The Dispute Landscape Part I: Fraud, disputes and their phases

Here at ChargebackHelp, our core business is to know everything we can about transaction disputes and other revenue threats merchants face. We regularly network with our payments industry colleagues and attend the latest forums & webinars to remain proficient in the ever-evolving “Dispute Landscape.” Merchants, on the other hand, don’t always have the time and resources to “stay current” because, you know, they have a whole retail business to run.

This article, and the next, is published specifically to get you caught up on the “Dispute Landscape” – in this article, the causes of disputes, their nomenclature and their definitions. We’ll look at the types of transactions that disputes come from, the causes of those disputes, and the outcomes that threaten merchant revenue. Then, in the next article, we’ll go over all the solutions to manage each type of dispute.

THE TRANSACTION

The main ingredient in all transaction disputes is that the transaction was paid for by either credit or debit card. Cash transactions have less wiggle room for disputes because as Omar Little says in The Wire, cash “ain’t got no owners, only spenders.” Conversely, card transactions must be authenticated by the owner of the card before cash changes hands to the merchant.

Card-Present Transactions

Card-present transactions are as close to cash as ever these days now thanks to a decades-long collaboration between EuropPay, Mastercard and Visa. Fraudsters can no longer create fake credit cards from stolen information like they used to, thanks to the now-ubiquitous “EMV” smart chip technology this collaboration created. That little gold square on your payment card means as a cardholder, you are almost invariably liable for all card-present purchases you make, as if you had paid in cash.

Card-Not-Present Transactions

Card-not-present (CNP) transactions are made virtually — without the physical card — either online, with a phone, or even via snail mail (though you shouldn’t ever do that). CNP transactions are far more susceptible to fraud and disputes, because they rely on authentication measures that can be hacked far more easily than the smart chip.

There was a time when the market share of disputes was divided more evenly between card-present and CNP transactions. However, EMV smart chips changed the game so much, when we now talk about the “Dispute Landscape,” this particular landscape is mostly occupied by CNP transactions. To learn more about the EMV shift, go here.

THE CAUSES OF DISPUTES

The causes of disputes fall into a handful of categories: Fraud, Merchant Error, and Processing errors. For our intents and purposes, we’ll focus on fraud here. Unforced errors like merchant errors, products not arriving as described… we trust you’re all on top of those issues.

Each card scheme maintains its own set of reason codes; and their issuers decide which code defines the liability for each dispute. Fraud is the most common reason for disputes, and its pervasiveness has earned it a great many names. True fraud, friendly fraud, chargeback fraud… all these terms actually belong to one of two parties — either first- or third-party fraud.

Fraud Parties

When an outside entity somehow compromises the cardholder’s payment details to perpetrate fraud, this is called third-party fraud. It’s also commonly known as true fraud or criminal fraud.

First-party fraud is perpetrated by the cardholders themselves, either by accident or intentionally. The accidental variety stems from transaction confusion — the cardholder not recognizing or remembering a purchase. This variety is ascribed with innocuous names like “friendly” fraud or “misuse.”

When the cardholder makes a transaction then knowingly mis-reports it as third-party fraud, this is “chargeback fraud.” However — intentional, accidental, whatever — to the merchant, it’s all still theft, and so it’s all known as first-party fraud.

INQUIRIES, DISPUTES & CHARGEBACKS

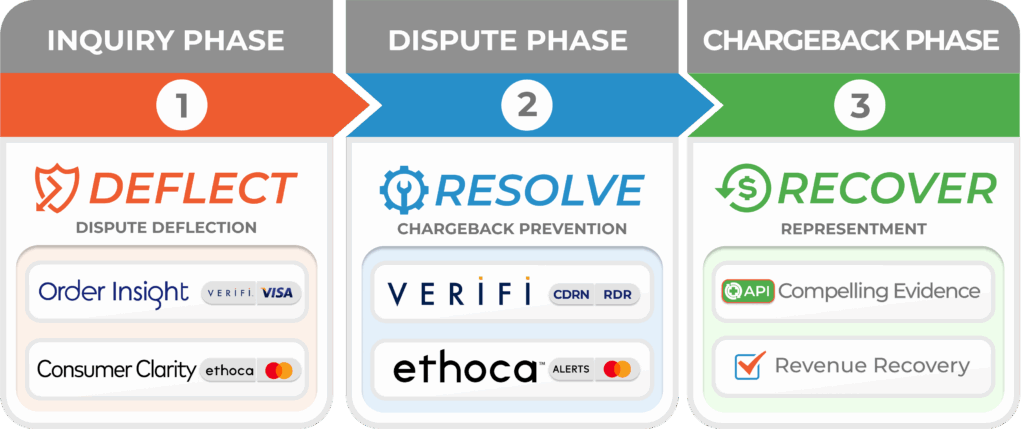

When a customer comes to you with an issue, that’s customer service – i.e. within your control to resolve. The moment a customer takes that same issue to their card-issuing bank, then it’s a dispute on its way to becoming a chargeback. Technically speaking, there are three phases to a dispute like this: the inquiry phase, dispute phase and chargeback phase.

Inquiry Phase

Here, a customer has an issue with a purchase made with their card, and they’re taking the issue to their card-issuing bank. Their bank will consider a handful of reasons as a legit dispute:

- They either did not make or don’t recognize a purchase

- They were charged the wrong amount

- The product never arrived

- They were double-charged… You get the idea.

The issuer will investigate the claim, and decide if the matter merits a dispute. The inquiry phase is also commonly known as the “pre-dispute phase.”

Dispute Phase

When an issuer decides its cardholder is not liable for payment, they will assign a reason code to it, making the dispute official. This starts a game clock that ticks down to a chargeback. Unless the merchant intercedes, or the cardholder relents, the dispute moves into the chargeback phase.

Chargeback Phase

If the merchant does not take steps to resolve the dispute, and an issuer has ruled out cardholder liability for the transaction, then a chargeback is processed. Basically, the issuer tells the merchant’s acquiring bank to return the money from a disputed transaction. The amount is taken from the merchant, along with a hefty chargeback fee charged to cover the expense of bank resources involved. That’s the chargeback phase in a nutshell.

THE CHARGEBACK PAIN POINT

In that final chargeback phase, the merchant not only loses their revenue. Chargebacks are also a vector for fees, penalties and worse. Merchants stand to lose up to three times the amount of a transaction to a chargeback. Add to that, if their chargeback-to-sales ratio exceeds 1% in any given month, the cost goes up evermore. Moreover, sustained +1% ratios will cause a merchant to lose their ability to process credit cards at all; and that is end-of-story for that business.

ChargebackHelp is here to stop that from happening to you. We provide sufficient solutions so that no merchant should ever lose their processing. We eliminate the chargeback as a pain-point for your business. Find out how in part two of this series, or come talk to us for a more specific game plan to protect your processing. Send us an email, call us at 1.800.975.9905 or contact us here.