Processing Explained, Simply

[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=”” type=”flex”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”true” min_height=”” hover_type=”none” link=”” border_sizes_top=”” border_sizes_bottom=”” border_sizes_left=”” border_sizes_right=”” first=”true” type=”1_1″][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” font_size=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” line_height=”” letter_spacing=”” text_color=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

Back in the day, when you were selling lemonade as a kid, the transaction was simple: your neighbors would give cash directly to you in exchange for a cool refreshing beverage. Nowadays, you’re selling goods and services across an array of banks, currencies and regulations that require multiple third parties to facilitate transactions between you and your customer. This is the world of payment processing.

At ChargebackHelp, part of what we do is help merchants — especially high-risk merchants — to navigate this terrain. It’s complicated. But we’ll break it all down into the basic elements that facilitate a transaction, in a way that even your entry-level lemonade vendor can understand.

MERCHANT ACCOUNTS AND MERCHANT IDS (MIDS)

The merchant account is your departure point into the world of processing. These bank accounts enable merchants to receive the electronic funds generated by a sale. The account itself is a simple business checking account. It really becomes a “merchant account” that can process transactions when it gets a merchant ID, or “MID”.

You can have as many business bank accounts as you have money to put in them, but you can only have one MID, undersigned by one person. That person is known as the MID’s signer. The signer is accountable for all the activity flowing through the MID, regardless of which bank account it ends up in. If a business processes too many chargebacks and the MID is terminated, it’s the signer’s name, not their businesses, that goes into the Terminated Merchant File.

[/fusion_text][fusion_content_boxes layout="icon-with-title" columns="1" link_type="" button_span="" link_area="" link_target="" icon_align="left" animation_type="" animation_direction="left" animation_speed="0.3" animation_delay="" animation_offset="" hide_on_mobile="small-visibility,medium-visibility,large-visibility" class="" id="" title_size="" heading_size="2" title_color="#ffffff" body_color="" backgroundcolor="" icon="" iconflip="" iconrotate="" iconspin="no" iconcolor="" icon_circle="" icon_circle_radius="" circlecolor="" circlebordersize="" circlebordercolor="" outercirclebordersize="" outercirclebordercolor="" icon_size="" icon_hover_type="" hover_accent_color="" image="" image_id="" image_max_width="" margin_top="" margin_bottom=""][fusion_content_box title="HISH RISK NOTE #1:" backgroundcolor="#ffdca8" icon="fa-comment far" iconflip="horizontal" iconrotate="" iconspin="no" iconcolor="" circlecolor="#8bc34a" circlebordersize="0" circlebordercolor="" outercirclebordersize="" outercirclebordercolor="" image="" image_id="" image_max_width="" link="https://chargebackhelp.com/high-risk-business-high-risk-products/" linktext="Read More" link_target="" animation_type="" animation_direction="left" animation_speed="0.3" animation_offset=""]

High-risk merchants pay more for their processing, but they also get more. Whomever you approach, remember: you’re making them money. You get some things in return for that. In general, you should be allowed a higher processing volume than low-risk merchants and the ability to transact in multiple currencies.

[/fusion_content_box][/fusion_content_boxes][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” font_size=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” line_height=”” letter_spacing=”” text_color=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

GATEWAYS

As the name suggests, this is the “point of sale” where the transaction begins. From the customer perspective, the gateway is the form they fill out to make a purchase. Gateways are maintained by specialized providers to securely handle the sensitive data submitted in a transaction, such as credit card number, billing address, name on card etc. For a guide to what makes a good payment gateway, we have some useful guides here, here, and here.

[/fusion_text][fusion_content_boxes layout=”icon-with-title” columns=”1″ title_size=”” heading_size=”2″ title_color=”” body_color=”” backgroundcolor=”” icon=”” iconflip=”” iconrotate=”” iconspin=”no” iconcolor=”” icon_circle=”” icon_circle_radius=”” circlecolor=”” circlebordersize=”” circlebordercolor=”” outercirclebordersize=”” outercirclebordercolor=”” icon_size=”” icon_hover_type=”” hover_accent_color=”” image=”” image_id=”” image_max_width=”” link_type=”” button_span=”” link_area=”” link_target=”” icon_align=”left” animation_type=”” animation_delay=”” animation_offset=”” animation_direction=”left” animation_speed=”0.3″ margin_top=”” margin_bottom=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=””][fusion_content_box title=”HISH RISK NOTE #2:” backgroundcolor=”#ffdca8″ icon=”fa-comment far” iconflip=”horizontal” iconrotate=”” iconspin=”no” iconcolor=”” circlecolor=”#8bc34a” circlebordersize=”0″ circlebordercolor=”” outercirclebordersize=”” outercirclebordercolor=”” image=”” image_id=”” image_max_width=”” link=”http://billapay.com” linktext=”Read More” link_target=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

A transaction is only as good as the gateway that captures it. If the gateway does not capture key information on the cardholder, and the transaction becomes a chargeback, the merchant can lose the money and the product. ChargebackHelp has created a gateway called BILLAPAY, exactly for this reason. Check it out at BILLAPAY.com.

