Five Quick Tips: How to prevent chargebacks

[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=”” type=”flex”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”true” min_height=”” hover_type=”none” link=”” border_sizes_top=”” border_sizes_bottom=”” border_sizes_left=”” border_sizes_right=”” first=”true” type=”1_1″][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” font_size=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” line_height=”” letter_spacing=”” text_color=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Chargebacks are a major threat to businesses big and small. As with many things in life, an ounce of prevention is worth (at least) a pound of cure. Fortunately, with chargebacks, there are steps you can take to prevent them from occurring in the first place.

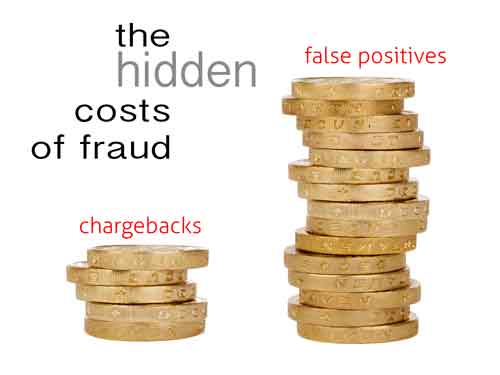

Prevention is crucial for merchants. If a business gets hit with a chargeback, not only might they lose the revenue from the sale, they might also lose inventory. That’s because the card issuers who authorize chargebacks rarely require their card holders to send products back.

On top of that, retailers will also be assessed a chargeback fee. Chargeback fees start around $25 but can reach as high as $100. This fee is paid no matter what, meaning even if you dispute a chargeback and ultimately win, you’ll still be on the hook for the fees.

Perhaps even worse, the merchant will see their chargeback ratio rise. If this ratio gets too high, payment processors may decline to work with the business or may charge them higher processing fees. The chargeback ratio will typically rise even if the merchant wins a chargeback dispute. Further, all payments processed will incur higher processing fees, including those that result in no chargebacks or other issues.

Given how serious of a risk chargebacks pose, let’s take a look at steps businesses can take to prevent them.

1. Set Up a Responsive Customer Service Department

Many chargebacks are due to fraud, but some come from legitimate customers who have no intention of taking advantage of a business. However, some customers may find customer service departments unresponsive, and so they turn to their banks instead. With chargebacks, a card issuer can essentially issue an unauthorized refund, returning money to a customer without the merchant’s permission.

By setting up the perfect customer service response to chargebacks and an easy-to-understand return process, businesses may be able to avoid chargebacks, issuing refunds instead. This way, you can avoid chargeback fees and a rising chargeback ratio. You can also recover merchandise by asking the client to return the goods.

2. Meet Customer Expectations

Over promising and underselling is a quick way to drum up chargebacks. If you promise the world but only deliver the moon, customers are going to be more likely to ask for a return and refund. Fail to issue a refund quickly and they could pursue a chargeback instead.

Businesses need to make sure that product descriptions and photos are accurate. This way, customers know what to expect before they make a purchase. Meeting customer expectations will reduce both returns and chargebacks. Satisfied customers will also be more likely to promote and support your company in the future.

3. Develop a Reputation for Fighting Fraudsters

So far, we’ve covered how to reduce legitimate chargebacks, meaning the customers aren’t trying to rip the merchant off. Sadly, however, many and probably most chargebacks stem from scammers. These scammers abuse the chargeback process to attempt to score free stuff and other benefits.

Fighting fraudsters requires a different approach. First, you need to be proactive when dealing with criminals. If you earn a reputation for being an easy target, more criminals may target your business. On the other hand, if scammers know you’re a tough cookie, they may pick softer targets.

Merchants can fight chargeback through the representment process, during which they will argue that charges were legitimate and that they did everything as a merchant that they were supposed to do, such as delivering the products. The representment process is rather complex, so it’s smart to study up.

The key takeaway here is that merchants should exercise the representment process to recover revenues, and crucially, to establish a reputation for fighting crime.

4. Screen Purchases and Halt Suspicious Transactions

When it comes to fraudulent transactions, there are often various red flags that merchants can watch out for. For example, if someone is trying to make a purchase from a strange IP address, it could be because the client’s account was hacked or their credit card information was stolen. Perhaps the actual customer lives in Maine, but the IP address shows them making an order from Germany.

It’s also crucial to require Card Verification Values (CVVs). These numbers are found on credit and debit cards and act sort of like a password. Often, even if a thief steals a credit card number, say with a skimmer at a gas station, if they don’t have the physical card, they won’t have the CVV.

Does all this sound like a lot of work? Some chargeback and dispute management platforms contain tools that will automatically watch out for strange shipping addresses and other out-of-character activities. Also, Visa and Mastercard offer “Verifi” and “Ethoca” (respectively), two programs that leverage data to identify fraudulent transactions.

5. Deflect Chargebacks with Chargeback Alerts

Chargeback alerts are another powerful and largely automated tool that retailers can use to prevent chargebacks. With a chargeback alert, the bank will warn a company before a chargeback is officially filed. This provides the retailer with crucial time to try to resolve the issue outside of having chargebacks filed. Knowing this, it’s important to know how to look up and resolve pending alerts.

Merchants may have to issue refunds or otherwise take a loss. However, in some situations, it’s better to bite the bullet now rather than get hit with chargeback fees and a rising chargeback ratio.

Prevent Chargebacks Today, Prevent Problems Tomorrow

Ultimately, merchants need to adopt a holistic approach to preventing and managing chargebacks. With the right tools, including chargeback and dispute management platforms, it’s possible to reduce if not eliminate fraud and many legitimate chargebacks too.

[/fusion_text][fusion_title title_type=”text” rotation_effect=”bounceIn” display_time=”1200″ highlight_effect=”circle” loop_animation=”off” highlight_width=”9″ highlight_top_margin=”0″ before_text=”” rotation_text=”” highlight_text=”” after_text=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” content_align_medium=”” content_align_small=”” content_align=”left” size=”2″ font_size=”” animated_font_size=”” fusion_font_family_title_font=”” fusion_font_variant_title_font=”” line_height=”” letter_spacing=”” text_shadow=”no” text_shadow_vertical=”” text_shadow_horizontal=”” text_shadow_blur=”0″ text_shadow_color=”” margin_top_medium=”” margin_bottom_medium=”” margin_top_small=”” margin_bottom_small=”” margin_top=”” margin_bottom=”” margin_top_mobile=”” margin_bottom_mobile=”” text_color=”” animated_text_color=”” highlight_color=”” style_type=”default” sep_color=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]Summary[/fusion_title][fusion_faq filters=”no” number_posts=”-1″ post_status=”” cats_slug=”27504″ exclude_cats=”” orderby=”menu_order” order=”DESC” featured_image=”” type=”” boxed_mode=”” border_size=”” border_color=”” background_color=”” hover_color=”” divider_line=”” title_font_size=”” icon_size=”” icon_color=”” icon_boxed_mode=”” icon_box_color=”” icon_alignment=”” toggle_hover_accent_color=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]