Important VAMP Update Every Merchant Should Review

We keep this page updated as Visa makes changes to its VAMP guidelines, but it’s always a good idea to confirm current details with your merchant service provider.

VAMP Is Changing: Here’s Why It Matters

Visa’s Acquirer Monitoring Program (VAMP), launched on April 1, 2025, was created to help acquirers identify elevated risk within their merchant portfolios. It was designed to reduce fraud, streamline compliance, and minimize friction across the card acceptance ecosystem. Initially, the program assessed fraud and non-fraud disputes separately, but that distinction is now changing.

As of June 1, Visa started folding all fraud disputes into the primary VAMP ratio, creating a unified measurement for risk. The updated formula aims to better reflect the overall impact of disputes—regardless of whether the underlying issue was fraud or something else.

For merchants, this matters. If your business sees even moderate fraud volumes or recurring non-fraud disputes, your risk profile could rise under the new criteria. That could mean higher fees, tighter scrutiny, and more required remediation.

The New VAMP Ratio: What’s Included Now

Under the new system, Visa will calculate your VAMP ratio by adding together all reported fraud (TC40 data), all processed disputes (TC15 data from categories 10, 11, 12, and 13), and then dividing that total by all settled card-not-present VisaNet transactions (TC05).

That’s it. All dispute types count. Only disputes resolved preemptively—through Visa’s early resolution tools—or those resolved via CE3.0 (Compelling Evidence) or Mastercard’s Ethoca Alerts will be excluded.

Our VAMP Calculator makes it easy to monitor compliance.

So even if you resolved a dispute in-house or avoided a chargeback by issuing a refund, it may still count against your ratio if it wasn’t routed through an approved pre-dispute solution.

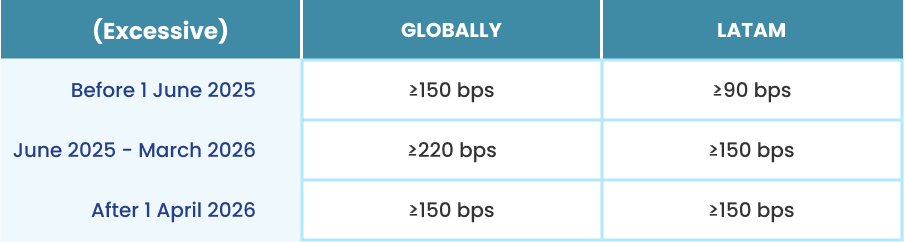

Thresholds and Minimums Are Increasing

Visa isn’t just updating the ratio. The performance thresholds are also changing:

At the same time, the minimum number of dispute events required to trigger program inclusion is going up:

- General minimums rise from 1,000 to 1,500 fraud + dispute counts per month

- For CEMEA merchants, the threshold increases from 100 to 150 monthly disputes, with a USD 75,000 volume requirement

These increases raise the bar, especially for smaller merchants. But once you cross that line, the new fee structure kicks in.

Fees Are Dropping, But Frequency Matters

Visa is lowering the per-event fees associated with VAMP identifications. The changes are:

- Above Standard: reduced from $5 to $4 per event

- Excessive / Merchant Excessive: reduced from $10 to $8 per event

But here’s the catch—fees are applied to every single fraud report and every single dispute once you’re flagged and meet the count and ratio thresholds.

So a merchant with 100 qualifying disputes and a VAMP ratio above 70 bps would pay $800 in fees for that month alone. There is no flat fee—it scales directly with your transaction issues.

Merchants with five or fewer qualifying events are excluded from these fee calculations, but only if they’re not contributing significantly to an identified acquirer’s overall risk profile.

New Enforcement Dates and Grace Periods

Visa is staggering enforcement to give acquirers and merchants time to adjust:

- June 1, 2025: New VAMP rules take effect

- September 30, 2025: Advisory period ends

- October 1, 2025: Enforcement begins for Excessive thresholds

- January 1, 2026: Enforcement begins for Above Standard thresholds

- April 1, 2026: Merchant Excessive threshold is reduced from 220 bps to 150 bps in AP, U.S., Canada, and Europe

Update: The advisory period has been extended to September 30, 2025, and enforcement begins October 1, 2025. The stricter thresholds originally scheduled for January 1, 2026, are now set to take effect April 1, 2026

Merchants in LAC (Latin America and the Caribbean) will remain at the 150 bps Merchant Excessive level. All others must prepare for tighter scrutiny.

