate and fraudulent chargebacks. Learn how to protect your business and minimize the impact of chargeback fraud.

-

2025 Merchant Guide to Lowering Chargebacks Under 0.56%

Learn how to effectively lower chargebacks to below 0.56 percent and protect your business with practical strategies and solutions.

-

What are Acquirer Reference Numbers (ARN)?

Learn about the Acquirer Reference Number and its importance in payment processing. Understand how this unique identifier helps track and trace transactions.

-

Fight Chargebacks With Our Chargeback Rebuttal Letter Template

Learn how to write an effective chargeback rebuttal letter with our step-by-step guide. Lower your chargeback rate and fees with our template.

-

Why use a Chargeback Management Platform?

Optimize your chargeback management with the right platform. Discover the benefits of using a chargeback management platform for your business.

-

Reducing Chargebacks in the Era of Subscriptions

Prevent subscription chargebacks and protect your revenue. Discover effective strategies to minimize the risk of chargebacks in your subscription business.

-

What is First-Party Fraud?

Understand the impact of first-party fraud. Learn about the strategies and prevention methods to protect your business.

-

Chargebacks: A $100 Billion Dollar Problem

Learn how to detect and prevent first party fraud in your business. Stay one step ahead of fraudsters with these strategies and tools.

-

What Are Chargeback Alerts?

Learn how chargeback alerts can help you prevent fraudulent transactions and protect your business.

-

Takeaways From NFIB’s Updated Chargeback Guide

A summary of NFIB’s newest chargeback guide for merchants to help protect business and preserve revenue in 2025.

-

What is Chargeback Representment?

Learn everything you need to know about representment and how it can help protect your business and reduce chargebacks.

-

Chargebacks 2025: What Merchants Need to Know

Complex changes are coming to the chargeback process for merchants in 2025. Learn how to utilize the changes to lower chargebacks in 2025.

-

What is Friendly Fraud?

Avoid falling victim to friendly fraud and first-party fraud. Discover how to protect your business and minimize the risks.

-

Merchant Guide to Chargebacks and Refund Requests

Discover the key differences between chargebacks and refunds. Learn how they can impact merchants and why chargebacks can be more costly in the long run.

-

Pre and Post-Transaction Fraud Prevention for Merchants

Protect your business from transaction fraud and chargebacks. Learn how to prevent and fight fraud for long-term success.

-

How to Prevent and Fight Chargeback Fraud

First-party chargeback fraud is a major issue for businesses, including restaurants, retailers, service providers, and more.

-

Understanding the EU’s Strong Customer Authentication Requirements

Strong Customer Authentication requires banks to ask for a second form of ID to confirm that the person using a credit card is the cardholder.

-

Industries and Businesses Most At Risk of Chargebacks

Chargebacks are a major threat to most small and medium enterprise. But which small businesses experience the highest chargeback risks?

-

Chargeback Accounting for Merchants: What You Need to Know

We’ve covered how to prevent and combat chargebacks extensively, and now we’re going to take a look at chargeback accounting.

-

Debit Versus Credit Card Chargebacks: What Merchants Should Know

There can be subtle differences between debit and credit card chargebacks and it’s wise for businesses to understand them.

-

How to use AI and Automation to Prevent Chargebacks

Artificial Intelligence anti-fraud and chargeback tools will expand the toolbox for merchants, allowing them to more effectively fight fraud.

-

How to Fight Chargebacks as a Small Merchant

Chargebacks are bad for businesses of every size, but for small businesses, even a few chargebacks could quickly evolve into an existential threat.

-

Chargeback Reasons: Why Customers Dispute Valid Purchases

Some cardholders end up filing chargebacks on valid purchases, sometimes by mistake, sometimes because they’re looking to commit fraud.

-

Merchant Guide to Reducing Holiday Chargebacks

Come January, you’ll likely see an uptick in holiday chargebacks. Late December and January are sometimes referred to as chargeback season.

