Reducing First-Party Fraud with Mastercard’s First-Party Trust

First-Party Fraud Is a Merchant-Driven Risk

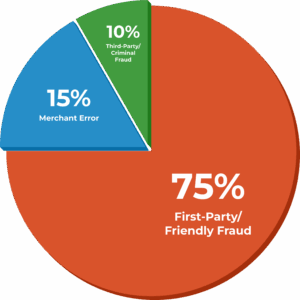

Not all fraud is committed by criminals with stolen cards. Often, merchants are blindsided by their own customers, real buyers who later claim a charge was unauthorized. This form of abuse, known as first-party fraud, has surged as more consumers grow familiar with the dispute process.

It’s frustrating, hard to prove, and often costs more than just the lost revenue.

Once a dispute becomes a chargeback, merchants absorb fees, lose inventory, and may see their chargeback ratio climb toward dangerous thresholds. For many merchants, especially those in high-risk categories like online entertainment, nutraceuticals, or travel, these chargebacks aren’t just troublesome. They’re operationally destabilizing.

What Is Mastercard’s First-Party Trust Program?

The First-Party Trust program was developed by Mastercard to tackle this very issue. It’s not a product merchants purchase directly. Instead, it’s a set of standards and infrastructure that allows merchants to send relevant transaction and fulfillment data to cardholders and issuers before a chargeback is filed. The goal is to resolve confusion at the point of inquiry. In many cases, what looks like fraud is simply a lack of clarity. A cryptic billing descriptor, a forgotten subscription, or a delayed delivery can all create confusion.

First-Party Trust builds on Mastercard’s existing services like Consumer Clarity, which provides rich order details within banking apps and issuer tools. Together, these programs support Mastercard’s long-term effort to reduce friendly fraud and make sure chargebacks only happen when absolutely warranted.

Why First-Party Trust Matters More Than Ever

Mastercard isn’t just offering a helpful tool here. It’s enforcing a new standard. As chargeback abuse continues to grow, the network has started holding merchants accountable for preventable disputes. If too many first-party fraud claims appear tied to your account, you could be flagged under Mastercard’s Excessive Chargeback Merchant program. That can result in higher fees, stricter requirements, and a much harder path to account recovery.

First-Party Trust offers a way to demonstrate good-faith efforts in preventing chargebacks. It also provides Mastercard and issuers with the documentation they need to evaluate disputes more fairly. In other words, it gives merchants a voice in a process that traditionally felt stacked against them.

What Merchants Can Do to Align

Merchants can take active steps to align with First-Party Trust expectations. These steps include:

Integrate transaction data with issuer systems

Use a solution like DEFLECT to automatically send order, product, and delivery details to the cardholder’s issuing bank. The faster this data is delivered, the more likely a dispute can be avoided.

Ensure descriptors and branding are clear

Misleading or generic billing descriptors are a major driver of first-party fraud. Merchants should regularly audit their statement appearances and make sure brand names and product types are accurately displayed.

Support Consumer Clarity participation

Mastercard’s Consumer Clarity is an essential part of the First-Party Trust ecosystem. Ensure your data flows into it properly. Without this, issuers may have no context to validate a customer claim.

Monitor chargeback reason codes for friendly fraud patterns

Certain codes, especially those related to “unrecognized” or “unauthorized” charges, can hint at first-party abuse. Watch for spikes in these areas.

Work with a chargeback management platform

Platforms like ChargebackHelp offer built-in support for First-Party Trust compliance. From data formatting to submission protocols, having a tech partner reduces complexity and improves consistency.

Beyond Compliance: Turning Trust into a Strategic Advantage

Here’s where things get interesting. Aligning with Mastercard’s First-Party Trust isn’t just about reducing losses or staying off watchlists. It’s also about building stronger relationships with issuers. When your brand shows up with verified data during a cardholder inquiry, you’re more likely to earn trust from the issuer. Over time, that trust can translate into fewer disputes, faster resolutions, and even better authorization rates.

It also opens the door to broader risk-reduction strategies. When First-Party Trust is paired with chargeback alerts and representment automation, merchants gain full visibility across the entire chargeback lifecycle. And that’s where real optimization happens.

Ready to Operationalize First-Party Trust? Let’s Talk

Mastercard’s expectations are rising, and first-party fraud is no longer something merchants can afford to shrug off. If you’re ready to build a more defensible chargeback strategy, or if you just want to understand where your current gaps are, we’re here to help. Our team can walk you through the right integration pathways, assess your data readiness, and implement a solution that works behind the scenes without disrupting your daily operations.

Why ChargebackHelp?

At ChargebackHelp, we don’t just react to chargebacks. We help you prevent them at the source. Our DEFLECT platform integrates Mastercard’s First-Party Trust standards with real-time data sharing and issuer-aligned formatting, giving merchants a powerful edge against first-party fraud. From chargeback alerts to full representment workflows, we combine deep industry knowledge with technical flexibility to keep your risk low, your revenue high, and your dispute ratios within acceptable bounds.

FAQs: How Mastercard First-Party Trust Helps Merchants Fight First-Party Fraud

What is Mastercard’s First-Party Trust program?

It’s a fraud prevention initiative that helps issuers recognize valid purchases before they escalate into chargebacks. Merchants share transaction data to reduce friendly fraud.

How does First-Party Trust differ from Consumer Clarity?

Consumer Clarity is the delivery mechanism, while First-Party Trust defines the broader framework and expectations for how merchants share data with issuers.

Is First-Party Trust mandatory for merchants?

It’s not required by default, but failure to align could increase your risk of network penalties or placement in Mastercard’s risk monitoring programs.

What industries benefit most from First-Party Trust?

High-risk sectors like SaaS, online education, supplements, and travel tend to see outsized benefits since they experience higher levels of friendly fraud.

How does ChargebackHelp support this program?

Our DEFLECT solution integrates directly with Mastercard’s systems, enabling merchants to participate in First-Party Trust automatically with no manual effort.

Can I track my First-Party Trust impact?

Yes. With the right platform in place, you can monitor reductions in friendly fraud and disputes over time. ChargebackHelp provides reporting that breaks this down.

Does First-Party Trust prevent chargebacks completely?

Not always, but it significantly reduces chargebacks tied to confusion or misinformation, which represent a large portion of first-party fraud cases.