How Ethoca Consumer Clarity Prevents Confusion and Chargebacks

How Consumer Clarity Makes Transactions More Transparent

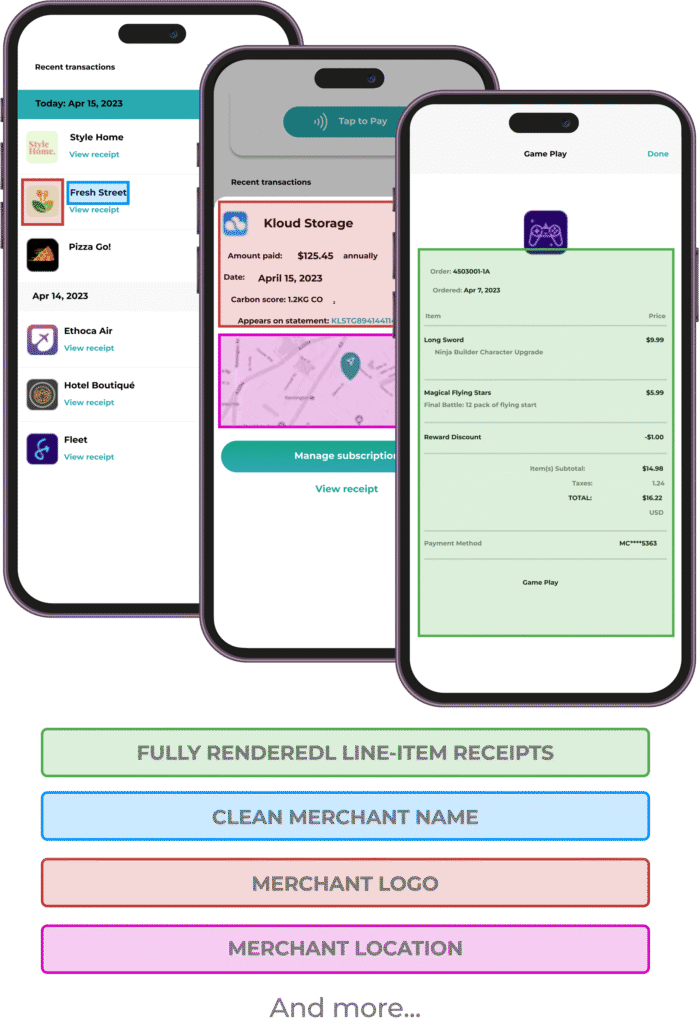

Ethoca Consumer Clarity is a Mastercard-powered solution that allows cardholders to see enhanced transaction details through their banking apps and statements. It displays merchant names, product descriptions, logos, timestamps, delivery status, and even customer support contacts at the exact moment a cardholder is questioning a charge.

When this information is available, cardholders are far less likely to file a dispute. There’s no need to contact the bank if they can recognize the transaction right away. And for merchants, that means fewer chargebacks from honest confusion.

Unlike chargeback alerts or representment, Consumer Clarity intervenes before a dispute ever begins. It provides a preemptive layer of protection for your business built around visibility and communication.

The Real Cost of Transaction Confusion

When a cardholder doesn’t recognize a transaction, their first instinct is often to call their bank. What starts as a simple question can quickly escalate into a chargeback, especially if the customer service rep can’t verify the purchase.

These are sometimes labeled as friendly fraud or first-party fraud, but most stem from simple gaps in communication. The merchant name might appear differently on the statement. The product description might be too vague. It could even be a legitimate charge made by a family member.

Whatever the cause, these confusion-driven chargebacks cost real money. There are fees, penalties, and the hit to your merchant account’s standing. Over time, these chargebacks can push your ratios above network thresholds, leading to stricter monitoring and higher processing costs.

With Consumer Clarity, you cut off these preventable issues at the source.

Why Merchant Trust Matters Now More Than Ever

Chargebacks aren’t just isolated financial losses. They’re interpreted as risk signals by networks and acquiring banks. A merchant with frequent preventable chargebacks is seen as someone who isn’t managing their payment experience well. That could affect your ability to grow, to negotiate better processing terms, or even to stay online in high-risk industries.