[/fusion_content_box][/fusion_content_boxes][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” font_size=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” line_height=”” letter_spacing=”” text_color=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

PROCESSORS

The world of processing is split between two realms: front-end authorizations and the back-end clearinghouses that settle the transaction. Front-end processors authenticate that the cardholder and merchant are who they say they are and that they consent to the transaction; they’re the gatekeepers. The back-end processors handle the actual money as it moves from customer to merchant. Once the front-end’s authentication requirements are met, they open the gates and the back-end processors move the money through them.

Unless you’re a huge retailer on the level of Walmart or Home Depot, most merchants never deal directly with the actual processors; they’re the megalithic handful of conglomerates like Bank of America, Wells Fargo, Citibank… literally the too-big-to-fail. They’re also too big to deal with merchants effectively as processors. Which is why most of us deal with agents who are outsourced to sell the front- and back-end processing. These are what’s known as Merchant Services.

MERCHANT SERVICES

These agents are known by a few terms: Independent Sales Organizations (ISOs), Member Service Providers (MSPs) and Agents. ISOs are contracted to VISA, MSPs to MasterCard, and Sales Agents are like a subcontractor providing said services for the ISO/MSP. Collectively, all three are referred to as “merchant services”. They are essentially the processor as far as the merchant is concerned. They provide transaction solutions such as gateways, merchant accounts, and POS terminals all connecting the merchant to the processing network.

[/fusion_text][fusion_content_boxes layout="icon-with-title" columns="1" title_size="" heading_size="2" title_color="" body_color="" backgroundcolor="" icon="" iconflip="" iconrotate="" iconspin="no" iconcolor="" icon_circle="" icon_circle_radius="" circlecolor="" circlebordersize="" circlebordercolor="" outercirclebordersize="" outercirclebordercolor="" icon_size="" icon_hover_type="" hover_accent_color="" image="" image_id="" image_max_width="" link_type="" button_span="" link_area="" link_target="" icon_align="left" animation_type="" animation_delay="" animation_offset="" animation_direction="left" animation_speed="0.3" margin_top="" margin_bottom="" hide_on_mobile="small-visibility,medium-visibility,large-visibility" class="" id=""][fusion_content_box title="HISH RISK NOTE #3:" backgroundcolor="#ffdca8" icon="fa-comment far" iconflip="horizontal" iconrotate="" iconspin="no" iconcolor="" circlecolor="#8bc34a" circlebordersize="0" circlebordercolor="" outercirclebordersize="" outercirclebordercolor="" image="" image_id="" image_max_width="" link="https://chargebackhelp.com/how-to-win-at-high-risk-merchant-services/" linktext="Read More" link_target="" animation_type="" animation_direction="left" animation_speed="0.3" animation_offset=""]

How to win at merchant services:

- Find an agent that works in your vertical

- Read your contract closely

- Budget for chargeback costs

- Shop around and avoid bad actors

- Get what you pay for: pay more, get more

[/fusion_content_box][/fusion_content_boxes][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” font_size=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” line_height=”” letter_spacing=”” text_color=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]

CONCLUSION

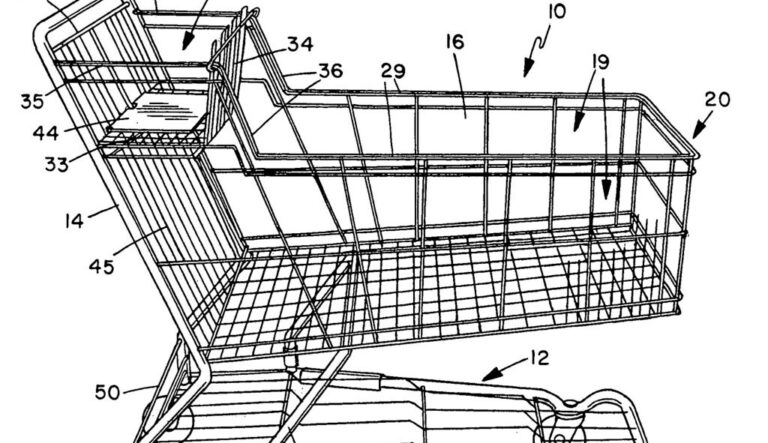

The basic flow of all these services works as follows. The cardholder makes a purchase through your payment GATEWAY. Your MERCHANT SERVICES – whether an ISO, MSP, or Agent – carries the transaction to the PROCESSORS. They in turn enable the money to move from the cardholder to the merchant. The money is routed through a MID and deposits into the MERCHANT ACCOUNT.

ChargebackHelp maintains extensive relationships across this spectrum of merchant services. We also provide a secure gateway designed specifically for high-risk merchants called BILLAPAY. If you’re a merchant finding your way through this labyrinth that sits between you and your customers, give us a call. We can help get you processing with the right merchant services for your business. Drop us a chat down on the right, shoot us an email, or go old-school and call us 1.800.975.9905

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]