Comparing Order Insight and Consumer Clarity for Chargeback Reduction

Order Insight and Consumer Clarity: What They Do

Both Order Insight and Consumer Clarity are chargeback prevention tools designed to intercept customer confusion before it turns into a dispute. Order Insight is a Visa-backed solution powered by Verifi, while Consumer Clarity is Mastercard’s equivalent, managed through Ethoca. Each tool allows merchants to send transaction and fulfillment details directly to the cardholder’s bank, which then makes that data visible to the cardholder through mobile banking apps or when they call customer service.

The goal is simple: help cardholders recognize legitimate purchases. These services are often a merchant’s first line of defense against first-party fraud and mistaken chargebacks. But as similar as they sound, key differences in execution can affect how effective they are for different types of businesses.

Comparing the Data Sharing Experience

Order Insight delivers data to Visa issuers. When a cardholder has a question about a transaction, the issuing bank can instantly pull order-level details like product name, billing descriptor, shipping address, and merchant branding. This data helps validate the purchase in real time before a chargeback is filed.

Consumer Clarity performs a similar function within the Mastercard ecosystem. It makes transaction data accessible to issuing banks through APIs and renders it in real time to cardholders within their bank apps or customer service channels.

The type of data supported by each program includes:

- Merchant name, logo, and contact information

- Purchase details like item names and SKUs

- Shipping and fulfillment data

- Billing descriptor and transaction timestamps

And more…

Both platforms support similar datasets, but some issuers may display the data differently. In some cases, one service may show a merchant logo where the other does not. This seemingly small detail can mean the difference between a resolved question and a filed chargeback.

Merchant Integration and Workflow Differences

Integration is where most merchants notice the biggest difference. Order Insight connects through Verifi’s platform and is often implemented via a middleware API or an integration partner like ChargebackHelp. Consumer Clarity uses Ethoca’s APIs or data portals. While both are automated services, merchants have reported that Order Insight tends to require slightly more up-front configuration, especially when aligning data fields with Visa’s expectations.

That said, both tools can be fully automated. Platforms like ChargebackHelp eliminate the complexity by connecting both services through a single interface, ensuring consistent data formatting, uptime, and network compliance. This allows merchants to deliver real-time data without having to manage two separate vendor relationships or platforms.

Coverage and Issuer Participation

Since these services are network-specific, coverage is determined by whether the card in question is a Visa or a Mastercard. Order Insight only works with Visa cardholders and Visa issuers. Consumer Clarity only applies to Mastercard cardholders and issuers.

But coverage also depends on issuer participation. While participation in these programs continues to grow, not every bank displays every data field in the same way. This is one reason why many merchants choose to activate both services at once, doing so ensures that regardless of network, cardholders have access to transaction information that can prevent a chargeback from ever being filed.

When to Use One, or Both

Each solution is tailored to a specific card network, they’re not interchangeable. Neither one can cover both Visa and Mastercard transactions. For merchants, that makes them complementary, not competing.

Order Insight supports Visa cardholders

It connects directly to issuers in the Visa network through Verifi. That means any time a customer with a Visa card has a question about a charge, Order Insight can deliver details like product name, order status, merchant logo, and transaction history to the issuer app or call center. It’s especially valuable for recurring billing models where confusion over subscription renewals is common.

Consumer Clarity supports Mastercard cardholders

It operates through Ethoca and pushes similar transaction data to Mastercard issuers. For merchants with a global customer base, this ensures customers outside the U.S. have equal access to purchase transparency. Consumer Clarity also supports logos and branding, just like Order Insight—ensuring cardholders recognize who they purchased from.

Bottom line: they work best together

Activating both through a unified partner like ChargebackHelp ensures that no matter what card a customer uses, their bank can access the purchase details needed to prevent chargebacks before they’re filed.

Need Help Choosing or Implementing?

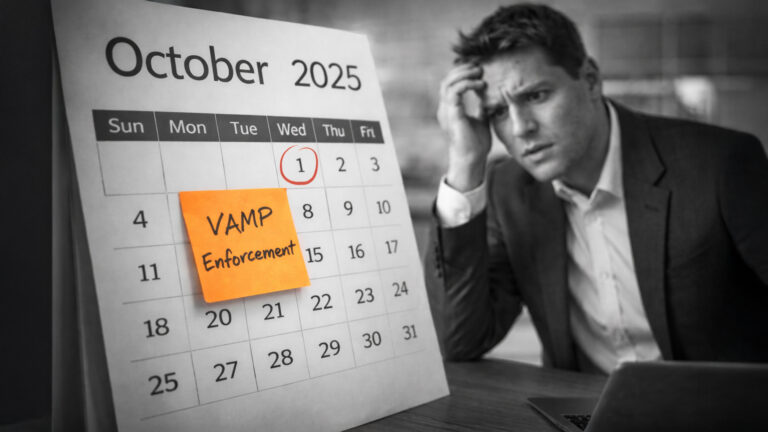

Choosing the right chargeback prevention strategy shouldn’t feel like guesswork. Reach out to our team if you’d like help assessing whether Order Insight, Consumer Clarity, or both solutions are right for your business. ChargebackHelp’s DEFLECT product integrates both services into a single platform, providing complete automation, full network compatibility, and guided compliance with network rules like Visa’s CE 3.0 (a framework that helps stop first-party fraud chargebacks by defining specific types of evidence) and Mastercard’s First-Party Trust program, which promotes reputation-based resolution outcomes when merchants deliver consistent, high-quality data.

Why ChargebackHelp?

ChargebackHelp connects you to both Visa and Mastercard’s early resolution programs with one simple integration. Our DEFLECT solution combines Verifi’s Order Insight and Ethoca’s Consumer Clarity, helping you intercept potential chargebacks before they’re filed. With deep integrations, automation, and compliance support, we help your business prevent disputes, reduce fraud, and retain revenue, without disrupting operations.

FAQs: Comparing Order Insight and Consumer Clarity

How do Order Insight and Consumer Clarity reduce chargebacks?

They help cardholders recognize purchases by providing detailed transaction data before a chargeback is filed. When cardholders can instantly see itemized order info, merchant branding, or delivery status, they’re far less likely to assume fraud or file a dispute. With ChargebackHelp, merchants can automate this process across both networks.

Which card networks support these tools?

Order Insight is for Visa cards, Consumer Clarity is for Mastercard. Neither solution works across both networks, so they aren’t redundant, they’re complementary. Together, they cover the vast majority of chargeback-prone transactions and ensure that cardholders receive the right data regardless of card type.

Can merchants use both at once?

Yes. Using both maximizes issuer coverage and ensures visibility across Visa and Mastercard ecosystems. Contact our team to get started with an integrated approach that works across both networks. We handle the setup, streamline workflows, and provide a single platform for both services.

Is there a lot of work required to implement these services?

Not with ChargebackHelp. We handle the integrations, compliance, and technical setup so you can start protecting revenue right away. Our DEFLECT platform brings both services together under one roof, ensuring you don’t have to manage separate vendors, APIs, or data formatting.

What’s the difference between chargeback alerts and these data services?

Chargeback alerts notify merchants of pending disputes, offering a chance to refund or intervene before a chargeback is finalized. Order Insight and Consumer Clarity help prevent disputes from being filed in the first place by resolving confusion at the inquiry stage, often without the merchant even knowing there was a potential issue.