Consumer Clarity helps change that narrative.

When your brand details are clear, your delivery data is accessible, and customers feel confident reviewing their transactions, you reduce the rate of avoidable disputes. That helps keep your chargeback ratios within acceptable bounds, avoiding network intervention or placement into enforcement programs. It also builds stronger relationships with customers, especially for merchants operating in verticals like travel, CBD, or online subscriptions, where recognition gaps are common.

The Easy Way to Use Consumer Clarity With ChargebackHelp

Ethoca Consumer Clarity is powerful, but it’s not plug-and-play. Most merchants don’t have the resources to set up secure APIs, maintain data feeds, and ensure compliance with Mastercard’s frameworks.

That’s where ChargebackHelp steps in.

Through our DEFLECT platform, we integrate Consumer Clarity directly into your transaction stream without the need for manual work or developer involvement. Your product descriptions, branding, fulfillment timelines, and support details are automatically delivered to participating issuers.

This setup runs in the background, quietly preventing confusion-based disputes and giving customers the confidence to trust what they see.

How to Get the Most Out of Consumer Clarity

To make the most of this visibility layer, merchants should prioritize a few key elements. The goal isn’t just to show information. It’s to show the right information in the moments that matter.

Clear product descriptions

Avoid abbreviations or vague terms. The more detail you provide, the easier it is for customers to recognize what they bought.

Include delivery or fulfillment status

If the product has shipped or been delivered, that status should show in the banking app. It adds credibility and reduces panic over unrecognized delays.

Display your brand visually

A logo, business name, or domain reference can go a long way in triggering recognition. Visual branding builds trust faster than text alone.

Add contact details

Letting cardholders know how to reach you shows you’re accessible and can even lead to a direct resolution instead of a chargeback.

All of these features are automatically supported through DEFLECT’s Mastercard integration, which takes care of formatting and data delivery for you.

Ready to Make Your Transactions More Recognizable? Let’s Talk

If you’re tired of losing revenue to chargebacks caused by unrecognized purchases, now’s the time to implement a smarter solution. Contact the ChargebackHelp team to help deploy Ethoca Consumer Clarity across your entire portfolio, giving your customers the visibility they need to trust their purchases and giving you the protection you need to stop avoidable losses.

Why ChargebackHelp?

We combine powerful chargeback prevention technology with white-glove support, helping merchants stay ahead of evolving network expectations. With tools like Verifi Order Insight and Ethoca Consumer Clarity, automated resolution workflows, and unmatched visibility into your chargeback data, we make it easy to prevent disputes before they happen and recover revenue when they do. When you partner with ChargebackHelp, you’re not just avoiding chargebacks. You’re building a smarter, more trusted merchant operation.

FAQs: How Ethoca Consumer Clarity Helps Prevent Chargebacks

What is Ethoca Consumer Clarity?

It’s a Mastercard solution that displays detailed transaction info like itemized orders and merchant logos to cardholders in their banking app. This helps prevent confusion and reduces chargebacks. ChargebackHelp integrates it automatically through DEFLECT.

How does Consumer Clarity prevent chargebacks?

By providing recognizable purchase details, it stops disputes before they start. Customers can verify a charge without calling their bank. ChargebackHelp ensures that your data feeds into the right issuer channels for maximum visibility.

Is Consumer Clarity different from chargeback alerts?

Yes. Alerts notify you after a dispute is filed. Consumer Clarity works before the dispute begins, giving customers the info they need to avoid filing in the first place.

Is Consumer Clarity difficult to implement?

On your own, yes. But with ChargebackHelp, it’s fully managed for you. No dev work or compliance audits required.

What’s the best way to combine Ethoca with other tools?

We recommend using it alongside chargeback alerts and representment support for a complete risk strategy. ChargebackHelp can tailor an approach based on your business model.

Can high-risk merchants use Ethoca Consumer Clarity?

Yes, and they should. Businesses like travel, supplements, and subscription services often face high dispute rates from confused customers. Consumer Clarity helps head that off at the source.