How ChargebackHelp Uses Order Insight to Deflect Disputes

Order Insight Explained in Merchant Terms

When a customer doesn’t recognize a charge, they often call their bank. This kicks off what’s known as the inquiry phase, a gray zone that comes before a formal chargeback is filed. That’s where Order Insight comes in.

Order Insight is a service developed by Visa that lets issuers access enriched merchant transaction details during that moment of doubt. Things like what was purchased, whether it was shipped, and the merchant’s contact info. That extra clarity can stop a dispute before it even starts. And when it works, you don’t lose revenue, trigger chargeback fees, or increase your ratio.

But there’s a catch: you have to deliver that information fast and in the right format.

Why Merchants Need More Than a Tool

Order Insight only works if the merchant is consistently supplying relevant, accurate, and up-to-date transaction data to Visa. This isn’t a one-time setup. It’s an ongoing, dynamic process that depends on deep API access, data mapping, formatting rules, and compliance with network standards like Compelling Evidence 3.0. If something breaks or falls out of spec, you risk losing your ability to prevent disputes.

Most merchants don’t have the time, resources, or tech bandwidth to handle this level of integration in-house. That’s why ChargebackHelp delivers Order Insight as part of our fully managed DEFLECT solution.

How DEFLECT Uses Order Insight to Protect Your Business

With DEFLECT, there’s nothing for you to manage or monitor. ChargebackHelp integrates directly with your transaction stream to capture purchase details, fulfillment updates, and other relevant data. That information is shared automatically with issuers when a cardholder initiates an inquiry.

What cardholders see on their banking app includes:

- Product names and descriptions

- Order numbers and delivery status

- Your logo and contact information

What issuers see goes even deeper: we help them connect that transaction to the cardholder’s behavior, so they can determine if the charge is legitimate. That’s what makes Order Insight such an effective line of defense. And since DEFLECT ensures the entire integration is handled for you, there’s no extra workload for your team.

How This Reduces Chargebacks Without More Refunds

Unlike chargeback alerts that often rely on issuing a refund to prevent escalation, Order Insight works by preventing confusion. There’s no financial concession involved. You don’t have to give the money back. You just help the cardholder recognize the charge.

The value of this model can’t be overstated:

- You keep the sale.

- You avoid chargeback fees.

- You stay below Visa’s chargeback thresholds.

- You preserve long-term customer trust.

For merchants, this is an ideal outcome. No lost revenue, no unnecessary refunds, and no hit to your chargeback ratio.

Better Visibility, Fewer Headaches

Order Insight is even more powerful when paired with Mastercard’s Consumer Clarity, which serves the same function for Mastercard transactions. DEFLECT supports both networks. This creates a seamless data-sharing environment for your brand, regardless of what card your customers are using.

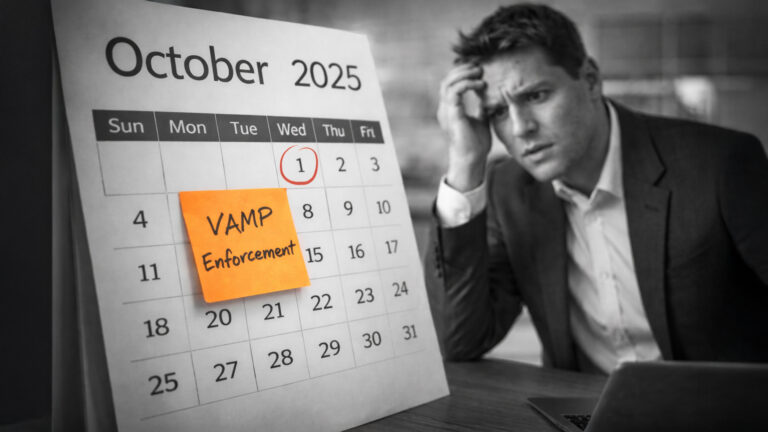

Over time, merchants using DEFLECT typically see a measurable drop in chargebacks tied to unrecognized transactions. That means fewer fees, less admin overhead, and lower operational stress. It also helps keep you out of risk programs like Visa’s Acquirer Monitoring Program or Mastercard’s ECM, where high ratios can cost you far more than a single dispute ever would.

Ready to Unlock the Power of Order Insight?

If you’re still relying on refunds or manual reviews to prevent chargebacks, it’s time for a smarter solution. ChargebackHelp’s DEFLECT product brings the power of Order Insight directly into your dispute prevention strategy, without requiring any extra tech or time investment from your team. Reach out today and let us show you how easy it can be to resolve cardholder confusion before it becomes a problem.

Why ChargebackHelp?

ChargebackHelp gives you more than just tools. Our solutions integrate directly with Visa, Mastercard, Verifi, and Ethoca so you can prevent chargebacks, recover revenue, and reduce operational overhead all in one platform. DEFLECT automates proactive resolution strategies, including Order Insight and Consumer Clarity, while RESOLVE and RECOVER handle alerts and representment. We help you protect what you’ve earned and future-proof your dispute management process.

FAQs: How Order Insight Helps Merchants Reduce Chargebacks

What is Order Insight?

Order Insight is a Visa service that lets card issuers access detailed transaction data from merchants when a customer questions a charge. This added context can prevent a dispute from escalating into a chargeback. ChargebackHelp integrates Order Insight automatically, making it effortless for merchants to benefit from the service.

How does Order Insight prevent chargebacks?

When customers contact their bank to question a charge, Order Insight supplies real-time purchase data to help them recognize the transaction. If the customer confirms it’s legitimate, the process stops there. With ChargebackHelp, this entire process happens in the background.

Is Order Insight the same as a chargeback alert?

No. Order Insight prevents the dispute before it’s filed, whereas alerts notify you after a dispute has been initiated. They serve different purposes and can work together in a layered defense strategy. ChargebackHelp supports both within our DEFLECT and RESOLVE solutions.

Do I need to install software to use Order Insight?

Not if you use ChargebackHelp. Our platform handles all integrations and API connections. There’s nothing to install or manage on your end.

What types of chargebacks does Order Insight prevent?

Mostly “unrecognized transaction” and “friendly fraud” cases, where the customer forgets about the charge or falsely claims they didn’t make it. It’s especially useful for subscription, eCommerce, and high-risk merchants.

Does Order Insight work for Mastercard too?

Not directly. Mastercard uses a similar service called Consumer Clarity. ChargebackHelp supports both services under our DEFLECT product.

How fast does Order Insight work?

It’s real-time. When a customer calls their bank, Order Insight responds with your data instantly, giving issuers and cardholders everything they need to recognize the transaction on the spot.