-

Preventing Chargebacks on Black Friday and Cyber Monday

Black Friday and Cyber Monday, in particular, drum up sales, but unfortunately, these shopping holidays can fuel chargebacks as well.

-

How to Reduce Chargeback Risk from MOTO Transactions

Before the Web, MOTO, or Mail-Order/Telephone Order transactions were one of the most popular alternatives to in-person shopping.

-

Prevent Chargeback Fraud with New Secure Payment Authentication

Fraud and cybercrime are major risks for businesses. Luckily, Google Pay has rolled out secure payment authentication services for merchants.

-

Chargeback Prevention Guide: 13 Proven Ways to Prevent Chargebacks

Chargebacks are a major hassle and risk for merchants. The good news is that there are many steps you can take to prevent and reduce them.

-

Protect Your Business from Enumeration Attacks: A Guide for Merchants

Businesses big and small need to take cybersecurity threats seriously. Enumeration attacks, in particular, have emerged as a grave threat.

-

How ChargebackHelp Makes Managing Multiple Chargeback Services Easier

ChargebackHelp’s dispute management platform can be used to streamline chargeback management and to bring various tools under one roof.

-

What is Chargeback Representment and How Does it Work?

Chargeback representment can be exceptionally useful for merchants, allowing them to fight fraud and protect revenues.

-

What You Should Know About High-Risk Merchants and Chargebacks

Some businesses are at a higher than normal risk of suffering chargebacks and can be designated as “high-risk” by acquiring banks.

-

What is the difference between Ethoca and Verifi Alerts?

By using chargeback alerts provided by Ethoca/Mastercard and Verifi/Visa, merchants can head off chargebacks before they are filed.

-

Ethoca Chargeback Alerts – Useful Guide

Updated: 8/7/2024 Chargebacks have been enshrined into federal law and aim to protect consumers from fraud and mishandled transactions. Chargebacks greatly reduce the risk of fraud for card holders, but unfortunately, they create a lot of risks for merchants. Yet there are many steps merchants can take to prevent and combat chargebacks. Ethoca Alerts rank…

-

What Are Chargeback Alerts and How Can They Help?

Chargeback alerts rank among the most effective and useful prevention tools. We’ll take a moment to explain what they are and how they work.

-

Valid & Invalid Chargebacks: What’s The Difference?

It’s crucial for merchants to know the difference between valid and invalid chargebacks and how to deal with them.

-

Understanding the Merchant’s Rights When it Comes to Chargebacks

Much of the discussion around chargebacks focuses on customer rights. However, businesses also have rights when it comes to chargebacks.

-

CFPB Extends Chargebacks to Buy Now, Pay Later Programs

Merchants may have used BNPL to dodge chargebacks; but now, that’s changed. However, with the right strategies and tools, merchants can still limit them.

-

Visa Verifi’s RDR and CDRN Tools Explained

Did you know all Verifi and Visa dispute solutions are available through ChargebackHelp? They’re part of our one-stop-solution for merchants.

-

How Ethoca Alerts Can Protect Your Business and Prevent Chargebacks

A comprehensive review of Ethoca’s chargeback prevention tool.

-

How Does Ethoca Consumer Clarity Prevent Chargebacks?

An in-depth look under the hood at how Consumer Clarity can deflect disputes and defend merchant revenue.

-

Visa’s Acquirer Monitoring Program: How it affects merchants (updated)

Visa will retire its Visa Fraud Monitoring Program (VFMP) and Visa Dispute Monitoring Program (VDMP) for merchants in the Visa Europe region.

-

Chargeback Prevention Tools Explained

How each tool works, why they’re important to merchants and how ChargebackHelp integrates them.

-

The Best Dispute Management Software in 2024

By leveraging the best dispute management software in 2024, you can dramatically reduce chargebacks, safeguarding your company.

-

What Are Chargeback Ratios?

Everything you need to know about this crucial business metric, why it matters, and what you can do to stay in the green.

