Use Returns to Reduce Chargebacks and Disputes

Returns are a part of life for retailers, and with January approaching, many merchants will experience higher than usual returns. Perhaps the purchaser is having second thoughts, or maybe the end user simply doesn’t like their gift. While some returns may be inevitable, there are steps you can take to reduce the risks that come along with returns, including chargebacks, fraud, and other problems.

Let’s take a close look at how retailers can set up effective return policies that keep customers happy and discourage chargebacks and other issues. Of course, every merchant must consider their own unique situation, but you can get off to a great start by considering the below suggestions for optimizing your return policy.

Just Say “No” to “No Returns”

Some merchants try to do away with returns altogether, perhaps requiring that every sale be “as is.” Unless you’re selling high-end bespoke items, a no-returns policy is bad for business. For one, some customers avoid retailers who don’t offer return policies. These folks might be worried about fraud themselves or they may question the quality of the products offered. Likewise, many customers prefer to shop with merchants that offer an easy to use, no question asked return policy. In fact, research has found that lenient return policies lead to more sales. From the customer’s point of view, a great return policy mitigates risks.

As such, an easy to exercise return policy can become a competitive advantage. If customers know that they can get their money back if they don’t like the product, they’ll be more likely to roll the dice on a purchase. This helps businesses build trust, especially with new shoppers who are unfamiliar with a company and/or their products and services.

On the other hand, if merchants don’t offer a return policy, many customers will simply shop elsewhere. Additionally, if a customer does buy from a merchant that doesn’t offer a return policy, they can still go to their bank and ask for a chargeback. In the long run, chargebacks are more grave a risk than traditional returns.

Why? Merchants have some control over return policies and often the decision comes down to their customer service department. With chargebacks, the customer’s card-issuing bank has the final say. If the bank decides to approve the chargeback, they’ll claw back the money spent and return it to the customer. And since banks want to keep customers happy, they tend to side with their cardholders.

Additionally, with chargebacks you’ll be assessed a chargeback fee, which typically costs between $20 to $100. Merchants will also see their chargeback ratio rise. If you deny a customer a return, they may still ask their bank for a chargeback. However by accepting returns, you may head off these types of chargebacks. Moreover when the bank investigates a transaction, your case is arguably stronger if you offer a return process.

Let’s examine chargebacks more closely.

A Closer Look at Chargebacks

In a sense, a chargeback is basically an unauthorized refund. Plus, with chargebacks, the customer keeps the products or services rendered. So not only might the retailer lose the funds from the sale, they may also lose inventory. If customers work with a company’s return policy, the business recovers the inventory, which can then be resold. With chargebacks, the inventory is gone forever.

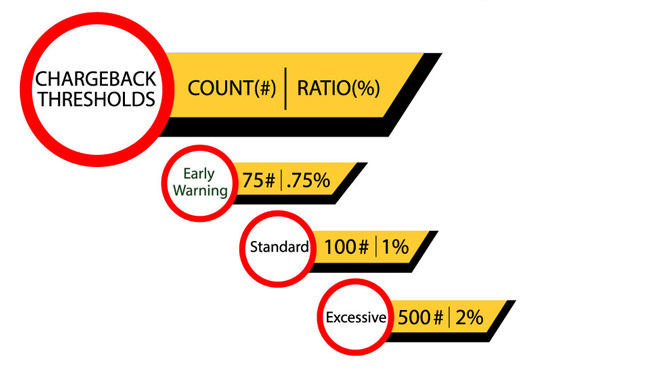

Additionally, losses continue to pile up for the merchant. Once hit with a chargeback, the retailer’s chargeback ratio will rise. If this ratio gets too high, around 1% of total transactions, payment processors may decline to work with the business, or they may demand higher fees. These fees will impact every transaction, not just those resulting in chargebacks. On top of that, the merchant will also have to pay chargeback fees. These fees typically range from $20 to $100 and are assessed whether you win or lose the chargeback dispute.

Speaking of chargeback disputes, merchants can file a chargeback dispute letter. In this letter, they will argue that the charge was legitimate and that they (the retailer) upheld their end of the bargain. Unfortunately, fighting chargebacks can take a lot of time. You’ll have to gather and submit evidence, furnish an argument, and otherwise state your case. With dispute management platforms it’s possible to streamline much of the process. That said, even with effective tools, fighting chargebacks can be time consuming.

