Industries and Businesses Most At Risk of Chargebacks

Chargebacks are a major threat to essentially every small and medium enterprise (SME). It should come as no surprise that retailers, such as clothing stores, are among the highest-risk businesses. That said, businesses operating in other industries face arguably even higher risks. We’ll take a look at which small businesses experience the highest chargeback risks. Keep in mind, however, that at the individual level, some businesses operating in high-risk industries are able to successfully prevent and combat chargebacks, while some businesses working in lower-risk industries get hit with abnormally high levels of chargebacks.

Education and Other Intangible Service Providers

Many individuals and SMEs have been using online courses to teach people various skills while generating revenue streams. Various other less tangible services, like consulting, can drum up revenue. Unfortunately, intangible services can result in heightened chargeback rates, making it crucial for such businesses to proactively combat chargebacks with sound chargeback reduction strategies and effective dispute management tools.

Psychology likely plays a major role. When customers buy a physical product, or a tangible service, like a haircut, the outcomes and benefits of the purchase are often obvious and immediate. With an education course, consulting, or other less tangible services, the benefits can be harder to define and may not be obvious right away. Customers who feel like they didn’t get much out of the service may try to recoup their funds via chargebacks.

Retailers (Both Online and Brick & Mortar)

There’s no doubt about it, retailers that sell directly to customers often get hit with a lot of chargebacks. High sales volumes, rising fraud rates, and various other issues create considerable risks. Brick-and-mortar retailers may face a bit lower risks compared to online retailers since they won’t face as many card-not-present (CNP) transactions and it’s sometimes easier to spot in-person fraud. Regardless, risks are still high.

Risks include:

-

Lost revenue from sales, as well as lost inventory.

-

Chargeback fees, which typically range from $20 to $100.

-

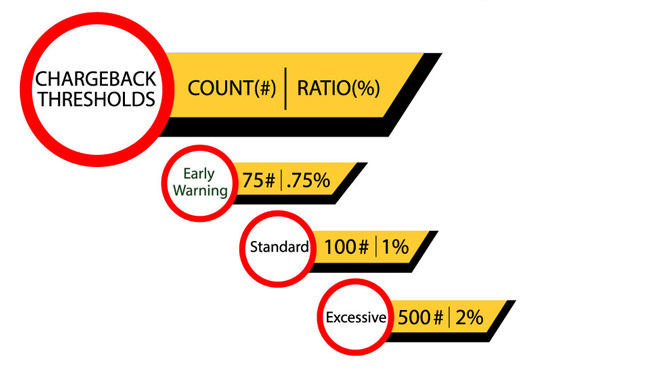

A rising chargeback ratio, which could lead to penalties, including higher processing costs.

-

Wasted labor managing chargebacks and fulfilling non-revenue generating orders.

Luxury Good Merchants

Merchants, both online and in the real world, who sell luxury goods are at especially high risk. Because so much money is often at stake, fraudsters love targeting luxury retailers. This includes cardholders who abuse the chargeback process to try to secure free (expensive) goods via first-party fraud.

Hospitality, Travel, and Tourism Firms

The travel industry has long been high risk as far as chargebacks are concerned. For one, many fraudsters target travel companies, and international transactions, in particular, can be complicated. Further, many transactions are card-not-present, increasing risks. On top of that, it can be hard to keep travelers happy and some may turn to their bank if they feel they got a bad deal.

Big hotel chains, airlines, and other travel/tourism companies often set up chargeback mitigation teams. A small bed & breakfast or Airbnb operation probably won’t have the funds to set up a chargeback team, but there are a variety of tools that SMEs can use to combat and prevent chargebacks, including:

-

Chargeback alerts- Used to deflect chargebacks before they are filed.

-

Address Verification Services- Can prevent fraudulent transactions, and thus chargebacks.

-

Dispute management platforms- Make it easier to manage tools, like alerts, and successfully win representment disputes.

Software, SaaS, and Gaming Companies

Many software companies, including smaller firms, have shifted to subscription-based models. Unfortunately, if a customer forgets to cancel a subscription, they may turn to their bank to file a chargeback. If the bank approves the chargeback, the customer is essentially getting an unauthorized refund.

Game developers specifically often get hammered by chargebacks. This is true even if the game isn’t subscription-based. One major driver of gaming chargebacks is unauthorized in-game purchases. If a child uses their parent’s credit card to make an unauthorized purchase, the parent might file a chargeback to claw back the money.

Chargebacks Are a Threat to Essentially Every SME

The above industries and SMEs operating in them are far from the only businesses that get hit with chargebacks. Health and wellness companies, anything involving gambling or other legal gray zones (like cannabis), and various other industries face heightened chargeback risks.

Some small businesses, like restaurants, are less likely to get hit with high numbers of chargebacks. That said, some cardholders may be looking for a free lunch via first-party fraud, or confusion, dissatisfaction, and other issues can lead to chargebacks.

No matter the industry you operate in, the ChargebackHelp team can help. We offer a variety of tools SMEs can use to prevent and combat chargebacks. Even if you can’t set up a dedicated chargeback team, with the right tools and approach, you may be able to substantially reduce chargebacks, thus protecting your bottom line.