-

Chargebacks | Fraud | Industry

How is Artificial Intelligence Impacting Fraud and Chargebacks?

Understanding what AI is and isn’t, and how it affects dispute management. Everything a merchant needs to know.

-

How to Ground Soaring Airline and Travel Fraud

The travel industry is rife with chargeback fraud. Luckily there are many tools available to reduce and manage chargebacks.

-

A Prescription to Reduce Chargebacks in the Healthcare Industry

Just like any other business, medical providers and health insurance companies get hit with fraud and chargebacks.

-

Chargebacks Are Still a Threat in the Era of EMV

The EMV rollout has greatly reduced card-present fraud, but scammers can still use exploits to compromise smart chip protections.

-

Bot vs. Bot: How Artificial Intelligence both drives and fights fraud

There is an arms race underway between hackers that use AI to commit fraud and the “white hat” AI that can be used to fight back.

-

Dealing with Lesser Known eCommerce Fraud

Sometimes, the quiet tactics are the most dangerous. Here are some strategies to deal with lesser-known types of fraud .

-

Game Over for Fraud in the Video Game Industry

The global video game industry is absolutely massive, with $385 billion generated in 2023 alone; it is also, however, plagued by chargebacks.

-

Here’s How Fraudsters Can “Phish” For Chargebacks

For businesses big and small, cybersecurity is crucial. Phishing can lead to fraudulent transactions, which can lead to chargebacks.

-

eSkimmers and Chargebacks

EMV chips have made it virtually impossible to spoof physical cards, but these chips do little to prevent card-not-present fraud.

-

The Five Best AI Solutions to eCommerce Fraud for Merchants

AI is a powerful tool for fighting fraud, but it’s not a stand-alone solution. Examine the advantages and disadvantages of these top 5 solutions.

-

Contactless Payments Continued: Benefits and drawbacks

There are concerns with contactless payment methods. Fraudsters and other risks abound. Let’s take a closer look at contactless payment.

-

How to Deal With Mobile Wallets and “Contactless Fraud”

Mobile wallet fraud is on the rise. As a retailer, understand this “contactless fraud” and take steps to protect your business and customers.

-

The Dispute Landscape Part II: Solutions galore

Previously, we covered dispute issues—now, let’s explore solutions to help merchants save money and protect revenue.

-

Chargebacks | Disputes | Fraud

The Dispute Landscape Part I: Fraud, disputes and their phases

This article dives into the “Dispute Landscape,” detailing dispute causes, terms, and definitions to get you up to speed.

-

Five Quick Tips: How to prevent chargebacks

Chargebacks are a major threat to businesses big and small, but there are steps you can take to prevent them from occurring.

-

Visa’s Compelling Evidence 3.0: Why you should (not) be worried

Dubbed “Compelling Evidence 3.0” or CE3.0, these guidelines guarantee merchant protections from certain categories of disputes.

-

Five Most Common Types of Fraud Merchants Must Watch For

Criminals like to play the Grinch, committing these common types of frauds against businesses and consumers alike.

-

The Ethoca Report on First-Party Fraud

Ethoca recently published an extensive report detailing the threat posed by first-party fraud and it’s certainly worth taking time to digest the findings.

-

Use Returns to Reduce Chargebacks and Disputes

Let’s take a close look at how retailers can set up effective return policies to keep your customers happy and keep your revenue safe.

-

Battle Chargeback Fraud and Returns During the Holiday Season

‘Tis the season for holiday shopping and that also means the season for holiday chargeback fraud and returns is fast approaching.

-

When Fraud Attacks in the Metaverse, Be Ready

The Internet revolutionized the global economy and with it fraud. It’s only a matter of time before fraud will also plague the Metaverse.

-

Q4 2022: Fraud Remains a Major Issue For Merchants

In this Q4 2022 report, we’re going to cover some of the most common types of fraud and the measures you can take to prevent or mitigate them.

-

Partial Chargebacks = Full Threat

Partial chargebacks are just as serious of a threat as full chargebacks; the revenue is only the beginning of what you stand to lose.

