Mastercard Report on the True Cost of Chargebacks in 2025

The Rising Cost of Chargebacks for Merchants

Mastercard’s recent report on chargebacks highlights just how much chargebacks have escalated in cost. In 2025, merchants may pay up to 2.5 times the original transaction value when all fees and operational expenses are factored in. What does this mean in practice? Imagine losing $340 on a $100 sale after a chargeback is processed. It’s a sobering reality. Beyond the immediate financial hit, excessive chargebacks could also push your account toward monitoring programs or even risk account termination by your acquirer.

Chargebacks Drain More Than Revenue

Many business owners think of chargebacks as a simple refund. But there’s more to it. Each one triggers admin costs, from reviewing transaction records to replying to chargeback notices. Your team spends valuable time fighting chargebacks instead of growing your business. There’s also the risk of long-term damage. High chargeback ratios can make it harder to negotiate favorable processing fees or keep your merchant account in good standing.

Chargebacks Hit Some Businesses Harder

If your business operates in high-risk industries, the cost impact of chargebacks can be even more severe. Sectors like supplements, online gaming, SaaS, and hospitality see higher average transaction values or elevated dispute rates. A single chargeback could potentially wipe out the profit from many legitimate sales. And when disputes pile up, your risk profile grows, making account stability harder to maintain.

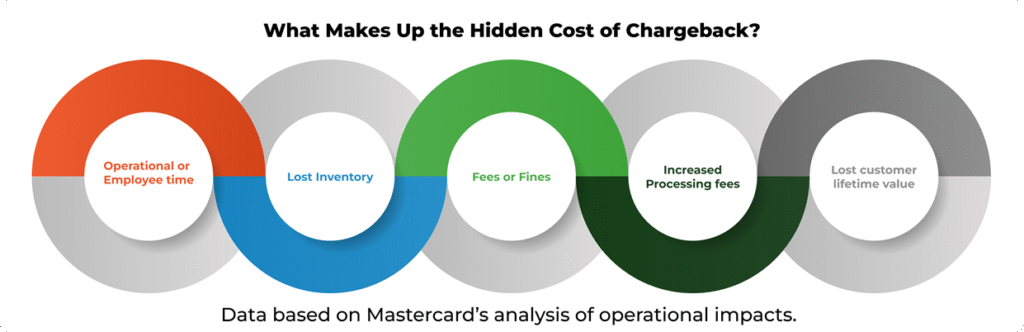

When merchants think about chargebacks, it’s easy to focus only on the lost sale or the refunded amount. But as Mastercard highlights, the real financial damage runs deeper. The hidden costs of a chargeback include the operational time your team spends managing disputes, lost inventory that can’t be resold, fees or fines from your processor or the networks, and higher processing fees that come from a riskier account profile. On top of that, there’s the long-term loss of customer lifetime value. A single chargeback can damage trust, making it harder to retain loyal customers and driving them toward competitors. Together, these factors explain why chargebacks can cost up to 2.5 times the original transaction amount.

Why Prevention Should Be a Priority

By the time a chargeback happens, the financial damage is already done. That’s why modern chargeback prevention tools are so important. Solutions like Ethoca Alerts, Verifi CDRN, Visa Rapid Dispute Resolution, and Mastercom Collaboration help stop disputes before they become chargebacks. Using these tools helps you avoid fees, reduce operational stress, and protect your merchant account from penalties or termination.

How Merchants Can Stay Ahead

Understanding the true cost of chargebacks lets merchants take action. Offering proactive chargeback prevention as part of your operations gives your business a competitive edge. Solutions that combine prevention and resolution features can help you sustain low chargeback ratios and protect your revenue. With the right support, you can focus on growing your business without constant worry about chargeback risk.

Where do we go from here?

If you’re ready to protect your business from the hidden costs of chargebacks, we’re here to help. Our team can assist with setting up prevention solutions like Ethoca Alerts, Verifi CDRN, Visa RDR, and Mastercom Collaboration so you can minimize risk and safeguard your revenue. Reach out to our team today to discuss the best options for your business.

Why ChargebackHelp?

ChargebackHelp delivers powerful solutions that simplify chargeback management for merchants. From prevention tools to revenue recovery, we help you stay ahead of disputes, lower your chargeback ratio, and protect your business from unnecessary loss. With automated systems and expert support, we make chargeback management easier so you can focus on what matters most—running your business.

FAQs: The True Cost of Chargebacks in 2025

What is the cost of a chargeback in 2025?

Mastercard reports that a single chargeback could cost up to 2.5 times the transaction value. ChargebackHelp can help you reduce these costs with prevention solutions.

Why do chargebacks cost more than a refund?

Chargebacks add fees and admin costs on top of lost sales. ChargebackHelp helps merchants avoid these extra costs by preventing chargebacks before they happen.

What types of businesses are hit hardest by chargebacks?

High-risk industries like SaaS, online gaming, supplements, and hospitality face higher exposure. ChargebackHelp provides tools tailored for these industries to lower chargeback risks.

How can merchants lower chargeback costs?

Prevention is key. Tools like chargeback alerts and automated resolution help. ChargebackHelp offers integrated solutions that make this easy for merchants.

Why act now to prevent chargebacks?

Chargeback costs in 2025 are higher than ever. Acting now protects your revenue and merchant account. ChargebackHelp can help you get started.