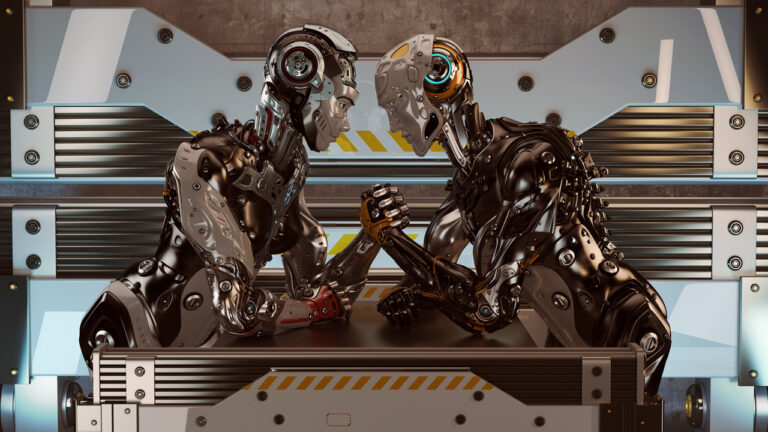

Bot vs. Bot: How Artificial Intelligence both drives and fights fraud

There is an arms race underway between hackers that use AI to commit fraud and the “white hat” AI that can be used to fight back.

There is an arms race underway between hackers that use AI to commit fraud and the “white hat” AI that can be used to fight back.

For businesses big and small, cybersecurity is crucial. Phishing can lead to fraudulent transactions, which can lead to chargebacks.

EMV chips have made it virtually impossible to spoof physical cards, but these chips do little to prevent card-not-present fraud.

The Internet revolutionized the global economy and with it fraud. It’s only a matter of time before fraud will also plague the Metaverse.

Acquirers must now purchase and distribute non-Ethoca alerts, a new mandatory workflow called “Acquirer Collaboration” by Mastercard.

Dispute management providers like ChargebackHelp integrate the right tools across all payment networks into one platform.

Many merchants know of chargebacks but may not fully understand them. We’ll explain what they are, their origins, and how the process works.

Chargebacks are a major threat for merchants online and IRL. Fortunately, companies can use dispute management services, to reduce risks.

Mastercard’s Connected Intelligence will help identify weak links in transaction streams regarding fraud detection and false declines.

The real danger chargebacks present are not just the fees that accumulate; if you process too many, your processing can be abruptly terminated.