Visa is also maintaining a rolling 90-day grace period for merchants who stay out of VAMP for at least 12 months.

New Platform, Same Expectations

Identification letters for VAMP will now be issued through the Visa Ecosystem Risk Central (VERC) platform. This centralized system helps acquirers track cases, respond to notifications, and manage VAMP-related requirements.

Merchants won’t interact with VERC directly—but it’s where the notices will come from, and it’s what your acquirer will be watching.

What Merchants Should Do Now

The new VAMP structure places the burden of risk on merchants earlier and more broadly than before. Here’s what merchants should do to stay ahead of the curve:

- Track Your Data: Work with ChargebackHelp to monitor TC40 and TC15 counts monthly.

- Adopt Pre-Chargeback Tools: Consider using ChargebackHelp’s chargeback management platform that integrates Verifi Order Insight, Ethoca Consumer Clarity, Visa Rapid Dispute Resolution, and Mastercom Collaboration.

- Validate All Disputes: Ensure you understand which disputes count. If possible, verify whether any were resolved through CE3.0 or other approved tools.

- Avoid Being Flagged: The 70 bps threshold isn’t hard to reach when all disputes are counted. A promo surge could tip the balance.

- Use Alerts to Avoid Fees: Resolve alerts before they escalate. Reach out to our team to learn more about proactive alert configuration.

Where Do We Go From Here?

As of June 2025, VAMP will evolve into a broader performance assessment tool that sees fraud and disputes as equal threats. This change rewards merchants who take a proactive stance—resolving disputes early, keeping ratios low, and using chargeback alerts and data tools wisely. If you’d like help reviewing your current ratios or integrating prevention platforms that qualify for VAMP exclusions, reach out to our chargeback experts today.

Why ChargebackHelp?

ChargebackHelp provides all the integrated solutions merchants need to stay below VAMP thresholds and avoid unnecessary fees. From real-time chargeback alerts to advanced fraud prevention tools, we automate and simplify the entire process. Our team helps you resolve issues before they escalate—keeping your VAMP ratio low and your processing uninterrupted.

FAQs: What Visa’s New VAMP Program Means for Merchants

What is the VAMP ratio and how is it changing?

The VAMP ratio is a risk calculation used by Visa to assess merchant performance. It now includes both fraud (TC40) and non-fraud (TC15) disputes, divided by total card-not-present settled transactions. This change means more dispute activity counts against merchants, potentially raising their risk profile. ChargebackHelp can help merchants track their counts and implement tools that reduce reportable activity.

When will the new VAMP criteria take effect?

The new rules take effect globally (excluding Brazil, Chile, and India) on June 1, 2025. Enforcement of fees begins later in the year. Our team at ChargebackHelp can walk you through what’s changing and ensure your business is prepared before enforcement begins.

Do fees apply to every dispute once a merchant is flagged?

Yes. Once a merchant exceeds the threshold and the minimum count, Visa applies a fee to each fraud and dispute event. That’s $4 for Above Standard and $8 for Excessive. With ChargebackHelp, you can reduce the volume of disputes that count toward these fees through early resolution services.

Can disputes resolved through pre-chargeback tools be excluded?

Yes, but only if they’re resolved through Visa-approved tools like RDR, Order Insight, or Consumer Clarity, and depending on when Visa extracts the data. ChargebackHelp offers these integrations directly through its DEFLECT and RESOLVE platforms.

How can a merchant reduce their VAMP ratio quickly?

Focus on resolving disputes before they escalate. Using alert platforms like Verifi CDRN and Ethoca Alerts, issuing timely refunds, and tightening fraud controls are all effective. ChargebackHelp can automate many of these responses and track performance in real time.

How do merchants know if they’ve been flagged in VAMP?

Visa notifies acquirers through the new VERC platform, and acquirers pass those notifications to merchants. If you receive one of these notices, ChargebackHelp can assist with remediation planning immediately.