Visa’s Compelling Evidence 3.0: Why you should (not) be worried

For any of you merchant who have submitted representments before, you’ve no doubt asked yourself what is compelling evidence — or rather is the evidence you’re submitting to an issuer compelling enough to make your case. What is considered “compelling” can vary from merchant to issuer and even from issuer to issuer. When it comes to first-party disputes where it’s you vs. the issuer’s customer, and your revenue is at stake, some evidence should be more than compelling, it should be indisputable.

Visa has set out to do just that with their Compelling Evidence 3.0 mandate. CE3.0 states that if merchants can show previous transaction history with a cardholder, then the merchant will be protected for certain disputes arising from that cardholder. There are lots of caveats and qualifiers to look at here, but if you capture specific data, that data can systematically invalidate specific disputes.

But before you go overhauling your transaction stream, know that we’ve been encouraging merchants to capture this transaction history all along; in fact, ChargebackHelp clients are already capturing said data. There’s just “one weird trick…” we’ll get to in a minute.

Qualifying Data Points, Explained

We’ve been saying it all along, but Visa makes it official with CE3.0. Merchants need to capture and store transaction data to protect themselves against first-party fraud. First-party fraud is when the cardholder makes a purchase, but then either fails to recognize it on their statement and disputes it (friendly fraud), or they’re abusing their bank’s chargeback policy by claiming fraud to steal product (chargeback fraud). Merchants can deflect first-party disputes or reverse ensuing chargebacks by tying cardholders to their purchases by capturing transaction data, aka “compelling evidence.”

Visa categorizes these types of disputes as “first-party misuse” under their reason code 10.4: “Other Fraud.” Currently, merchants can already prevent many 10.4 disputes through Verifi’s Order Insight®, which ChargebackHelp clients are integrated with already under DEFLECT. However, CE3.0 guarantees protection against 10.4’s if the merchant can show the following:

At least two historical transactions on the same [cardholder] PAN,

older than 120 days but less than or equal to 365 days.

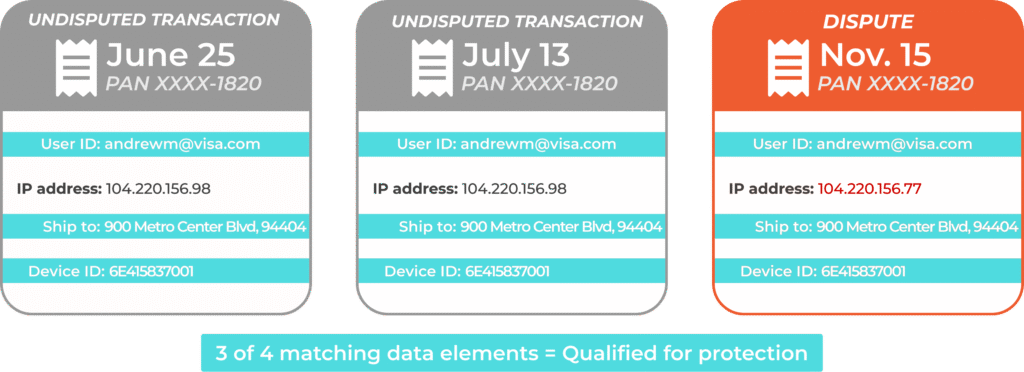

To achieve this, the following data points — known as “qualifying transaction data” — must match across the disputed transaction and the historical transactions:

- Any two of the following:

- IP Address

- Device ID or Device Fingerprint

- Account ID

- Delivery Address

- One of the two must be either:

- IP Address, or

- Device ID or Device Fingerprint

EXAMPLE: 2 previous transactions vs. 1 dispute

The One Weird Trick

If merchants can match the qualifying transaction data from a pending 10.4 dispute to the historical transactions, then a merchant deflection will be a slam dunk, according to Visa. Qualified disputes cannot be entered into Visa Resolve Online (VROL) as disputes, and liability shifts to the issuer. As long as you have qualified transaction history with a cardholder that is older than 120 days (the Visa dispute window), that cardholder cannot dispute the purchase via the 10.4 reason code.

CE3.0 basically spells out certain evidence as “indisputable.” As clear cut as it makes any qualifying transaction, CE3.0’s pending rollout begs new questions, about it and about compelling evidence in general. Visa has also provided an FAQ for additional inquiries here:

Visa’s Compelling Evidence 3.0 FAQs

One thing is for sure though, if you are CE3.0 compliant on any 10.4 dispute, you will not be liable. CE3.0 might make it easier for merchants to win certain disputes, but it also creates a stronger business case for Order Insight. After all, this is a product. The more merchant-friendly outcomes Visa can guarantee, the more value OI has to merchants.

ChargebackHelp Clients Need Not Worry

ChargebackHelp already captures and mobilizes the CE3.0 data points for its clients; compliance is already built in. Furthermore, we integrate our merchants’ transaction streams not only with Order Insight, but also Ethoca Consumer Clarity (Mastercard’s deflection tool) for unparalleled, card-agnostic dispute protection. So if you’re a client of ours — smart choice, and thank you! Now pat yourself on the back, and return to your core business.

Not a ChargebackHelp Client?

Jealous? You should be. Contact ChargebackHelp and we can have you sleeping better at night by improving your dispute protection in very short order. Contact us here or call us at 1.800.975.9905.