What Are Chargeback Ratios?

Business is humming, orders are coming in and products are going out. It’s a busy week as you onboard new team members and secure deals with vital partners. Markets are cutthroat and you face stiff competition but the future looks bright. Then you get a message from your acquiring bank, warning you that your chargeback ratio is rising. Soon, you’re informed, you may have to pay increased processing fees for every transaction and your processor might even drop you altogether.

Chargebacks!? You forgot all about them. Here and there, you get hit with them but your overall success has made it easy to put resources elsewhere. However, increased processing fees could start eating into those resources, and losing your acquiring bank could cripple your business.

Sound dramatic? Sadly, many business owners and managers end up in such situations. A chargeback ratio in excess of just .9 percent can spell trouble, meaning if you process 500 orders a month and just 5 or 6 customers file a chargeback, you may run into issues.

We’ll take a closer look at chargeback ratios and why merchants need to keep a close eye on them. If you’ve recently been warned about a rising ratio, however, make sure you act quickly to address the issue — your success could be in peril. Fortunately, with the right dispute management strategies, you can ward off these threats and can even secure competitive advantages.

Chargeback Ratios Explained and Defined

Cardholders are legally entitled to recourse in the event of fraudulent transactions with credit and debit cards. This right is enshrined into federal law in the United States and many other jurisdictions as well. Should a business try to defraud a cardholder, they can turn to their card-issuing bank to request that a charge be reversed. In practice, from the cardholder’s point of view, chargebacks essentially function as a forced refund.

Chargebacks create a lot of headaches, and not just for merchants. Card issuers, payment processors, acquiring banks, and card networks have to dedicate resources to manage chargebacks and fraud. Additionally, disputes are bad for customer relations. Add it all up and stakeholders typically want to avoid the hassle.

Card networks use chargeback ratios to keep merchants accountable. These ratios track how much a merchant is hit with chargebacks. This, in turn, makes it easier to determine how risky working with a particular merchant is. If a merchant has a high chargeback ratio, card networks and banks may decline to work with them or may insist on higher fees.

How is the Chargeback Ratio Calculated?

The chargeback ratio is calculated by taking the number of chargebacks during a time period (specified by the card network) and dividing that by the number of transactions in a specified time frame.

There are some differences in how different card networks calculate chargeback ratios. For example, Mastercard takes the number of chargebacks in a given month and divides by the number of transactions in the prior month. Visa takes the number of chargebacks in a given month and divides by the number of transactions in that month. American Express and Discover use the same method as Visa.

Crucially, when a card network, such as Visa or Mastercard, calculates a chargeback ratio, they will only use the chargebacks that occurred through their network. So, Visa won’t include chargebacks incurred on Mastercard’s network and vice versa.

Here’s Why a High Chargeback Ratio is a Grave Risk

Unfortunately for any merchant hit with chargebacks, the loss of revenue is only the beginning. Products or services already delivered are lost, as well as the fulfillment costs. They will also have to pay chargeback fees and penalties that add up and increase with these ratios. Once the chargeback ratio crosses specified thresholds, chargeback penalties and payment processing fees start to rise. A high chargeback ratio can result in many penalties, which are outlined below.

Placement in a Chargeback Monitoring Program

Organizations running up high chargeback ratios will usually be placed in a chargeback monitoring program where the card networks assess higher fees. Different card networks have different programs, but in general the costs are painful. Visa and Mastercard’s programs are outlined below.