-

New Mandate! The Mastercard Acquirer Collaboration explained

Acquirers must now purchase and distribute non-Ethoca alerts, a new mandatory workflow called “Acquirer Collaboration” by Mastercard.

-

Taking the Fight to Chargebacks: A Step-by-Step Guide to Dispute Management

Dispute management providers like ChargebackHelp integrate the right tools across all payment networks into one platform.

-

Breaking Down the True Cost of Chargebacks

Chargebacks cost businesses over $30 billion yearly—more than McDonald’s or Netflix’s revenue. We’ll explore chargeback fees and their true overall costs.

-

What Are Chargebacks?

Many merchants know of chargebacks but may not fully understand them. We’ll explain what they are, their origins, and how the process works.

-

The Four Most Common Dispute Management Services

Chargebacks are a major threat for merchants online and IRL. Fortunately, companies can use dispute management services, to reduce risks.

-

Confirm Your Deliveries, Retain Your Revenue

Your money rides along with that package, and without that delivery confirmation, your revenue can float away if a dispute arises.

-

How We Connect Merchants to Dispute Management

Today, we’re going under the hood of CBH+ to show off how it connects merchants to the most effective dispute management tools.

-

Compelling Evidence: Find it, use it, profit!

The key to winning representment is proper data capture. We share a little “insider knowledge” on spotting successful representment opportunities.

-

What is 3D Secure (2.0 Edition)?

Technically speaking, 3D Secure (3DS) is an authentication process where three “domains” (hence 3D) are involved in authorizing a transaction.

-

UPDATE! The EU Payment Service Directive

Sorry, nerds—PSD2 isn’t a game sequel or Star Wars character. It’s an EU law regulating payment services within the European Economic Area (EEA).

-

Eliminate Friendly Fraud with DEFLECT and Order Insight

In our webinar “Eliminate Friendly Fraud Before It Starts,” ChargebackHelp and Verifi provide merchants with crucial insider knowledge.

-

Cryptocurrency Eliminates Fraud and Chargebacks, But…

Cryptocurrency also known as “coins”, “tokens” or simply “crypto”, this technology can be extremely useful to merchants in combating fraud and chargebacks.

-

Do You Need Manual Review to Prevent Fraud?

It’s not a question of “if” manual review is needed, but of “where” can it be most effective. Let’s review where manual review can be effective.

-

Recover More Revenue with Effective Rebuttal Letters

If you’re composing a chargeback rebuttal letter to a bank, a couple of things have already happened to get you there.

-

How To Profit From Returns

Returns are expensive, but chargebacks cost even more, so you do need a sensible and visible returns policy.

-

What is Secure Remote Commerce?

Smart-chip maker EMVco has come up with a innovation that unifies security and convenience called Secure Remote Commerce.

-

A Guide to Disputes with the Big Four Issuing Banks

Here’s everything you need to know about handling chargeback disputes with the big four credit card companies and banks.

-

American Express Chargebacks – How Different Are They?

AMEX issue their cards and deal directly with cardholders. That’s why American Express chargebacks work differently than other chargebacks.

-

Subscription Merchants: New Visa mandate for free trials

Visa’s free trial mandate aims to give greater transparency for customers and help merchants with better dispute protocols and accurate reason codes.

-

Chargebacks 101: A merchant’s guide

AMEX issue their cards and deal directly with cardholders. That’s why American Express chargebacks work differently than other chargebacks.

-

Merchant Help for Disputes on Amazon

Selling with Amazon comes with some unique benefits when dealing with disputes, provided the merchant complies with their requirements.

-

Managing Disputes on Stripe

Stripe offers a cutting-edge solution for digital payments, but merchants still face disputes and chargebacks on the platform.

-

Shopify Processing and Dispute Management Explained

Shopify is all-inclusive storefront solution for eCommerce merchants. It’s super-easy to set up and is used worldwide in over 175 countries.

