Managing Chargebacks in the Travel Industry

The Rising Chargeback Challenge in Travel

Travel has seen a surge in online bookings and mobile transactions, which brings convenience but also higher exposure to disputes. Fraudsters exploit these channels, and legitimate customers often file chargebacks when plans change unexpectedly or policies feel unclear. The stakes are significant: chargebacks can erode margins, trigger penalties from card networks, and disrupt operations during peak seasons.

Merchants in this space must address not only fraud but also misunderstandings. Complex itineraries, multi partner bookings, and foreign currency fluctuations all contribute to confusion on card statements. Without clear strategies for managing chargebacks, these pain points can quickly spiral into higher ratios that put merchant accounts at risk.

Key Triggers Behind Travel Related Chargebacks

Several patterns stand out in travel disputes. The most common involve cancellations and refund requests, especially when a trip is nonrefundable or rescheduled due to weather or airline policy changes. Another driver is first party fraud, sometimes called friendly fraud, where cardholders dispute legitimate purchases after completing their trip.

Third party fraud also remains a problem, particularly with stolen card details used for online bookings. Service quality complaints play a role as well, often linked to unmet expectations for accommodations or amenities.

Understanding these triggers is the first step toward implementing effective chargeback management.

Best Practices for Managing Chargebacks

Proactive measures are critical for reducing dispute volume. Clear cancellation and refund policies should be visible at checkout and reinforced in confirmation emails. Transparent billing descriptors help cardholders recognize charges on their statements, lowering confusion driven disputes.

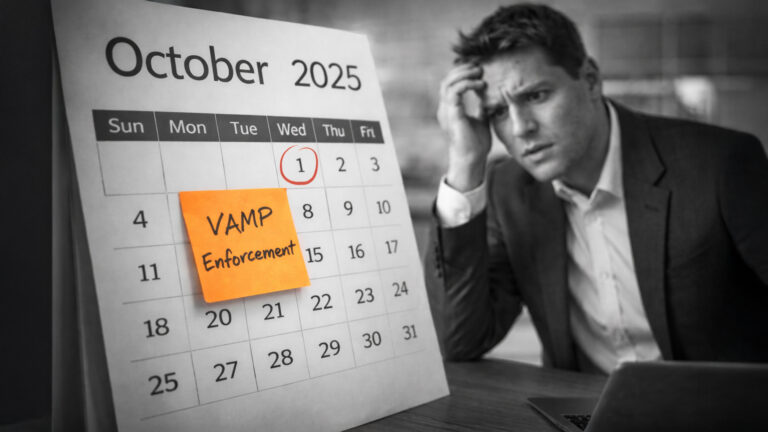

Modern chargeback prevention relies heavily on network tools. Visa’s Rapid Dispute Resolution (RDR) can automate refunds when specific criteria are met, preventing escalation into chargebacks. Verifi CDRN and Ethoca Alerts notify merchants in real time when disputes are initiated, offering a narrow window to resolve the issue before it impacts ratios. Mastercom Collaboration, a Mastercard feature, provides similar early stage notifications for its network. Integrating these alerts into a unified workflow ensures faster responses and fewer missed opportunities to prevent chargebacks.

Leveraging Data and Technology

Travel merchants increasingly turn to platforms that consolidate all dispute related data.

By linking booking systems, CRM platforms, and payment gateways, merchants can respond to alerts automatically and maintain accurate evidence for representment. This unified approach improves operational efficiency while giving teams a clear view of trends across multiple sales channels.

Predictive analytics is emerging as another advantage. By analyzing past transactions, merchants can flag high risk bookings such as last minute purchases with mismatched customer details before they result in disputes. This shift from reactive defense to predictive prevention is reshaping chargeback management in the travel sector.

Industry Specific Considerations for Travel Merchants

Unlike other industries, travel merchants must manage long lead times between booking and fulfillment. This increases the risk of disputes related to policy changes, currency adjustments, or vendor side cancellations. Documentation requirements are also unique: evidence may include boarding passes, reservation confirmations, or signed rental agreements, all of which must be organized for quick submission during representment.

Compared to other high risk verticals like online gaming or subscription boxes, travel merchants face more complex multi party arrangements. This makes strong data sharing and internal coordination even more critical when preventing or contesting chargebacks.

Where Do We Go from Here?

Reducing travel chargebacks is not about one tool or one policy. It requires layered defenses that combine proactive communication, network alerts, and automated representment. Merchants that invest in this holistic approach see fewer losses, stronger customer relationships, and reduced operational stress. If you are exploring ways to integrate chargeback alerts or automate resolution workflows, our team can help you evaluate options tailored to travel.

Why ChargebackHelp?

ChargebackHelp connects merchants directly to Visa, Mastercard, and third party networks through a single platform. Our solutions combine Verifi CDRN, Ethoca Alerts, Visa RDR, and Mastercom Collaboration, giving travel merchants complete coverage from prevention through recovery. We manage the technical integrations, monitor performance, and optimize workflows so your team can focus on customers rather than disputes. For travel businesses navigating high chargeback volumes, we provide the expertise and technology needed to lower ratios and recover revenue.

FAQs: Managing Chargebacks in the Travel Industry

What makes travel merchants more vulnerable to chargebacks?

High ticket transactions, long booking windows, and nonrefundable policies expose travel merchants to higher dispute rates compared to other industries. ChargebackHelp helps by integrating alerts and automated tools to resolve these disputes quickly.

Which chargeback prevention tools work best for travel?

Combining Verifi CDRN, Ethoca Alerts, Visa RDR, and Mastercom Collaboration provides broad coverage across networks. Our team can assist in selecting and implementing the right mix for your travel operation.

Can clear policies really reduce disputes?

Yes. Transparent refund and cancellation policies lower misunderstandings and improve customer trust. ChargebackHelp guides merchants on how to display policies clearly to reduce chargeback risk.

How does predictive analytics help prevent travel chargebacks?

Predictive models flag risky transactions before they convert to disputes. ChargebackHelp’s platform supports data driven prevention strategies for high volume travel merchants.

Is representment still necessary with alerts?

Absolutely. Alerts prevent many chargebacks, but some still occur. Representment remains vital for recovering revenue, and ChargebackHelp’s RECOVER solution streamlines this process.