Understanding Transaction Data Analysis and Chargebacks

Discover the importance of transaction data analysis to help forecast and prevent chargebacks using a data-driven approach.

Discover the importance of transaction data analysis to help forecast and prevent chargebacks using a data-driven approach.

The key to winning representment is proper data capture. We share a little “insider knowledge” on spotting successful representment opportunities.

Order Insight sends transaction data to issuing banks deflecting cardholder inquiries from becoming disputes and chargebacks.

Descriptors are the line items you see on your bank statement that describe each transaction. Merchants must deliver concise descriptors to customers.

We’ve put together a checklist of some key red flags that your gateway should be automated to catch in your transactions.

The EMV card transition is finally in high gear, which is great news for compliant retailers; card-present fraud is in decline.

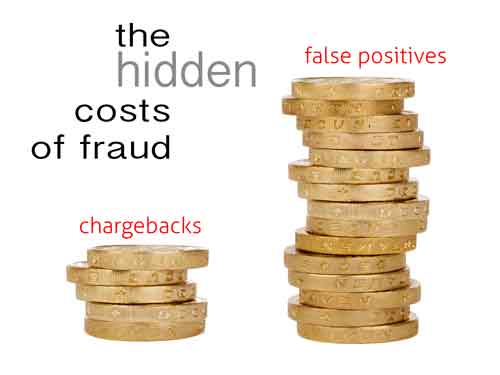

While screening out fraud is a top priority, it is five times more important to avoid false positives-declining legitimate purchases as fraud.

Friendly fraud is the new “rubber check” because most issuing banks have a rubber stamp policy on chargebacks.