-

The Merchant Guide to Visa and MasterCard’s Chargeback Programs

Understand what happens with the card schemes when you process excessive chargebacks on their networks. Hint: It’s expensive.

-

Gift Cards: A Cautionary Tale

They may be intended for the act of giving but gift cards are also the de facto currency for fraud online, since they’re as anonymous as cash.

-

Are Blacklists Effective for Fraud Prevention?

Blacklisting is not a cure-all against eCommerce fraud even if it employs some useful mechanisms for catching suspected fraud.

-

Does It Pay to Process Venmo?

Merchants looking to connect with the next generation of consumers will certainly want to consider peer-to-peer payment (P2P) solutions like Venmo.

-

In-House or Out-Sourced Dispute Management? What You Need to Know

Dispute management is a balancing act. You want to protect your bottom line from fraud and chargebacks, but keep your costs low.

-

How the US Congress Created Chargebacks

Chargebacks were created almost fifty years ago by the Fair Credit Billing Act to protect consumers from abuse.

-

Subscription Merchants: 7 Fundamentals for Recurring Billing

Seven simple steps you can take in your recurring transactions that are just as important as the product to keep each account rolling.

-

Retrieval Requests: An old process still haunting merchants

Receipts are needed for bookkeeping and taxes, of course, but they are equally important for retrieval requests.

-

Automating Refunds With Visa RDR

Visa RDR helps automate refunds before disputes become chargebacks. Learn how to use Visa RDR to reduce fees and protect your merchant account.

-

How to Fight Chargebacks That Matter Most

Fight chargebacks that matter most. Learn how to prioritize disputes, recover revenue, and protect your merchant account with a smarter strategy.

-

Early Warning Signals for Chargeback Risk

Chargeback risk builds before ratios spike. Discover early warning signals and how to protect your merchant account from rising exposure.

-

How AI Is Reshaping Chargeback Management

AI commerce chargebacks are coming. Learn how agent-driven purchases will change disputes, evidence, and risk management for merchants preparing ahead.

-

Get to Know RECOVER: Fight Chargebacks

Fight chargebacks more effectively with automated representment. Learn how RECOVER helps merchants recover revenue and reduce chargeback losses.

-

Get to know RESOLVE: Get Chargeback Alerts

Chargeback alerts give merchants early visibility into disputes so they can act before fees and ratios are impacted. Learn how RESOLVE centralizes alerts.

-

Get to Know DEFLECT: Prevent Chargebacks

Prevent chargebacks by stopping disputes before they start. Learn how DEFLECT shares transaction data early to reduce risk and protect merchant accounts.

-

How ChargebackHelp Uses Order Insight to Deflect Disputes

Order Insight helps prevent chargebacks by resolving confusion early. Learn how ChargebackHelp delivers it seamlessly through DEFLECT.

-

How ChargebackHelp Simplifies Chargeback Management

Discover how ChargebackHelp streamlines chargeback management by combining alerts, automation, and expert support into one solution merchants can trust.

-

What Every Merchant Should Know About Visa RDR

Visa RDR lets merchants resolve disputes automatically before they become chargebacks. Learn how Rapid Dispute Resolution works and how to activate it.

-

2025 Chargeback Time Limits Explored and Explained

Understand Chargeback Time Limits to protect your business and manage disputes effectively. Learn all the necessary details.

-

How Does Ethoca Consumer Clarity Prevent Chargebacks?

An in-depth look under the hood at how Consumer Clarity can deflect disputes and defend merchant revenue.

-

Get to know RESOLVE: Get Chargeback Alerts

Chargeback alerts give merchants early visibility into disputes so they can act before fees and ratios are impacted. Learn how RESOLVE centralizes alerts.

-

Using Dispute Notifications to Reduce Chargebacks

Dispute notifications give merchants a chance to resolve issues early and avoid chargebacks. Learn how ChargebackHelp streamlines dispute notification workflows.