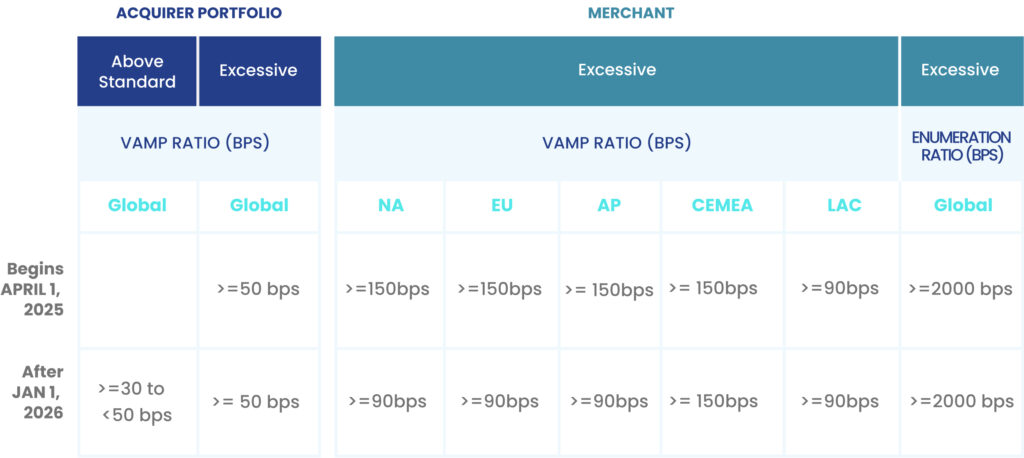

Visa Acquirer Monitoring Program

VAMP – the Visa Acquirer Monitoring Program — merges their two legacy programs VDMP (dispute monitoring) and VFMP (fraud monitoring). While on the surface, VAMP is targeted at acquiring banks to keep their overall merchant portfolio below a revised threshold, there are actually two tracks at play here. Under VAMP, acquirers must remain under thresholds set for their geographic region. However merchants also get their own thresholds to comply with.

The Key VAMP Takeaways for Merchants

- Accounting: Just as VAMP has combined their legacy programs VDMP and VFMP, elements from both of these old programs’ ratio math are accounted for in the new VAMP ratio calculation. Total Monthly TC40 fraud notices plus non-fraud disputes are divided by monthly transaction volume to get your ratio.

[ (Monthly TC40 + Non-Fraud Disputes) ÷ Monthly Transaction Volume ] - Accountability: Under VAMP, merchants essentially have to answer to both their acquirer (who has their own ratio to comply with) and also Visa, who will single out merchants that exceed these thresholds. So while the Visa thresholds above certainly apply, you should check with your acquirer in case they have a revised standard that will help them stay VAMP-compliant overall.

- What Counts: Any transaction dispute resolved over Visa/Verifi channels are not included in the VAMP ratio equation. Not only is Visa trying to simplify its monitoring programs under the VAMP umbrella, they are also low-key necessitating that you use their resolution products to keep your ratios down.

Mastercard’s Excessive Chargeback Merchant Program

The Mastercard Excessive Chargeback Program (ECM) may seem a bit more complex at first glance. Mastercard uses “basis points” to determine whether a merchant should be placed in the program. This is calculated by taking the number of chargebacks in a given month and dividing by the number of transactions in the previous month, producing a chargeback ratio. Next, Mastercard multiplies this number by 10,000.

Let’s say you had a hundred chargebacks in June and had 7,000 transactions in May, your basis points will be calculated like so:

100/7000 = .014 and thus .014 X 10,000 = ~142 points

Mastercard’s ECM Tiers

Mastercard assess flat monthly fees based on how long you have had excessive chargeback ratios and whether you’re in the Excessive or Highly Excessive program. Fees start at $1,000 but can reach up to $100,000 for the Excessive program and $200,000 for the Highly Excessive program.

Increased Fees From Acquiring Banks

Chargebacks create risks and costs for the acquiring banks as well. As a result, they may levy increased fees. These fees could impact transactions that don’t result in chargebacks. Card networks may start to penalize acquiring banks if a client continues to process at high chargeback rates. In practice, many acquiring banks will simply drop the merchant.

Policies vary from bank to bank. As such, it’s important to read the fine print of your specific acquirer’s chargeback policy.

Frozen Funds

Payment processors may also start freezing funds or require the merchant to set aside higher reserves. This will shield the payment processor should they have to refund a customer.

Being Placed on the MATCH List

One of the biggest risks that a high chargeback ratio presents is the possibility of getting placed on the MATCH list. This list is also known as a Terminated Merchant File (TMF) — which means exactly that. If one bank places a company on the TMF/MATCH list, other banks will flat-out refuse to work with the business. In practice, you may be cut out from many modern payment processing systems, which could cripple your company.

What is an Acceptable Chargeback Ratio?

