The Merchant Guide to Visa and MasterCard’s Chargeback Programs

By guest contributor Cris Carillo

In recent years, the increase in online sales has helped ignite the rise in the number of disputed and fraudulent transactions. Excessive fraud and chargebacks are not only limited to businesses and merchants using a high risk merchant account, but merchants from all types of industries can experience these problems.

In response, the major credit card networks of Visa and Mastercard have created programs to help merchants improve their business practices. Both brands have had mitigation programs in place and every few years the programs are updated to reflect industry changes. Let’s tackle the most recent updates to the Visa and Mastercard Dispute programs and explain how they work.

What is the Visa Dispute Monitoring Program?

The Visa Dispute Monitoring Program, VDMP, consists of 2 different programs to help merchants operate their business with fewer instances of fraud and minimal chargebacks. The Visa Fraud Monitoring Program, VFMP, was developed to help identify and eliminate occurrences of fraud during CNP (card-not-present) transactions.

Through the Verified by Visa program, cardholders information is confirmed to ensure that the purchaser is the owner of the card. This ID verification program helps protect merchants and reduce fraud during eCommerce transactions when the verification process is carried out correctly upon checkout.

The other part of the VDMP program is the Visa Chargeback Monitoring Program (VCMP) which monitors merchant disputes and notifies their acquirers when the preset limits are reached. Acquirers are expected to take the proper steps to help begin reducing the frequency of disputes. The type of actions taken will depend on any of a number of different factors affecting the business; including the type of business, volume of sales or current fraud controls.

Visa regularly updates the guidelines for their Dispute Monitoring Programs. Merchants that violate the Visa Fraud or Visa Chargeback thresholds may be required to enroll in the Visa Dispute Monitoring or Visa Fraud Monitoring Programs. Below are the previous and most current guidelines set forth by Visa.

The VDMP has an enforcement period of 8 months. During the first 3 months of the program Visa will assess a $50 fine to the acquirer for each dispute filed. Merchants that are above the Visa chargeback threshold are classified as excessive and will be assessed a $100 fine per dispute during their first 3 months.

How do merchants get out of Visa monitoring programs?

Merchants will need to work with their acquirer to create a plan to reduce disputes. These plans need to identify the cause of the disputes and the actions they will be taking. Many times these plans include training or retraining staff on the proper procedures for accepting transactions.

Visa offers merchants a number of different fraud prevention tools to help them reduce the risk of losses. Some of the tools available to merchants through Visa include:

- Verified by Visa

- AVS

- CVV

- EMV

- Tokenization

- Velocity Controls

- 3-D Secure

All merchants that are placed into the Excessive Dispute Monitoring Program can face the potential of a $25,000 fee at the end of the enforcement period for a review of their account.

Similar to the VDMP, the standard Visa Fraud Monitoring Program also has an 8-month period where merchant activity will be monitored. While there are no fines assessed to merchants during this period for the Standard Fraud Monitoring, merchants do not have access to the 3D Secure fraud monitoring program. Merchants that fall into the excessive fraud category will be required to enter into a 12 month program where they will be assessed non-compliance fees for every month that the acceptable fraud threshold is exceeded.

What are the Mastercard Chargeback Monitoring and Fraud Monitoring Programs?

Since their implementation in 2019, Mastercard rolled out 2 new programs to help fight chargebacks and fraud. The Excessive Chargeback Program (ECP) works with merchants to help reduce the number of chargebacks they are experiencing. Similarly, the Excessive Fraud Merchant Compliance Program (EFM) partners with merchants to help reduce the frequency of fraud as a global problem.

The Excessive Fraud Merchant program has specific guidelines that if a merchant exceeds the threshold in a given month, they will be placed into the EFM program.

- Minimum 1,000 Mastercard transactions during previous month

- Minimum $50,000/€50,000 in Mastercard fraud chargebacks

- Minimum 0.50% fraud chargeback to sales ratio

- Less than 10% of volume utilizing 3DS in non-regulated countries

- Less than 50% of volume utilizing 3DS in regulated countries

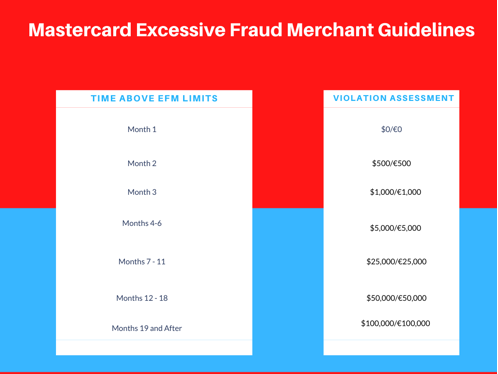

Merchants that exceed these numbers will be placed in the EFM. Fines for merchants in the EFM will be assessed based on the number of months they have been enrolled in the program.

The other program that Mastercard runs to prevent chargebacks is the Excessive Chargeback Merchant Program. The program consists of two categories of merchants, ECM (Excessive Chargeback Merchant) and HECM (High Excessive Chargeback Merchant). The ratio of chargebacks to their total transactions determines which program the merchant is placed into.

The Excessive Chargeback Merchant Program

- Between 100 – 299 Monthly Chargebacks

- Between 1.5% – 2.99% of Total Transactions

The High Excessive Chargeback Merchant Program

- More than 300 Monthly Chargebacks

- More than 3% of Total Transactions

Mastercard has set up their Excessive Chargeback Merchant program to assess violations based on the amount of time in the program and the type of ECM program the business has been placed in. The fines for violations are currently as follows

Acquirers become responsible once the merchant reaches their sixth month in the program, and those fees only increase as time carries on. Reviews and other plans to eliminate the merchant chargeback problems could potentially be required from the acquirer by Mastercard. These fees for non- compliance can reach upwards of $50,000, forcing many acquirers to cut ties with problematic merchants rather than work with them.

How do merchants avoid Mastercard monitoring programs?

Mastercard will decide which merchants are required to enter into the Excessive Fraud Monitoring program. Once in the program, it is up to the merchants to implement new processes to lower the number of fraudulent occurrences below Mastercard’s thresholds.

Similar to the programs listed above for Visa, Mastercard has a number of different tools for merchants to utilize to help combat fraud. These fraud prevention tools and practices include:

- AVS

- CVV

- EMV

- Tokenization

- Velocity Controls

- 3-D Secure

Many of the gateway providers out there also provide their own internal fraud prevention tools to help identify and eliminate those questionable transactions. By using a number of different tools and practices, merchants can help to avoid fraud and keep themselves clear of the Mastercard Excessive Fraud Merchant monitoring programs.

For merchants to be successfully removed from the program, they need to demonstrate that they have remained under the thresholds set forth for at least three consecutive months. Merchants that are unable to meet these limits will be facing problems not only from Mastercard, but also their acquirer.

Conclusion

While both programs have become increasingly stringent on their expectations for merchants, they have done this to help promote better business practices. These new terms from both Visa and Mastercard have resulted in higher fines for violations, but this has also created a renewed sense of urgency for merchants to get a grasp on any problems before they spiral out of control.