-

How Chargeback Alerts Power Automated Protection

Learn how chargeback alerts and automation combine to help merchants reduce risk, protect revenue, and simplify chargeback management.

-

Mastercom Collaboration as a Competitive Advantage

Mastercom Collaboration helps merchants resolve Mastercard disputes before they escalate. Learn how ChargebackHelp integrates it for early resolution and revenue protection.

-

How Automated Chargeback Protection Works

Discover how automated chargeback protection helps merchants reduce manual work, improve dispute outcomes, and scale faster with ChargebackHelp’s integrated platform.

-

How Verifi CDRN Helps Merchants Stay Ahead of Chargebacks

Verifi CDRN gives merchants an early edge by resolving disputes before they escalate. Learn how ChargebackHelp makes CDRN easy to implement and scale.

-

Automating Refunds With Visa RDR

Visa RDR helps automate refunds before disputes become chargebacks. Learn how to use Visa RDR to reduce fees and protect your merchant account.

-

How to Fight Chargebacks That Matter Most

Fight chargebacks that matter most. Learn how to prioritize disputes, recover revenue, and protect your merchant account with a smarter strategy.

-

Early Warning Signals for Chargeback Risk

Chargeback risk builds before ratios spike. Discover early warning signals and how to protect your merchant account from rising exposure.

-

How AI Is Reshaping Chargeback Management

AI commerce chargebacks are coming. Learn how agent-driven purchases will change disputes, evidence, and risk management for merchants preparing ahead.

-

Get to Know RECOVER: Fight Chargebacks

Fight chargebacks more effectively with automated representment. Learn how RECOVER helps merchants recover revenue and reduce chargeback losses.

-

Get to know RESOLVE: Get Chargeback Alerts

Chargeback alerts give merchants early visibility into disputes so they can act before fees and ratios are impacted. Learn how RESOLVE centralizes alerts.

-

A Quick Look at the Legal History of Chargebacks

Learn about the key developments in the legal history of chargebacks that shaped today’s payment systems and the laws that govern them.

-

Chargebacks | Fraud | Industry

Understanding Visa’s VAMP

The VAMP is launching on April 1st, 2025. Discover what this means for merchants and acquirers and how to keep your business in compliance.

-

Could High Inflation Spur Chargebacks?

Learn effective strategies for managing chargebacks during inflation to protect your business and maintain profitability.

-

Chargebacks | Fraud | Industry

pAIscreen and ChargebackHelp Team Up to Bring Enhanced Screening and Fraud Prevention To Issuers and Merchants

pAIscreen is pleased to announce it is collaborating with ChargebackHelp, a leader in dispute management, to augment it’s AI-powered, real-time transaction screening solution.

-

Takeaways From NFIB’s Updated Chargeback Guide

A summary of NFIB’s newest chargeback guide for merchants to help protect business and preserve revenue in 2025.

-

Chargebacks 2025: What Merchants Need to Know

Complex changes are coming to the chargeback process for merchants in 2025. Learn how to utilize the changes to lower chargebacks in 2025.

-

Understanding Transaction Data Analysis and Chargebacks

Discover the importance of transaction data analysis to help forecast and prevent chargebacks using a data-driven approach.

-

Compelling Evidence: Find it, use it, profit!

The key to winning representment is proper data capture. We share a little “insider knowledge” on spotting successful representment opportunities.

-

Chargebacks | Data | Disputes | Integrations

The ChargebackHelp Guide to Order Insight

Order Insight sends transaction data to issuing banks deflecting cardholder inquiries from becoming disputes and chargebacks.

-

How to Win at Transaction Descriptors

Descriptors are the line items you see on your bank statement that describe each transaction. Merchants must deliver concise descriptors to customers.

-

Red flags your gateway should be catching

We’ve put together a checklist of some key red flags that your gateway should be automated to catch in your transactions.

-

Self Assessment: Are you a soft target for fraud?

The EMV card transition is finally in high gear, which is great news for compliant retailers; card-present fraud is in decline.