For a long time, the general rule of thumb was 1%. However, Visa now sets its threshold at .9%. As such, you should strive to maintain a chargeback ratio of less than .9%. MasterCard is a bit more lenient, setting its threshold at 1% (or 100 basis points if you use that measurement). Industry chatter suggests these thresholds will trend lower still.

It’s always best to avoid as many chargebacks as possible, but merchants should aim for a chargeback ratio of .6% or less. This gives you some breathing room should chargebacks suddenly increase. It’s also smart to consider the chargeback rates of your competitors. If your rates are higher than theirs, you’ll be at a competitive disadvantage, and something is wrong. We’ll cover some of the rates for major industries below.

Chargeback Ratios by Industry

Some industries are more likely to produce chargebacks than others. Reasons can vary from industry to industry, and over time, trends often change. For example, the increased use of signed delivery receipts and detailed order tracking will help merchants reduce disputes. Meanwhile, as brick-and-mortar companies increasingly offer in-store pickup, chargebacks could increase because in-store pickup is often targeted by fraudsters.

Common Chargeback Ratios by Industry

Food and Beverage: .10 – .15%

Restaurants actually enjoy some of the lowest chargeback rates of any industry. Many customers are regulars and will strive to maintain good relations. What’s more, many transactions are card-present, which in recent years has experienced lower chargeback rates than card-not-present transactions thanks to EMV chips. Additionally, if there is a problem with an order, it’s often resolved on the scene.

Brick-and-Mortar Retail: <.5%

Retail merchants need to pay close attention to chargebacks or risk a reputation for being easy to exploit; their ratio will quickly climb as more fraudsters target them. That said, typically brick and mortar retailers will experience a chargeback ratio of less than .5%.

Online Retail: >.5%

It’s relatively common for online businesses to suffer higher chargeback rates. First, card-not-present transactions present heightened risks because a physical card with EMV is not required. If they have the authorization relevant info, like the credit card number, billing zip code and backside Card Verification Value, they can place a fraudulent order. Further, fraudsters don’t have to show their face and can more easily hide their identity.

Media and Entertainment: ~.56%

Chargebacks in entertainment services can be rather common. Among other things, there may not be a clear return or refund policy if someone is not, in fact, entertained. Likewise, many entertainment services rely on subscriptions, and if a customer has trouble canceling their subscription or forgets to do so, they will ultimately file an expensive chargeback.

Software (Including SaaS): ~.66%

Just as subscriptions can push chargeback ratios higher in the entertainment industry, they can do so with Software-as-a-Service as well. One-off software may also trigger chargebacks, perhaps because a customer can’t figure out how to use the software or simply doesn’t enjoy the experience.

High-Risk Industries

Some industries as a whole are designated as “high risk” and any company operating in these industries face higher fees. High-risk designees can typically suffer chargeback ratios of 2% or more.

Accordingly, payment processors charge higher fees to any company operating in these designated industries, even if they run a lower-than-average chargeback ratio. That said, by maintaining a low chargeback ratio, companies operating in high-risk industries may still be able to negotiate better terms on an individual basis.

High-Risk Industries Include:

- Online gambling: Gamblers are prone to cognitive dissonance and often try to claw back losses by abusing the chargeback process.

- Cannabis and Tobacco: The complicated legal environment along with quality control difficulties and other factors can make chargebacks more likely.

- Adult Entertainment: Legally complex and subscription-based (which often incur more chargebacks).

- Pharmaceuticals and Supplements: Complex legal environment and high liability. Some treatments are unproven.

- Crypto: High levels of fraud, outstanding legal issues, and an emerging industry.

Effective chargeback management is crucial for every company. While high-risk companies face extra challenges, businesses that secure a lower chargeback ratio develop a crucial competitive advantage. Let’s explore how businesses can reduce chargebacks.

How to Keep Chargeback Ratios Low

Quite simply, to maintain a good chargeback ratio, merchants must reduce the number of chargebacks filed against them. While chargebacks are a serious and potentially even grave threat, there are many steps merchants can take to reduce the likelihood of them being filed.

