The New Visa Rules Explained

Knowledge is power, as the saying goes, because knowledge dissolves uncertainty. And there has been a lot of uncertainty generated from the latest changes made by Visa. As your partner in reducing chargebacks, ChargebackHelp will also reduce the daunting complexities of this change into terms merchants can understand, and profit from.

We’re going to delve into the chargeback monitoring aspects of the new Visa policies, but know that their fraud monitoring policies function in much the same way, as a precursor to chargebacks. Whereas excessive chargebacks lead to fees and penalties, excessive fraud precedes that by making chargebacks more likely.

Basically, the new Visa Chargeback Monitoring Program (VCMP) has three key components for both chargebacks and fraud: thresholds, notifications, and timelines. Let’s break down the thresholds first.

VCMP THRESHOLDS

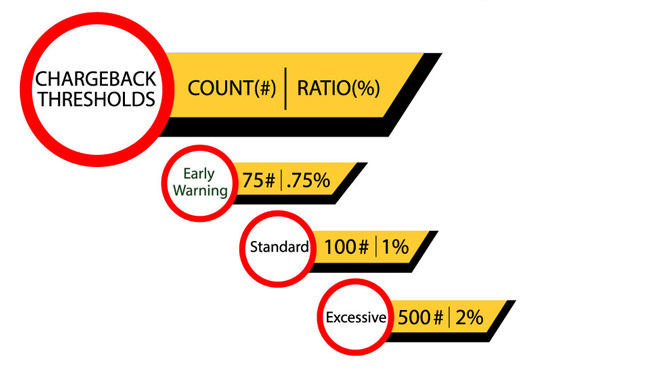

Thresholds are determined by two metrics: chargebacks-to-sales ratio (%) and chargeback count (#). There are three levels of thresholds on the new menu: the “Early Warning” (.75% | 75#), the “Standard” (1% | 100#) and the “Excessive” (2% | 500#).

The VCMP looks at your current month and the previous month’s transactions. You’re good-to-go until you’ve processed more than 75 chargebacks or .75% chargebacks-to-sales ratio over that two-month period. So even if 75 chargebacks is less than .75% of your transactional volume, you cross the early warning threshold just the same.

(Just note that the same applies to fraud thresholds, though the threshold metrics are ratio (%) and dollar amounts ($): Early Warning for fraud comes at .75% | $50k, Standard is 1% | $75k, Excessive is 2% | $250k.)

VCMP TIMELINES

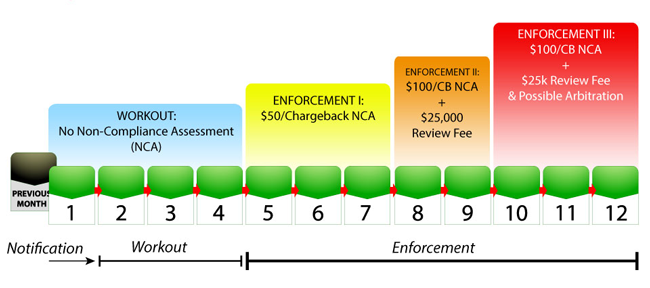

Once you cross that .75% | 75# threshold, you are notified and enter into the Timeline phase, starting with the “Workout” (for all you gym biscuits out there, this “workout” phase is bad). The Workout lasts three months in which all told you have get back below the Early Warning threshold. If you do not, you enter the “Enforcement” phase in the Timeline. Under Enforcement, you receive a Non-Compliance Assessment of $50 per chargeback, and your NCAs go up from there after 3 months, and chargebacks begin to really hurt.

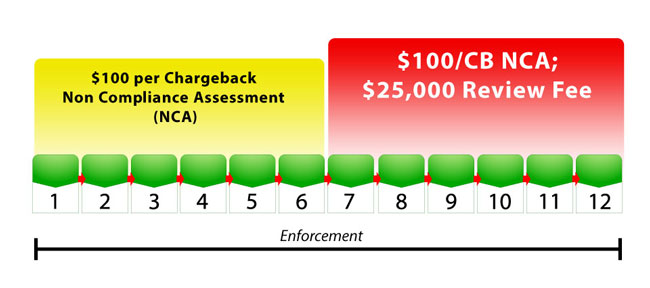

If you cross the 1% | 100# chargebacks “Standard” threshold in a two-month period, you begin to approach the 2% | 500# “Excessive” threshold. Here, you skip workout and go directly to NCAs. You get strapped with a $100 fee per chargeback over six months. After that, it’s $100 per, plus a $25,000 “review fee.” If that was not enough, once you cross the 2% | 500# threshold, you can lose your processing and your world just might come to an end.

CHARGEBACKHELP: EVOLUTIONARY SOLUTIONS

You don’t have to lose your processing, of course. With ChargebackHelp on your side, our managed services monitor fraud alerts 24/7 from both “friendly” fraud and “true” fraud. Our managed services can deflect many disputes before they affect your revenue, otherwise we refund disputes before they become a chargeback with expensive fees and penalties. If that’s still not enough, we still have you covered with aggressive representation to fight fraud and prevent disputes from ever becoming chargebacks. For a more in-depth analysis of how these thresholds and timelines will affect your business in particular, give us a call for a free chargeback analysis and avoid those nasty assessments!

Sources:

https://globalrisktechnologies.com/new-visa-chargeback-regulations-to-hit-in-the-new-year/

https://www.braintreepayments.com/blog/changes-to-visa-chargeback-and-fraud-monitoring-programs/

https://www.clearslide.com/view/mail?iID=CrVSk6GqRt8fz85NmngJ