Still, disputing unwarranted chargebacks is the right move. Further, there are steps retailers can take to reduce the chances of getting hit with a chargeback while setting return policies.

How Merchants Can Optimize Return Policies to Reduce Chargebacks and Create Competitive Advantages

Chargebacks are a serious problem for retailers big and small. Each year, businesses lose billions of dollars to chargebacks in the form of lost revenues, fees, and lost inventory. Fortunately, well-crafted return policies can reduce risks.

First, merchants should offer an accessible return process. Otherwise, customers will simply turn to their bank to file a chargeback. If bank employees see that you don’t offer a return process, or that you’ve made it very difficult for customers to secure returns, they may be quicker to approve the chargeback filed by their client. On the other hand, if you offer a simple, easy-to-understand return process, you can point out that the cardholder had other options besides trying to file a chargeback.

At the same time, businesses may not want to be overly generous when it comes to returns. Scammers look for easy targets. If a scammer visits a website and thinks that the business will be a pushover, they may target that company specifically. By being overly effusive with “hassle-free” return policies like money back guarantees or bold offers of “no questions asked”,, businesses may attract bad actors, and straight up fraudsters.

Instead of being a pushover, businesses should offer a balanced, fair, and easy to understand return process. Let’s take a closer look at what such a return process looks like.

Offer Responsive, Easy to Reach Customer Service

Sometimes people file chargebacks because they feel like they have no other option. They might try emailing a website’s customer service department but hear only crickets. They could send messages via social media that never get answered and may be forced to play phone tag with customer service reps that never seems to go anywhere.

One of the most effective ways to increase customer satisfaction in general is to offer responsive customer service. Businesses should try to reply within 24 hours or less. When a customer calls, they should be able to speak with customer service reps within a few minutes. This way, shoppers will be more likely to turn the merchant for a return rather than their card issuer for a chargeback.

Besides potentially reducing chargebacks, effective customer service can also improve your brand reputation and shopper satisfaction. Even if someone returns something today, they might be more likely to shop with you again in the future.

Refund Only To The Original Payment Method or Store Credit

Fraudsters can be exceptionally savvy. Sometimes a fraudster will steal someone’s credit card or hack into their account and use saved payment information to make a purchase.

Then, they’ll contact the retailer and ask for the order to be canceled and refunded. But instead of sending the money back to the original payment method, they’ll ask for it to be sent elsewhere. If the scammer can get the money sent to a bank account they control, they can take control of the funds. Unfortunately, the merchant may ultimately end up on the hook for the lost funds.

If someone asks for a refund, you should only refund it to the original payment method, say a credit or debit card. You can also offer them in-store credit instead of funds. While in-store credit is great for customers, it’s often not particularly useful for fraudsters. Brick and mortar stores should also ask for receipts and identification. Having security cameras set up is also wise. Online stores too should consider extra authentication steps when they request a refund.

Offer a Longer Return Window

Longer return windows can actually reduce the number of returns a retailer has to deal with. If the return window is short, customers may decide to return products before they have a chance to become attached to the product. On the other hand, if customers can hang onto the items for a few weeks or even a few months, they might fall in love.

Set Up Chargeback Alerts

Generally speaking, allowing a customer to make a return and then offering a refund is better than getting hit with a chargeback. As already mentioned, chargebacks result in fees and potentially increased payment processing costs. Additionally, inventory might be lost, and you could end up losing the revenue from the sale. So when possible, it’s better to refund the customer.

With chargeback alerts, banks can give you a heads up and warn you of pending chargebacks before they are filed. This provides you with time to contact the customer and to try to resolve the issue before the chargeback becomes official. Remember, once a chargeback is filed, the merchant must pay the fees and will suffer a rising chargeback ratio even if they win the dispute.

Often, simply providing a refund is the safer course. Even if you previously declined refunding a customer for whatever reason, if a chargeback is imminent, it might be best to provide the refund.

The Right Return Process Reduces Headaches

Returns and refunds are a hassle. In a perfect world, every transaction would go off without a hitch with both the customer and business left happy. However, while most transactions will ultimately prove beneficial for all involved, some returns are inevitable.

That said, by optimizing your return process to ensure customer satisfaction and to reduce issues like chargebacks, you can put your business in a better position to succeed while also reducing risks. It’s especially wise to pay close attention to returns following the holiday season, but a well-designed return process and responsive customer service department can pay dividends year round.