Below are some best practices to minimize disputes and the chargebacks they spawn. Reducing and fighting chargebacks can be labor-intensive, especially if your staff is unfamiliar with the chargeback dispute process. Entrepreneurs and managers should identify automation opportunities and consider partnering with dispute management solutions providers.

Set Up Responsive Customer Service

One of the most powerful tools for reducing chargebacks is setting up a responsive customer service department. Often, chargebacks are the result of cardholders struggling to exercise a return policy. An accessible and concise return policy could ward off many chargebacks.

Poor communication can also lead to chargebacks. If a shipment is delayed, for example, the customer may wonder if their order was fulfilled or might think that it got lost or forgotten. Should they contact a merchant’s customer service department but never hear back or find that department unhelpful, they may file a chargeback. On the other hand, if customer service can quickly provide data, such as tracking info for a package, customers may be more patient

Use Dispute Management Platforms

Dealing with chargebacks is its own pain point. There’s quite a bit of paperwork to file, important dates to track, and various parties are at odds with one another. You may also have to gather information, such as receipts, shipment tracking, and evidence that the customer is using the product. Getting all of this together used to be extremely taxing, but these days, powerful dispute management platforms handle much of the work.

Platforms like ChargebackHelp allow merchants to resolve chargebacks before they are filed, and even deflect the disputes that cause them altogether. By using chargeback alerts, a merchant can refund disputes before chargebacks are filed; especially in true-fraud disputes you’re likely to lose, it’s better to issue a refund before a chargeback is filed.

Send Clear, Accurate, and Comprehensive Transaction Data

ChargebackHelp also integrates merchant transaction streams to deflect disputes altogether by sending purchase and fulfillment data to cardholders and issuers. With deflection services, the merchant can provide additional data proving that the order was legitimate and fulfilled. ChargebackHelp’s DEFLECT solution sends this information automatically, thus better informing cardholders and making it easier for the issuing bank to disrupt first-party fraud.

Use Concise Descriptors

Descriptors are also crucial. Let’s say John Smith owns a local bar called “The Corner Pub.” The bar is held under a holding company called “Acme F&B”. A customer came in for a drink and paid with her credit card. When she goes over her spending at the end of the month, she comes across a charge from Acme F&B but doesn’t recognize that name. Thus, she thinks she was defrauded and files a dispute. If the billing descriptor had instead been “The Corner Pub,” she would have been much more likely to recognize the purchase and thus would not have filed a chargeback.

Use Accurate Product Descriptions

Products that fail to meet the customers’ expectations rank among the biggest sources of customer dissatisfaction and thus chargebacks. By using accurate videos, photos and product descriptions, you can help customers develop more reasonable expectations.

Train Employees to Spot Fraud

Fraudsters are pernicious, and even as security measures improve, fraud evolves. Ultimately, your employees will be on the frontline in the battle against fraud. This makes training crucial. If you can successfully train your employees to identify suspicious activity, such as an order coming from an out-of-country IP address, it’ll likely be easier to maintain a low chargeback ratio.

Other Methods for Fighting Chargebacks

The list above is not exhaustive. There are other tactics companies can use to reduce chargebacks. For example, offering free trials and using AI to monitor for suspicious transactions, among other things, may also protect your chargeback ratio. In the long run, companies should develop a thorough and holistic chargeback mitigation strategy and sound protocols.

Conclusion: Overlook Chargeback Ratios at Your Own Peril

Those who fall behind stay behind. Markets can be hyper competitive and you can bet that your competitors are taking every opportunity to snatch up your market share. Proactive companies can carve out advantages by keeping their chargeback ratio low. Competitive firms can pass on savings to customers and still enjoy a healthy bottom line.

Meanwhile, companies that fail to maintain a good chargeback ratio may struggle to find an acquiring bank. Credit and debit card purchases now make up the majority of B2C transactions in the U.S. and other markets. If a business can’t accept card payments, it may struggle to survive. Even if a merchant finds a willing bank, it may have to absorb higher processing fees and other penalties, which could devastate its bottom line.

Over time, merchants struggling with high fees may be pushed out of the market. Meanwhile, companies that mitigate chargebacks and keep their chargeback ratio low may be able to secure a larger share of the market. Ultimately, the difference between effective and ineffective chargeback management could be the difference between success and failure.